Politics and Current

Black conservative claims ‘African-Americans in the field’ are voting for Trump

A black conservative radio host is facing backlash for calling black supporters of Donald Trump “African-American field men.”

Shelley Wynter appeared on October 16, where made the “bazooka explosion” when it divided the U.S. Black male electorate into “African-Americans at home and African-Americans in the field.”

“Let me boil this election in the African-American community down to a very simple word: I will refer to the great Malcolm X,” he said. “This race is between home African Americans and field African Americans, and field African Americans are voting for (Donald) Trump.”

The remarks referred to “house slaves” who worked in the slave house during U.S. slavery and “field slaves” who worked outside. Although Wynter claims he was referring to the Malcolm X quote, his comments were met with criticism from co-host Sarah Sidner and guest Michael Blake, in addition to many who rewatched the clip.

According to Rashawn Ray, a senior fellow at the Brookings Institute, Wynter’s comments “speak to the growing class divide among black Americans between the haves and have-nots.”

“These types of comments often occur behind closed doors in the black community.”

Wynter claims he was referring to a portion of Malcolm The host of “The Shelley Wynter Show” stands by his comments, saying anyone who has an issue along with his evocation of Malcolm X and slavery is “over-analyzing it.”

“There is an argument to be made that technically we are all slaves to this system, whether you are a Democrat or a Republican,” he said. “No one can be called a slave. “He uses the analogy in the context of what it was used, just like when Malcolm was explaining something and he didn’t call black people slaves when he gave that speech.”

“He said it was a matter of attitude. There are people in the Black community who, once they get near power – i.e. a champion – will tackle the attributes and defend it. And that is what we’re seeing in this race now. “

Politics and Current

The challenging supporter of Trump is trying to embarrass Letitia James for the allegations of fraud – her flap up the crowd

The Prosecutor General of New York Letitia James even kept Wiul during the interrogation on the impact on the community by which she was cheated on the investigation that Trump’s administration began on the allegations that James had committed a mortgage fraud.

James organized a hearing in Suny Westchester College on 8 May together with several other general prosecutors to discuss the influence of the federal plans of Trump’s restructuring on New Yorkers and defend critical social assistance programs.

During the questions and answers of the hearing, one supporter of Donald Trump took her to MIC to a needle regarding the investigation of mortgage fraud and challenging her lawsuit against the president, who accused him and his members of the family of the dishonest filling of the net value and the value of his business assets for lenders.

“Will you apologize to President Trump for wasting millions of dollars and the state of New York for the process of witches and how is it to know that you will be imprisoned for a mortgage fraud?” The man asked around a 52 -minute character.

Heckler’s query only met with the chorus Boos and Jeers from dozens of audience members before he was escorted by security.

“Thank you for coming,” James said coldly before you directed the audience. “We want to thank him for coming. We respect all opinions. Everyone knows that these allegations are unfounded. They are discredited, so we want to thank him.”

Last month, the director of the Federal Residential Finance Agency, WILLIAM PULTE, appointed by the Federal Finance Agency, sent a criminal referral to the US PAM Bondi Prosecutor General, asking for checking the allegations listed in the “media reports” that James misled Real Estate, which he has in New York and Virginia and was lying on financial documents to secure loans.

In the Pulte to Bondi letter, he wrote that James “in many cases forged bank documents and real estate registers to acquire aid and loan supported by the government and more favorable terms of the loan.”

Pulte accused James of the appointment of real estate in Norfolk, Virginia, as her most important residence, despite the serving and being in New York. He also claimed that she had bought a five -level property in Brooklyn with a loan authorized only for 4 units.

James’ defense lawyer, Abbe Lowell, sent the Department of Justice letter By condemning the allegations and claiming that they’re related to Trump’s hostility to the Prosecutor General, calling the referral “an act of personal revenge.”

Trump previously condemned James and her criticism, which caused a civil trial by which he was ordered to pay $ 454 million after he was responsible for fraud in New York.

He repeatedly called the “hunt for political witches”, and his anger against James landed on the list of his political opponents. In a more moderen attack on the figure of James, president called Her “terrible human being”, “sick person” and “total cheater”.

