Technology

IRL social app founder charged with fraud

While enterprise capitalists and other technocrats are on vacation or attending the Olympics in Paris, the U.S. Securities and Exchange Commission and its lawyers have their hands full this summer.

For the second time this week — and no less than the fourth up to now few months — the SEC has charged the founder of a venture-backed company with fraud.

The SEC said Wednesday it has charged Abraham Shafi, the founder and former CEO of a social media startup generally known as IRL, with allegedly defrauding investors. The agency alleges that Shafi made false and misleading statements concerning the company’s growth and concealed that he and his fiancée, Barbara Woortmann, made extensive use of company bank cards to pay for private expenses.

IRL was positioned as a viral social media app that gained popularity through the pandemic, but there was one small problem: Its thousands and thousands of users were fake. IRL, which began as a social calendar app and built a messaging-based social network to turn out to be the “WeChat of the West,” was shut down in June 2023 after an internal investigation by company management found that 95% of the app’s users were “automated or bot-based.”

Before IRL collapsed, Shafi had raised $200 million in enterprise capital. The startup’s last round—a $170 million Series C led by Softbank’s Vision Fund 2—made IRL a unicorn with a valuation of $1.17 billion. The problems and concerns soon followed.

The SEC said in its grievance Wednesday that Shafi portrayed IRL as a viral social media platform that organically attracted a purported 12 million users. Instead, IRL spent thousands and thousands of dollars on ads that offered incentives to download the IRL app, in response to the SEC.

The SEC alleges that Shafi hid those expenses. The grievance also alleges that Shafi didn’t speak in confidence to investors that he and Woortmann had charged a whole bunch of hundreds of dollars to the corporate’s bank cards for clothing, home furnishings and travel.

“As we alleged, Shafi exploited investors’ appetite for pre-IPO technology investments and fraudulently raised approximately $170 million by lying about IRL’s business practices,” said Monique C. Winkler, director of the SEC’s San Francisco regional office. “Investors in this space should remain vigilant.”

Earlier this week, the SEC charged BitClout founder Nader Al-Naji with fraud and unregistered securities offering, alleging that he used the pseudonym “DiamondHands” to avoid regulatory scrutiny while raising greater than $257 million in cryptocurrency. BitClout, a high-profile cryptocurrency startup, was backed by high-profile enterprise capitalists reminiscent of a16z, Sequoia, Chamath Palihapitiya’s Social Capital, Coinbase Ventures, and Winklevoss Capital.

In June, the SEC charged Ilit Raz, CEO and founder of now-shuttered AI recruiting startup Joonko, with defrauding investors of no less than $21 million. The agency accused Raz of creating false and misleading statements concerning the number and quality of Joonko’s customers, the variety of candidates on the platform and the startup’s revenue.

The agency has also been going after enterprise capital firms in recent months. In May, the SEC charged Robert Scott Murray and his firm Trillium Capital LLC with fraud for manipulating the stock price of Getty Images Holdings Inc. by announcing a bogus offer from Trillium to purchase Getty Images.

Technology

Flipkart co-founder Binny Bansal is leaving PhonePe’s board

Flipkart co-founder Binny Bansal has stepped down three-quarters from PhonePe’s board after making an identical move on the e-commerce giant.

Bengaluru-based PhonePe said it has appointed Manish Sabharwal, executive director at recruitment and human resources firm Teamlease, as an independent director and chairman of the audit committee.

Bansal played a key role in Flipkart’s acquisition of PhonePe in 2016 and has since served on the fintech’s board. The Walmart-backed startup, which operates India’s hottest mobile payment app, spun off from Flipkart in 2022 and was valued at $12 billion in funding rounds that raised about $850 million last 12 months.

Bansal still holds about 1% of PhonePe. Neither party explained why they were leaving the board.

“I would like to express my heartfelt gratitude to Binny Bansal for being one of the first and staunchest supporters of PhonePe,” Sameer Nigam, co-founder and CEO of PhonePe, said in a press release. His lively involvement, strategic advice and private mentoring have profoundly enriched our discussions. We will miss Binny!”

