Technology

Nvidia may be ready to be the successor to AWS

Nvidia and Amazon Web Services, Amazon’s lucrative cloud arm, has surprisingly much in common. First, their core business was created by glad accident. In the case of AWS, it realized that it could sell internal services—storage, compute, and memory—that it had built for itself in-house. In Nvidia’s case, it was the proven fact that a GPU created for gaming purposes also performed well for processing AI workloads.

Ultimately, this led to a surge in revenues in recent quarters. Nvidia’s revenue is growing by triple digits, from $7.1 billion in the first quarter of 2024 to $22.1 billion in the fourth quarter of 2024. That’s a reasonably amazing trajectory, although the overwhelming majority of that growth has been in the company’s data center business.

While Amazon has never experienced such an intense growth spurt, it has consistently been a big revenue driver for the e-commerce giant, and each firms have gained early market advantage. However, over the years, Microsoft and Google have joined the market to form the Big Three cloud service providers, and other chipmakers are expected to eventually start gaining significant market share, even when the revenue graph continues to rise over the coming years. several years.

Both firms were clearly in the right place at the right time. When web applications and mobile devices began to emerge around 2010, the cloud provided on-demand resources. Enterprises soon began to see the value of moving workloads or constructing applications in the cloud reasonably than running their very own data centers. Similarly, the rise of artificial intelligence over the past decade, and more recently large language models, has coincided with an explosion in the use of GPUs to process these workloads.

Over the years, AWS has evolved into an especially profitable company, currently earning a rate of return close to $100 billion, and which, even aside from Amazon, would be a really successful company. But AWS’s growth has begun to slow at the same time as Nvidia gains momentum. Part of that is the law of huge numbers, which can eventually affect Nvidia as well.

The query is whether or not Nvidia will be able to sustain this growth and develop into a long-term revenue powerhouse like AWS is for Amazon. If the GPU market starts to shrink, Nvidia could have other businesses, but as this chart shows, they’re much smaller revenue generators which can be growing much slower than the current GPU data center business.

Image credits: Nvidia

Short-term financial prospects

As you possibly can see in the chart above, Nvida’s revenue growth in recent quarters has been astronomical. According to Nvidia and Wall Street analysts, this case will proceed.

In his recent earnings report covering the fourth quarter of fiscal 2024 (the three months ending January 31, 2024), Nvidia has informed its investors that it expects revenue of $24 billion in the current quarter (Q1FY25). Compared to last 12 months’s first quarter, Nvidia expects growth of roughly 234%.

It’s just not a number we regularly see for mature public firms. However, given the company’s massive revenue growth in recent quarters, its growth rate is anticipated to slow. Following 22% revenue growth from the third to fourth quarters of the recently ended fiscal 12 months, Nvidia expects a more modest growth rate of 8.6% from the last quarter of fiscal 2024 to the first quarter of fiscal 2025. Certainly next 12 months – compared to last 12 months, reasonably than looking back at just three months, Nvidia’s growth rate stays incredible in the current period. However, there are other growth declines on the horizon.

For example, analysts expect Nvidia to generate revenue of $110.5 billion in the current fiscal 12 months, up just over 81% from a 12 months ago. This is significantly lower than the 126% growth recorded in the recently ended fiscal 12 months 2024.

To which we ask: So what? Nvidia is anticipated to proceed growing its revenues over no less than the next few quarters, surpassing the $100 billion annualized rate mark, a powerful result for a corporation that reported total revenues of just $7.19 billion a 12 months ago .

In short, analysts and, to a more modest extent, Nvidia, see tremendous growth ahead for the company, even when a few of its impressive revenue growth numbers slow this calendar 12 months. It is unclear what is going to occur in a rather longer time horizon.

Forward momentum

It looks like AI may be the gift that keeps on giving to Nvidia for the next few years, at the same time as it starts to see more competition from AMD, Intel and other chipmakers. Like AWS, Nvidia will eventually face stronger competition, however it currently controls a lot of the market that it might afford to lose some.