Many reports are that the Department of Justice has just been investigating the real estate transactions related to loans and purchases of real estate in New York and Virginia.

In response to the submission of a meat from criminal advice, the spokesman for the office James said the media: “Prosecutor General James focuses daily on the protection of New Yorkers, especially since the administration of the Federal Government weapons against the rule of law and structure.

Politics and Current

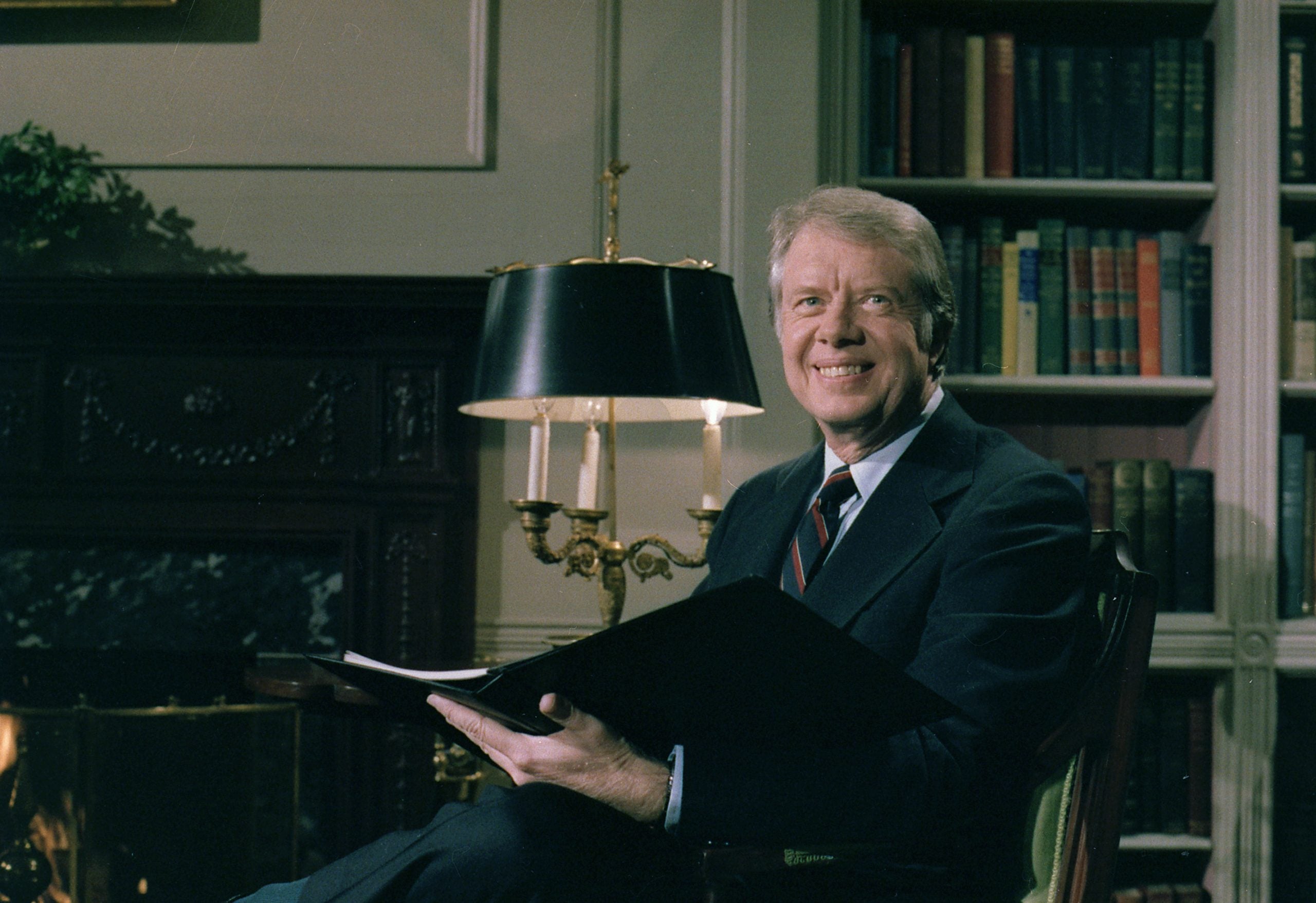

Jimmy Carter, 39. US President and Nobel Prize winner, dies at 100 – ESENCE

Getty images

Jimmy Carter, 39. President of the United States and global humanitarian, died calmly at the age of 100 in his hometown of the plains in Georgia, where he spent most of his life. Carter Center He announced his death on Sunday, almost two years after entering the hospice.

