Technology

Nvidia may be ready to be the successor to AWS

Nvidia and Amazon Web Services, Amazon’s lucrative cloud arm, has surprisingly much in common. First, their core business was created by glad accident. In the case of AWS, it realized that it could sell internal services—storage, compute, and memory—that it had built for itself in-house. In Nvidia’s case, it was the proven fact that a GPU created for gaming purposes also performed well for processing AI workloads.

Ultimately, this led to a surge in revenues in recent quarters. Nvidia’s revenue is growing by triple digits, from $7.1 billion in the first quarter of 2024 to $22.1 billion in the fourth quarter of 2024. That’s a reasonably amazing trajectory, although the overwhelming majority of that growth has been in the company’s data center business.

While Amazon has never experienced such an intense growth spurt, it has consistently been a big revenue driver for the e-commerce giant, and each firms have gained early market advantage. However, over the years, Microsoft and Google have joined the market to form the Big Three cloud service providers, and other chipmakers are expected to eventually start gaining significant market share, even when the revenue graph continues to rise over the coming years. several years.

Both firms were clearly in the right place at the right time. When web applications and mobile devices began to emerge around 2010, the cloud provided on-demand resources. Enterprises soon began to see the value of moving workloads or constructing applications in the cloud reasonably than running their very own data centers. Similarly, the rise of artificial intelligence over the past decade, and more recently large language models, has coincided with an explosion in the use of GPUs to process these workloads.

Over the years, AWS has evolved into an especially profitable company, currently earning a rate of return close to $100 billion, and which, even aside from Amazon, would be a really successful company. But AWS’s growth has begun to slow at the same time as Nvidia gains momentum. Part of that is the law of huge numbers, which can eventually affect Nvidia as well.

The query is whether or not Nvidia will be able to sustain this growth and develop into a long-term revenue powerhouse like AWS is for Amazon. If the GPU market starts to shrink, Nvidia could have other businesses, but as this chart shows, they’re much smaller revenue generators which can be growing much slower than the current GPU data center business.

Image credits: Nvidia

Short-term financial prospects

As you possibly can see in the chart above, Nvida’s revenue growth in recent quarters has been astronomical. According to Nvidia and Wall Street analysts, this case will proceed.

In his recent earnings report covering the fourth quarter of fiscal 2024 (the three months ending January 31, 2024), Nvidia has informed its investors that it expects revenue of $24 billion in the current quarter (Q1FY25). Compared to last 12 months’s first quarter, Nvidia expects growth of roughly 234%.

It’s just not a number we regularly see for mature public firms. However, given the company’s massive revenue growth in recent quarters, its growth rate is anticipated to slow. Following 22% revenue growth from the third to fourth quarters of the recently ended fiscal 12 months, Nvidia expects a more modest growth rate of 8.6% from the last quarter of fiscal 2024 to the first quarter of fiscal 2025. Certainly next 12 months – compared to last 12 months, reasonably than looking back at just three months, Nvidia’s growth rate stays incredible in the current period. However, there are other growth declines on the horizon.

For example, analysts expect Nvidia to generate revenue of $110.5 billion in the current fiscal 12 months, up just over 81% from a 12 months ago. This is significantly lower than the 126% growth recorded in the recently ended fiscal 12 months 2024.

To which we ask: So what? Nvidia is anticipated to proceed growing its revenues over no less than the next few quarters, surpassing the $100 billion annualized rate mark, a powerful result for a corporation that reported total revenues of just $7.19 billion a 12 months ago .

In short, analysts and, to a more modest extent, Nvidia, see tremendous growth ahead for the company, even when a few of its impressive revenue growth numbers slow this calendar 12 months. It is unclear what is going to occur in a rather longer time horizon.

Forward momentum

It looks like AI may be the gift that keeps on giving to Nvidia for the next few years, at the same time as it starts to see more competition from AMD, Intel and other chipmakers. Like AWS, Nvidia will eventually face stronger competition, however it currently controls a lot of the market that it might afford to lose some.

