Technology

Nvidia may be ready to be the successor to AWS

Nvidia and Amazon Web Services, Amazon’s lucrative cloud arm, has surprisingly much in common. First, their core business was created by glad accident. In the case of AWS, it realized that it could sell internal services—storage, compute, and memory—that it had built for itself in-house. In Nvidia’s case, it was the proven fact that a GPU created for gaming purposes also performed well for processing AI workloads.

Ultimately, this led to a surge in revenues in recent quarters. Nvidia’s revenue is growing by triple digits, from $7.1 billion in the first quarter of 2024 to $22.1 billion in the fourth quarter of 2024. That’s a reasonably amazing trajectory, although the overwhelming majority of that growth has been in the company’s data center business.

While Amazon has never experienced such an intense growth spurt, it has consistently been a big revenue driver for the e-commerce giant, and each firms have gained early market advantage. However, over the years, Microsoft and Google have joined the market to form the Big Three cloud service providers, and other chipmakers are expected to eventually start gaining significant market share, even when the revenue graph continues to rise over the coming years. several years.

Both firms were clearly in the right place at the right time. When web applications and mobile devices began to emerge around 2010, the cloud provided on-demand resources. Enterprises soon began to see the value of moving workloads or constructing applications in the cloud reasonably than running their very own data centers. Similarly, the rise of artificial intelligence over the past decade, and more recently large language models, has coincided with an explosion in the use of GPUs to process these workloads.

Over the years, AWS has evolved into an especially profitable company, currently earning a rate of return close to $100 billion, and which, even aside from Amazon, would be a really successful company. But AWS’s growth has begun to slow at the same time as Nvidia gains momentum. Part of that is the law of huge numbers, which can eventually affect Nvidia as well.

The query is whether or not Nvidia will be able to sustain this growth and develop into a long-term revenue powerhouse like AWS is for Amazon. If the GPU market starts to shrink, Nvidia could have other businesses, but as this chart shows, they’re much smaller revenue generators which can be growing much slower than the current GPU data center business.

Image credits: Nvidia

Short-term financial prospects

As you possibly can see in the chart above, Nvida’s revenue growth in recent quarters has been astronomical. According to Nvidia and Wall Street analysts, this case will proceed.

In his recent earnings report covering the fourth quarter of fiscal 2024 (the three months ending January 31, 2024), Nvidia has informed its investors that it expects revenue of $24 billion in the current quarter (Q1FY25). Compared to last 12 months’s first quarter, Nvidia expects growth of roughly 234%.

It’s just not a number we regularly see for mature public firms. However, given the company’s massive revenue growth in recent quarters, its growth rate is anticipated to slow. Following 22% revenue growth from the third to fourth quarters of the recently ended fiscal 12 months, Nvidia expects a more modest growth rate of 8.6% from the last quarter of fiscal 2024 to the first quarter of fiscal 2025. Certainly next 12 months – compared to last 12 months, reasonably than looking back at just three months, Nvidia’s growth rate stays incredible in the current period. However, there are other growth declines on the horizon.

For example, analysts expect Nvidia to generate revenue of $110.5 billion in the current fiscal 12 months, up just over 81% from a 12 months ago. This is significantly lower than the 126% growth recorded in the recently ended fiscal 12 months 2024.

To which we ask: So what? Nvidia is anticipated to proceed growing its revenues over no less than the next few quarters, surpassing the $100 billion annualized rate mark, a powerful result for a corporation that reported total revenues of just $7.19 billion a 12 months ago .

In short, analysts and, to a more modest extent, Nvidia, see tremendous growth ahead for the company, even when a few of its impressive revenue growth numbers slow this calendar 12 months. It is unclear what is going to occur in a rather longer time horizon.

Forward momentum

It looks like AI may be the gift that keeps on giving to Nvidia for the next few years, at the same time as it starts to see more competition from AMD, Intel and other chipmakers. Like AWS, Nvidia will eventually face stronger competition, however it currently controls a lot of the market that it might afford to lose some.

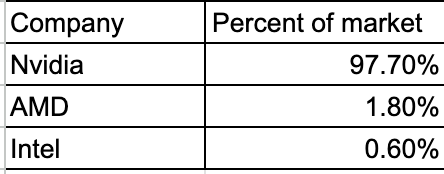

By looking solely at the chip level, and never at the boards or other adjoining components, IDC shows that Nvidia is in total control:

Image credits: IDC

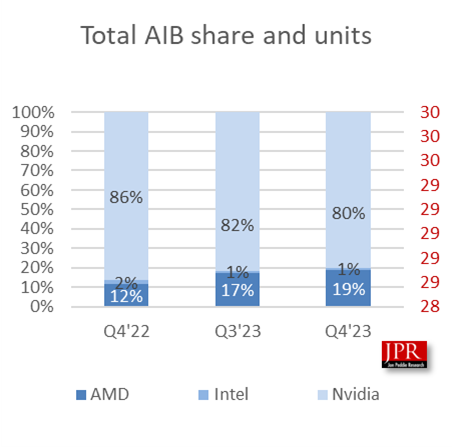

If you take a look at the motherboard level and supply market share data from Jon Peddie Research (JPR), an organization that tracks the GPU market, while Nvidia continues to dominate, AMD becomes stronger:

Image credits: Jon Peddie’s research

C Robert Dow, an analyst at JPR, says a few of these fluctuations have to do with the timing of recent product introductions. “AMD is gaining percentage points here and there depending on market cycles – when new cards are introduced – and inventory levels, but Nvidia has had a dominant position for years and will continue to do so,” Dow told TechCrunch.