Technology

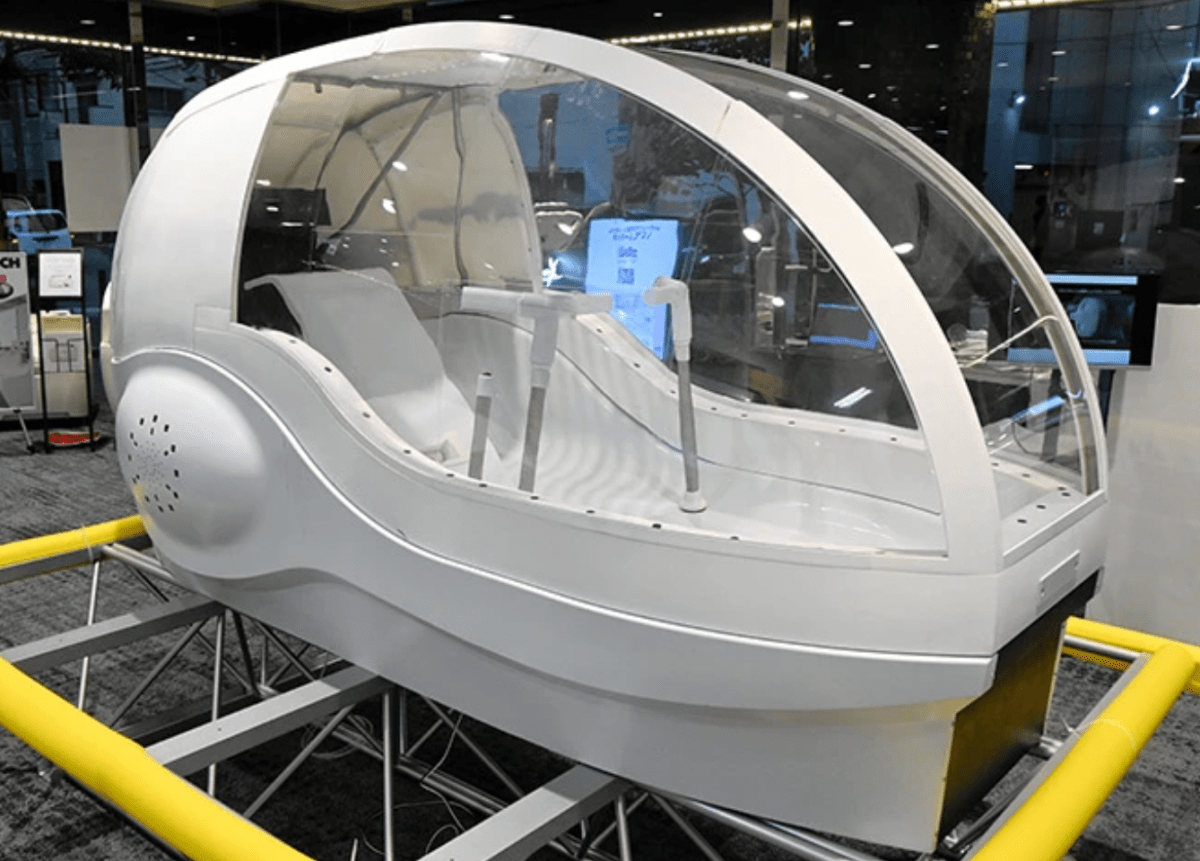

The company is currently developing washing machines for humans

Forget about cold baths. Washing machines for people may soon be a brand new solution.

According to at least one Japanese the oldest newspapersOsaka-based shower head maker Science has developed a cockpit-shaped device that fills with water when a bather sits on a seat in the center and measures an individual’s heart rate and other biological data using sensors to make sure the temperature is good. “It also projects images onto the inside of the transparent cover to make the person feel refreshed,” the power says.

The device, dubbed “Mirai Ningen Sentakuki” (the human washing machine of the longer term), may never go on sale. Indeed, for now the company’s plans are limited to the Osaka trade fair in April, where as much as eight people will have the option to experience a 15-minute “wash and dry” every day after first booking.

Apparently a version for home use is within the works.