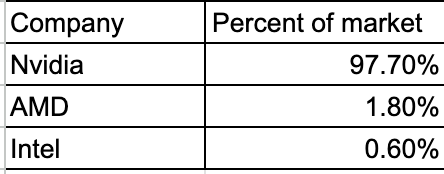

By looking solely at the chip level, and never at the boards or other adjoining components, IDC shows that Nvidia is in total control:

Image credits: IDC

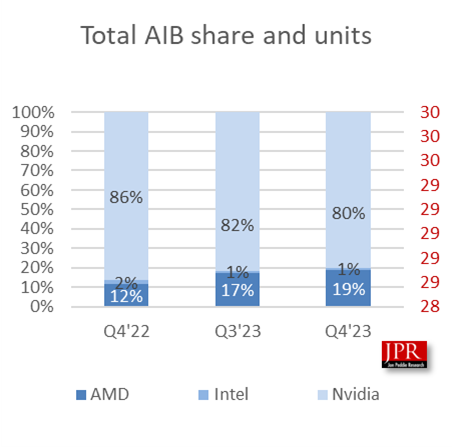

If you take a look at the motherboard level and supply market share data from Jon Peddie Research (JPR), an organization that tracks the GPU market, while Nvidia continues to dominate, AMD becomes stronger:

Image credits: Jon Peddie’s research

C Robert Dow, an analyst at JPR, says a few of these fluctuations have to do with the timing of recent product introductions. “AMD is gaining percentage points here and there depending on market cycles – when new cards are introduced – and inventory levels, but Nvidia has had a dominant position for years and will continue to do so,” Dow told TechCrunch.

Shane Rau, an IDC analyst who tracks the silicon market, also expects this dominance to proceed, at the same time as trends change. “There are trends and counter-trends, the markets in which Nvidia participates are large and getting larger, and growth will continue for at least the next five years,” Rau said.

One reason is that Nvidia sells greater than just the chip itself. “They sell you boards, systems, software, services and time spent on certainly one of their supercomputers. So each of those markets is large and growing, and Nvidia is committed to each of them,” he said.

However, not everyone sees Nvidia as an unstoppable force. David Linthicum, a long-time cloud consultant and writer, says you do not at all times need GPUs, and corporations are starting to realize this. “They say they need GPUs. I take a look at it, do the calculations on the back of the envelope, and it seems they do not need them. The processors are in excellent condition,” he said.

He believes that when this happens, Nvidia will start to decelerate and the competition will weaken its position in the market. “I think Nvidia will turn into an underdog over the next few years. And we will see that because too many substitutes are being built.”

Rau says other vendors will even profit as firms expand AI applications to include Nvidia products. “I think we will see growing markets in the future, which will be a positive factor for Nvidia. But then there will be other companies that will also follow this tailwind and will particularly benefit from artificial intelligence.”

It can be possible that some disruptive force will be at work, with a positive effect if one company doesn’t develop into too dominant. “You almost hope there will be disruption because that’s how markets and capitalism work best, right? Someone gains an early advantage, other suppliers follow, the market grows. You get established players that end up being disrupted by a better way of doing the same thing in their market or in adjacent markets that are encroaching on theirs,” Rau said.

In fact, we’re starting to see this occur at Amazon as Microsoft gains traction with its relationship with OpenAI and Amazon is forced to play catch-up when it comes to AI. Whatever happens to Nvidia in the future, it’s currently firmly in the driver’s seat, creating wealth, dominating a growing market, and just about all the pieces goes its own way. However, this doesn’t mean that this may at all times be the case and that there won’t be greater competitive pressure in the future.

Technology

The latest model AI Google Gemma can work on phones

It grows “open” AI Google, Gemma, grows.

While Google I/O 2025 On Tuesday, Google removed Gemma 3N compresses, a model designed for “liquid” on phones, laptops and tablets. According to Google, available in a preview starting on Tuesday, Gemma 3N can support sound, text, paintings and flicks.

Models efficient enough to operate in offline mode and without the necessity to calculate within the cloud have gained popularity within the AI community lately. They will not be only cheaper to make use of than large models, but they keep privacy, eliminating the necessity to send data to a distant data center.

During the speech to I/O product manager, Gemma Gus Martins said that GEMMA 3N can work on devices with lower than 2 GB of RAM. “Gemma 3N shares the same architecture as Gemini Nano, and is also designed for incredible performance,” he added.

In addition to Gemma 3N, Google releases Medgemma through the AI developer foundation program. According to Medgemma, it’s essentially the most talented model to research text and health -related images.

“Medgemma (IS) OUR (…) A collection of open models to understand the text and multimodal image (health),” said Martins. “Medgemma works great in various imaging and text applications, thanks to which developers (…) could adapt the models to their own health applications.”