“Our founder, former US president Jimmy Carter, died this afternoon in Plains, Georgia,” Carter Center Made available on social media. “He died calmly, surrounded by his family.”

President Carter survived his children-Jack, Chip, Jeff and Amy-Wraz with 11 grandchildren and 14 great-grandchildren. He was preceded by death by his beloved 77 -year -old wife, Rosalynn, who died in 2023 and one grandson.

Carter, who was the president in 1977–1981, is remembered not only due to his time in an oval office, but in addition concerning the extraordinary life he later led. From conducting diplomatic missions to the Eighties to the development of homes from the habitat for humanity within the 90s, Carter was an example of lifetime involvement in service.

“My faith requires – it is not optional – my faith requires that I do everything I can, wherever I am, whenever I can, as long as possible, with what I have to try to change something,” said Carter.

His relentless dedication to Human Rights brought him the Nobel Peace Prize in 2002 through the Carter Center, which he founded in 1982 along with his wife Rosalynn, Carter worked on promoting democracy, monitoring elections and the fight for social justice world wide.

President Joe Biden was one in all the primary to pay tribute, calling Carter a “extraordinary leader, state and humanitarian husband.” Thinking about their a long time, Biden described Carter’s life as a guide for anyone who’s searching for a goal.

“For all young people in this nation and for everyone who is looking for, what it means to live with life and meaning – good life – study Jimmy Carter, a man of principles, faith and humility,” said Biden in a press release.

Former President Barack Obama also honored Carter’s heritage, emphasizing his honesty and commitment to service throughout his life.

“Chosen in the shadow of Watergate, Jimmy Carter promised voters that he would always tell the truth. And so – in favor of public good, let the consequences not be” – said Obama. “He believed that some things were more important than re -election – such things such as honesty, respect and compassion.”

Obama added: “Whenever I had the opportunity to spend time with the Carter, it was clear that he not only confessed these values. He jumped them. In this way he taught us all, what it means to live the life of grace, dignity, justice and service.”

Condolences spilled from leaders world wide, including UN Secretary General Antonio Guterres, the premiere of Barbados Mia Mottley, the prime minister of Great Britain Keir Starmer and President Panama José Raúl Mulino.

Born on October 1, 1924 in Plains, Georgia, James “Jimmy” Earl Carter Jr. He was the primary president of the USA to be born within the hospital. His upbringing at the nut farm instilled in him a robust ethics of labor and a deep sense of values that shaped his presidency and life outside of it.

During his presidency, Carter achieved significant milestones, including inhabiting Camp David Porads, which paved the method to the room between Egypt and Israel. However, his term of office was also marked by challenges similar to Iran’s crisis of plants, which overshadowed his re -election offer in 1980.

After leaving the office at the age of 56, Carter re -defined the role of the previous president. Often called “the greatest former president of America” he devoted over 4 a long time to the explanations which have crossed the policy, gaining admiration world wide.

President Biden announced plans for the official state funeral in Washington and announced mourning on January 9 on January 9 to honor Carter’s extraordinary life and heritage.

Politics and Current

HegeSeth directs 20% cut to the highest military managerial positions

The Secretary of Defense Pete HegeSeth on Monday ordered the military lively service to lose 20% of 4 -star general officers, when the Trump administration moves forward with deep cuts, which he thinks will promote performance, but critics that worry may cause more politicized strength.

HegeSeth also told the National Guard to lose 20% of his highest positions and recommend the military to reduce an extra 10% of his general and flagship officers of their forces, which can include one star or official with an equivalent rank of navy.

The cuts are at the top of over half a dozen of the best general officers that President Donald Trump or HegeSeth released from January, including the chairman of the joint heads of the staff, Gen. CQ Brown Jr. They also released only two women serving as 4 -star officers, in addition to a disproportionate variety of other older officers.