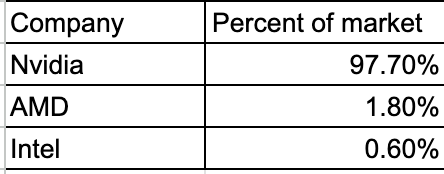

By looking solely at the chip level, and never at the boards or other adjoining components, IDC shows that Nvidia is in total control:

Image credits: IDC

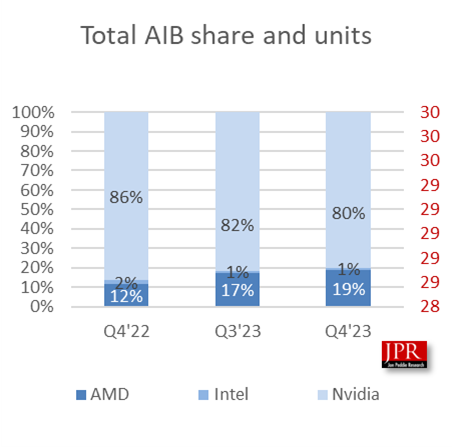

If you take a look at the motherboard level and supply market share data from Jon Peddie Research (JPR), an organization that tracks the GPU market, while Nvidia continues to dominate, AMD becomes stronger:

Image credits: Jon Peddie’s research

C Robert Dow, an analyst at JPR, says a few of these fluctuations have to do with the timing of recent product introductions. “AMD is gaining percentage points here and there depending on market cycles – when new cards are introduced – and inventory levels, but Nvidia has had a dominant position for years and will continue to do so,” Dow told TechCrunch.

Shane Rau, an IDC analyst who tracks the silicon market, also expects this dominance to proceed, at the same time as trends change. “There are trends and counter-trends, the markets in which Nvidia participates are large and getting larger, and growth will continue for at least the next five years,” Rau said.

One reason is that Nvidia sells greater than just the chip itself. “They sell you boards, systems, software, services and time spent on certainly one of their supercomputers. So each of those markets is large and growing, and Nvidia is committed to each of them,” he said.

However, not everyone sees Nvidia as an unstoppable force. David Linthicum, a long-time cloud consultant and writer, says you do not at all times need GPUs, and corporations are starting to realize this. “They say they need GPUs. I take a look at it, do the calculations on the back of the envelope, and it seems they do not need them. The processors are in excellent condition,” he said.

He believes that when this happens, Nvidia will start to decelerate and the competition will weaken its position in the market. “I think Nvidia will turn into an underdog over the next few years. And we will see that because too many substitutes are being built.”

Rau says other vendors will even profit as firms expand AI applications to include Nvidia products. “I think we will see growing markets in the future, which will be a positive factor for Nvidia. But then there will be other companies that will also follow this tailwind and will particularly benefit from artificial intelligence.”

It can be possible that some disruptive force will be at work, with a positive effect if one company doesn’t develop into too dominant. “You almost hope there will be disruption because that’s how markets and capitalism work best, right? Someone gains an early advantage, other suppliers follow, the market grows. You get established players that end up being disrupted by a better way of doing the same thing in their market or in adjacent markets that are encroaching on theirs,” Rau said.

In fact, we’re starting to see this occur at Amazon as Microsoft gains traction with its relationship with OpenAI and Amazon is forced to play catch-up when it comes to AI. Whatever happens to Nvidia in the future, it’s currently firmly in the driver’s seat, creating wealth, dominating a growing market, and just about all the pieces goes its own way. However, this doesn’t mean that this may at all times be the case and that there won’t be greater competitive pressure in the future.

Technology

Benchmarks meta for new AI models are somewhat misleading

One of the new flagship AI Meta models released on Saturday, Maverick, Second rating at LM ArenaA test during which human rankings compare the outcomes of models and select which they like. But it appears that evidently the Maverick version, that the finish implemented on LM Arena differs from the version that’s widely available to programmers.

How several And researchers He pointed to X, Meta noticed within the announcement that Maverick on LM Arena is a “experimental version of the chat.” Chart on The official website of LlamaMeanwhile, it reveals that the testing of the LM META Arena was carried out using “Llama 4 Maverick optimized for conversation.”

As we wrote earlier, for various reasons LM Arena has never been essentially the most reliable measure of the performance of the AI model. But AI firms generally didn’t adapt or otherwise adapted their models to higher rating at LM Arena-Lub a minimum of didn’t admit it.

The problem related to adapting the model to the reference point, suspension of it, after which releasing the “vanilla” variant of the identical model, is that programmers are difficult to predict how good it can work in specific contexts. It can be misleading. It is best if the tests tests – miserably inadequate – provide a shutter of strong and weaknesses of 1 model in various tasks.

Indeed, scientists on X have Stark was observed Differences in behavior From publicly to download maverick in comparison with the hosted model on LM Arena. The LM Arena version seems to make use of many emoji and provides extremely long answers.

Okay, Lama 4 is Def and Littled cooked lol, what a yap city is that this city pic.twitter.com/y3gvhbvz65

– Nathan Lambert (@natolambert) April 6, 2025

For some reason, the Llam 4 model in the sector uses rather more emoji

together. Ai, it seems higher: pic.twitter.com/f74odx4zttt

– technological notes (@techdevnotes) April 6, 2025

We arrived at Meta and Chatbot Arena, a company that maintains LM Arena to comment.