Also on the horizon there may be SignGEMMA, an open model for signaling sign language right into a spoken language. Google claims that Signgemma will allow programmers to create recent applications and integration for users of deaf and hard.

“SIGNGEMMA is a new family of models trained to translate sign language into a spoken text, but preferably in the American sign and English,” said Martins. “This is the most talented model of understanding sign language in history and we are looking forward to you-programmers, deaf and hard communities-to take this base and build with it.”

It is value noting that Gemma has been criticized for non -standard, non -standard license conditions, which in accordance with some developers adopted models with a dangerous proposal. However, this didn’t discourage programmers from downloading Gemma models tens of tens of millions of times.

.

(Tagstransate) gemma

Technology

Trump to sign a criminalizing account of porn revenge and clear deep cabinets

President Donald Trump is predicted to sign the act on Take It Down, a bilateral law that introduces more severe punishments for distributing clear images, including deep wardrobes and pornography of revenge.

The Act criminalizes the publication of such photos, regardless of whether or not they are authentic or generated AI. Whoever publishes photos or videos can face penalty, including a advantageous, deprivation of liberty and restitution.

According to the brand new law, media firms and web platforms must remove such materials inside 48 hours of termination of the victim. Platforms must also take steps to remove the duplicate content.

Many states have already banned clear sexual desems and pornography of revenge, but for the primary time federal regulatory authorities will enter to impose restrictions on web firms.

The first lady Melania Trump lobbyed for the law, which was sponsored by the senators Ted Cruz (R-TEXAS) and Amy Klobuchar (d-minn.). Cruz said he inspired him to act after hearing that Snapchat for nearly a 12 months refused to remove a deep displacement of a 14-year-old girl.

Proponents of freedom of speech and a group of digital rights aroused concerns, saying that the law is Too wide And it will probably lead to censorship of legal photos, similar to legal pornography, in addition to government critics.

(Tagstransate) AI

Technology

Microsoft Nadella sata chooses chatbots on the podcasts

While the general director of Microsoft, Satya Nadella, says that he likes podcasts, perhaps he didn’t take heed to them anymore.

That the treat is approaching at the end longer profile Bloomberg NadellaFocusing on the strategy of artificial intelligence Microsoft and its complicated relations with Opeli. To illustrate how much she uses Copilot’s AI assistant in her day by day life, Nadella said that as a substitute of listening to podcasts, she now sends transcription to Copilot, after which talks to Copilot with the content when driving to the office.

In addition, Nadella – who jokingly described her work as a “E -Mail driver” – said that it consists of a minimum of 10 custom agents developed in Copilot Studio to sum up E -Mailes and news, preparing for meetings and performing other tasks in the office.

It seems that AI is already transforming Microsoft in a more significant way, and programmers supposedly the most difficult hit in the company’s last dismissals, shortly after Nadella stated that the 30% of the company’s code was written by AI.

(Tagstotransate) microsoft

-

Press Release1 year ago

Press Release1 year agoU.S.-Africa Chamber of Commerce Appoints Robert Alexander of 360WiseMedia as Board Director

-

Press Release1 year ago

Press Release1 year agoCEO of 360WiSE Launches Mentorship Program in Overtown Miami FL

-

Business and Finance12 months ago

Business and Finance12 months agoThe Importance of Owning Your Distribution Media Platform

-

Business and Finance1 year ago

Business and Finance1 year ago360Wise Media and McDonald’s NY Tri-State Owner Operators Celebrate Success of “Faces of Black History” Campaign with Over 2 Million Event Visits

-

Ben Crump1 year ago

Ben Crump1 year agoAnother lawsuit accuses Google of bias against Black minority employees

-

Theater1 year ago

Theater1 year agoTelling the story of the Apollo Theater

-

Ben Crump1 year ago

Ben Crump1 year agoHenrietta Lacks’ family members reach an agreement after her cells undergo advanced medical tests

-

Ben Crump1 year ago

Ben Crump1 year agoThe families of George Floyd and Daunte Wright hold an emotional press conference in Minneapolis

-

Theater1 year ago

Theater1 year agoApplications open for the 2020-2021 Soul Producing National Black Theater residency – Black Theater Matters

-

Theater12 months ago

Theater12 months agoCultural icon Apollo Theater sets new goals on the occasion of its 85th anniversary