In earlier rounds of shooting, HegeSth said that the eliminations were “a reflection of the president who wants the right people around him to perform the approach to national security that we want to take.”

As the head of the Pentagon, HegeSeth advertised his efforts to upload any programming or leadership, which support diversity in ranks, tried to end members of transgender services and commenced sweeping changes to implement a uniform fitness standard for the fight position.

In the note announcing the cuts on Monday, HegSeth said that they might remove “unnecessary forces to optimize and improve leadership.” He said that the goal was to free the army from “unnecessary bureaucratic layers.”

Rep. Seth Moulton, D-Mass. Marine, who served in Iraq and is now in the Armed Service Committee, said he perceived HegeSetha as trying to politicize the army.

“He creates a formal framework to slow down all generals who disagree with him – and president,” said Multon AP in Capitol.

He said that actually every organization can search for performance, but HegeSeth has been clearly clearly expressing its program. “He wrote a book about it. He wants to politicize the army,” said Multon. “So it’s hard to see these cuts in any other context.”

Multon warned against the fall of the soldiers. “It is necessary for our soldiers to understand that they receive constitutional orders, not political orders,” he said, “otherwise you have no democracy, otherwise you have an army that works well for one or another political party.”

Adding to the confusion in the Pentagon, HegeSeth in recent weeks I actually have released or moved many close advisersstrongly narrowing his inner circle. He also handled questions from each Democrats and Republicans about coping with sensitive information and the use of applications for sending signal messages.

There are about 800 general officers in the army, but only 44 of them are 4 -star general or flag officials. The army has the largest variety of general officers, from 219, including eight 4 -star generals.

The variety of positions of the general officer in the army is set by law. Congress members didn’t receive a notification upfront, which they might normally receive in cuts, but in the afternoon they received a “very short warning”, according to a congress worker, which spoke on the condition of anonymity to provide details that weren’t made public.

The cuts were first reported by CNN.

The Pentagon is under pressure to reduce expenses and staff as a part of wider cuts of the federal government pushed by the Department of the Government of Trump and Ally Elon Musk.

HegeSeth last week ordered a sweeping transformation Army to “build a slim, more deadly force”, including connecting or closing the headquarters, shedding outdated vehicles and aircraft, cutting up to 1,000 employees of the headquarters in the Pentagon and transfer of staff to units in the field.

Also last week, the army confirmed that it could be Military Parade for Trump’s birthday In June, as a part of the celebration of the 250th birthday of the service. Officials say it would cost tens of tens of millions of dollars.

—-

Associated Press Writers Lisa Mascaro and Lolita C. Baldor contributed to this report.

(Tagstranslat) troops

-

Press Release1 year ago

Press Release1 year agoU.S.-Africa Chamber of Commerce Appoints Robert Alexander of 360WiseMedia as Board Director

-

Press Release1 year ago

Press Release1 year agoCEO of 360WiSE Launches Mentorship Program in Overtown Miami FL

-

Business and Finance11 months ago

Business and Finance11 months agoThe Importance of Owning Your Distribution Media Platform

-

Business and Finance1 year ago

Business and Finance1 year ago360Wise Media and McDonald’s NY Tri-State Owner Operators Celebrate Success of “Faces of Black History” Campaign with Over 2 Million Event Visits

-

Ben Crump1 year ago

Ben Crump1 year agoAnother lawsuit accuses Google of bias against Black minority employees

-

Theater1 year ago

Theater1 year agoTelling the story of the Apollo Theater

-

Ben Crump1 year ago

Ben Crump1 year agoHenrietta Lacks’ family members reach an agreement after her cells undergo advanced medical tests

-

Ben Crump1 year ago

Ben Crump1 year agoThe families of George Floyd and Daunte Wright hold an emotional press conference in Minneapolis

-

Theater1 year ago

Theater1 year agoApplications open for the 2020-2021 Soul Producing National Black Theater residency – Black Theater Matters

-

Theater11 months ago

Theater11 months agoCultural icon Apollo Theater sets new goals on the occasion of its 85th anniversary