(Tagstotransate) benchmark

Technology

Trump delays the ban

Donald Trump has signed a brand new executive order “Save Tiktok”.

Tiktok will live to see the next day – at the least for now. On April 4, President Donald Trump signed a brand new executive order delaying the ban on a preferred social application by one other 75 days. The application was to darken in the USA on April 5.

The application, belonging to the Chinese company Bytedance, is now on the second extension in the first quarter of the 12 months. In 2024, President Biden signed bilateral laws of Ban Tiktok, citing fears about national security. Congress voted in a predominant means. Although Trump has signed the executive order to “save” the application, many questioned the legality of the movement. Like many president’s actions at the starting of his term, they complain that evidently he exceeds the authority of the executive office.

Trump announced his move to Stop the ban on social truthSaying that his administration remains to be working on the contract.

“My administration worked very hard on the Tiktok saving contract, and we have made great progress,” Trump wrote on April 4. “The contract requires more work to ensure the signing of all necessary approvals, which is why I sign an executive order to continue tiktok for an additional 75 days.”

Trump quoted his newly imposed tariffs to China as a key reason for detained negotiations for the buyer.

“We hope to continue working in good faith with China, which, as I understand, are not very satisfied with our mutual tariffs – necessary for honest and balanced trade between China and the USA,” wrote Trump. “It proves that tariffs are the most powerful economic tool and very important for our national security. We do not want Tiktok to go dark. We are looking forward to cooperation with Tiktok and China to complete the contract.”

This means a second time Trump entered to delay the ban. On January 2, just a couple of days after returning to the office, he signed the first extension to stop Tiktok, utilized by over 170 million Americans available to users.

The potential sales of Tiktok draws the major attention of the principal players in the business world. According to HillMany private equity firms, the Venture Capital groups and the best technological investors have introduced offers for a preferred application.

Among the firms, apparently in the mix are Blackstone, Oracle, Amazon – led by Jeff Bezos – and the founding father of Onlyfans Tim Stokely. Interest in purchasing Tiktok has increased, how uncertainty about its future in the US is always growing.

The application, utilized by 170 million Americans, is situated at the center of ongoing political and economic negotiations between the United States and China. Along with the upcoming pressure and deadlines, the possibility of selling opened the door to the largest technological and financial names.

Technology

Doge is supposedly planning Hackathon to build a “mega api” for IRS data

The Department of Government Elon Musk (DOGE) is planning Organize Hackathon next week Focused on creating a “mega API interface”, which is able to provide access to taxpayers, according to Wired.

Wired claims that Hackathon is organized by two Doge employees within the service of the inner rule – Gavin Kliger and Sam Corcos, who’re also the final director at the extent of Healthtech startups. Corcos reportedly said to others in Doge that his goal is to build “one new API to rule them all.”

This would facilitate cloud suppliers access to IRS data, including taxpayers’ names, addresses, social insurance numbers, tax declarations and employment information, which may very well be exported to external systems. According to Wired, the vendor of external parties managed parts of the project, and Palantir “consistently” grew up as a candidate.

“Basically, they are open door controlled by Musk for the most sensitive information of all Americans without any rules that normally secure this data,” said an anonymous IRS worker said.

(Tagstranslate) dog

-

Press Release12 months ago

Press Release12 months agoU.S.-Africa Chamber of Commerce Appoints Robert Alexander of 360WiseMedia as Board Director

-

Press Release1 year ago

Press Release1 year agoCEO of 360WiSE Launches Mentorship Program in Overtown Miami FL

-

Business and Finance10 months ago

Business and Finance10 months agoThe Importance of Owning Your Distribution Media Platform

-

Business and Finance1 year ago

Business and Finance1 year ago360Wise Media and McDonald’s NY Tri-State Owner Operators Celebrate Success of “Faces of Black History” Campaign with Over 2 Million Event Visits

-

Ben Crump12 months ago

Ben Crump12 months agoAnother lawsuit accuses Google of bias against Black minority employees

-

Theater1 year ago

Theater1 year agoTelling the story of the Apollo Theater

-

Ben Crump1 year ago

Ben Crump1 year agoHenrietta Lacks’ family members reach an agreement after her cells undergo advanced medical tests

-

Ben Crump1 year ago

Ben Crump1 year agoThe families of George Floyd and Daunte Wright hold an emotional press conference in Minneapolis

-

Theater1 year ago

Theater1 year agoApplications open for the 2020-2021 Soul Producing National Black Theater residency – Black Theater Matters

-

Theater10 months ago

Theater10 months agoCultural icon Apollo Theater sets new goals on the occasion of its 85th anniversary