Technology

Zepto raises another $350 million amid retail upheaval in India

Zepto has secured $350 million in latest financing, its third round of financing in six months, because the Indian high-speed trading startup strengthens its position against competitors ahead of a planned public offering next yr.

Indian family offices, high-net-worth individuals and asset manager Motilal Oswal invested in the round, maintaining Zepto’s $5 billion valuation. Motilal co-founder Raamdeo Agrawal, family offices Mankind Pharma, RP-Sanjiv Goenka, Cello, Haldiram’s, Sekhsaria and Kalyan, in addition to stars Amitabh Bachchan and Sachin Tendulkar are amongst those backing the brand new enterprise, which is India’s largest fully national primary round.

The funding push comes as Zepto rushes so as to add Indian investors to its capitalization table, with foreign ownership now exceeding two-thirds. TechCrunch first reported on the brand new round’s deliberations last month. The Mumbai-based startup has raised over $1.35 billion since June.

Fast commerce sales – delivering groceries and other items to customers’ doors in 10 minutes – will exceed $6 billion this yr in India. Morgan Stanley predicts that this market shall be value $42 billion by 2030, accounting for 18.4% of total e-commerce and a pair of.5% of retail sales. These strong growth prospects have forced established players including Flipkart, Myntra and Nykaa to cut back delivery times as they lose touch with specialized delivery apps.

While high-speed commerce has not taken off in many of the world, the model seems to work particularly well in India, where unorganized retail stores are ever-present.

High-speed trading platforms are creating “parallel trading for consumers seeking convenience” in India, Morgan Stanley wrote in a note this month.

Zepto and its rivals – Zomato-owned Blinkit, Swiggy-owned Instamart and Tata-owned BigBasket – currently operate on lower margins than traditional retail, and Morgan Stanley expects market leaders to realize contribution margins of 7-8% and adjusted EBITDA margins to greater than 5% by 2030. (Zepto currently spends about 35 million dollars monthly).

An investor presentation reviewed by TechCrunch shows that Zepto, which handles greater than 7 million total orders every day in greater than 17 cities, is heading in the right direction to realize annual sales of $2 billion. It anticipates 150% growth over the following 12 months, CEO Aadit Palicha told investors in August. The startup plans to go public in India next yr.

However, the rapid growth of high-speed trading has had a devastating impact on the mom-and-pop stores that dot hundreds of Indian cities, towns and villages.

According to the All India Federation of Consumer Products Distributors, about 200,000 local stores closed last yr, with 90,000 in major cities where high-speed trading is more prevalent.

The federation has warned that without regulatory intervention, more local shops shall be vulnerable to closure as fast trading platforms prioritize growth over sustainable practices.

Zepto said it has created job opportunities for tons of of hundreds of gig employees. “From day one, our vision has been to play a small role in nation building, create millions of jobs and offer better services to Indian consumers,” Palicha said in an announcement.

Regulatory challenges arise. Unless an e-commerce company is a majority shareholder of an Indian company or person, current regulations prevent it from operating on a listing model. Fast trading corporations don’t currently follow these rules.

-

Press Release8 months ago

Press Release8 months agoCEO of 360WiSE Launches Mentorship Program in Overtown Miami FL

-

Business and Finance6 months ago

Business and Finance6 months agoThe Importance of Owning Your Distribution Media Platform

-

Press Release7 months ago

Press Release7 months agoU.S.-Africa Chamber of Commerce Appoints Robert Alexander of 360WiseMedia as Board Director

-

Business and Finance8 months ago

Business and Finance8 months ago360Wise Media and McDonald’s NY Tri-State Owner Operators Celebrate Success of “Faces of Black History” Campaign with Over 2 Million Event Visits

-

Ben Crump7 months ago

Ben Crump7 months agoAnother lawsuit accuses Google of bias against Black minority employees

-

Fitness7 months ago

Fitness7 months agoBlack sportswear brands for your 2024 fitness journey

-

Theater8 months ago

Theater8 months agoApplications open for the 2020-2021 Soul Producing National Black Theater residency – Black Theater Matters

-

Ben Crump8 months ago

Ben Crump8 months agoHenrietta Lacks’ family members reach an agreement after her cells undergo advanced medical tests