Shane Rau, an IDC analyst who tracks the silicon market, also expects this dominance to proceed, at the same time as trends change. “There are trends and counter-trends, the markets in which Nvidia participates are large and getting larger, and growth will continue for at least the next five years,” Rau said.

One reason is that Nvidia sells greater than just the chip itself. “They sell you boards, systems, software, services and time spent on certainly one of their supercomputers. So each of those markets is large and growing, and Nvidia is committed to each of them,” he said.

However, not everyone sees Nvidia as an unstoppable force. David Linthicum, a long-time cloud consultant and writer, says you do not at all times need GPUs, and corporations are starting to realize this. “They say they need GPUs. I take a look at it, do the calculations on the back of the envelope, and it seems they do not need them. The processors are in excellent condition,” he said.

He believes that when this happens, Nvidia will start to decelerate and the competition will weaken its position in the market. “I think Nvidia will turn into an underdog over the next few years. And we will see that because too many substitutes are being built.”

Rau says other vendors will even profit as firms expand AI applications to include Nvidia products. “I think we will see growing markets in the future, which will be a positive factor for Nvidia. But then there will be other companies that will also follow this tailwind and will particularly benefit from artificial intelligence.”

It can be possible that some disruptive force will be at work, with a positive effect if one company doesn’t develop into too dominant. “You almost hope there will be disruption because that’s how markets and capitalism work best, right? Someone gains an early advantage, other suppliers follow, the market grows. You get established players that end up being disrupted by a better way of doing the same thing in their market or in adjacent markets that are encroaching on theirs,” Rau said.

In fact, we’re starting to see this occur at Amazon as Microsoft gains traction with its relationship with OpenAI and Amazon is forced to play catch-up when it comes to AI. Whatever happens to Nvidia in the future, it’s currently firmly in the driver’s seat, creating wealth, dominating a growing market, and just about all the pieces goes its own way. However, this doesn’t mean that this may at all times be the case and that there won’t be greater competitive pressure in the future.

Technology

The signal is the number one application in the Netherlands. But why?

The application signal for sending a privacy -oriented message flew high in Dutch application stores last month, often sitting at the top as the most steadily downloaded free application for iOS and Android in all categories, for data from many application tracking platforms akin to the sensor tower.

The application has experienced popularity over the years, often in response to Changes in politics in rivals akin to WhatsApp Or Geopolitical events. This is because Signal has set a reputation as a more friendly privacy option-it is served by the non-profit foundation (though based in the USA), not a personal company focused on data earning data. In addition, the signal tracks minimal metadata.

In 2025, along with the recent US president, who strengthened the warm Big Tech hug, it is not surprising that digital privacy tools have a moment – especially in Europe, which attracted the anger of President Trump.

But this time, the meaning of the signal in one very specific place-Holandia is particularly eye-catching.

IN Interview with Dutch newspaper de Telelegraaf last week, President signal Meredith Whittaker He noticed that the number of “new registrations” in the Netherlands was 25 this 12 months, even though it is not clear what the exact comparative period for this data is.

Asked why the Netherlands recorded such development, Whittaker pointed to the combination of things: “growing awareness of privacy, distrust of large technology and political reality in which people realize how sensitive digital communication can be,” said Whittaker.

Data provided to TechCrunch from the application intelligence company Appfigures Increase in Signal Signal in the Netherlands. According to its data, the signal was 365. Among the applications apart from the iPhone in the Netherlands on January 1 and didn’t appear on the list of the most significant general applications. Then, from around January 5, he began to climb the rankings, reaching the highest position until February 2.

The signal immersed and comes out of the lead during weeks, spending around mid -February at the top – including every single day from February 22. By digging deeper into the data, the AppFigures estimates that the total download in Apple and Google Applets in total in December 2024 jumped to 99,000 in January and increased to 233,000 to February – 958%.

While a part of this height could be assigned to a lower saturation signal than other markets, a continuing application position at the top in comparison with neighboring markets of comparable size.

“No other markets are approaching the Netherlands in terms of growth between December and February,” said AppFigures Techcrunch.

For comparison, from December in Belgium, download increased by over 250%, Sweden by 153%and dishes by 95%.

So why the signal can experience what one redditor called “The moment of mass adoption“In the Netherlands?

Clear signal

Give ZengerSenior Policy Advisor at Dutch Digital Rights Foundation Fragments of freedomHe said that even though it is difficult to point one specific reason, he is not surprised.

The last changes in the US have seen Large platform suppliers Adapt with the recent Trump administration, and this has retained a major public and media debate. Relying Europe from the technology of big private American corporations has turn out to be the point of interest of this debate.

“The Dutch are, like many others, very dependent on the infrastructure provided by extremely dominant technology companies, mainly from the USA,” said Zenger. “What does this mean, and the risk that results from it has been nicely demonstrated in the last few weeks. As a result, the public debate in the Netherlands was relatively sharp. Where in the past this problem was discussed only at the level “:” I feel that we are now conducting a debate at the higher levels: “.

In this context, society can mix dominance with data protection abuse. Since corporations akin to meta are frequently studied and fined in the field of information privacy practices, the signal could appear to be less evil: it is based on the US, but supported by a non-profit organization, which ensures encryption of each the content of the message and around it.

Vincent BöhreDirector of the Dutch Organization of Privacy Privacy firstHe also pointed to increased media relationships and a wider change of public opinion.

“Since a few months ago he was re-elected in the United States, in the Dutch-and European media, which seem to support Trump, there were many” Elon) Muska. “Articles criticizing X (previously Twitter) and Meta appear everywhere in the Dutch media, which leads to a change in Dutch public opinion: even people who have never really known or cared for privacy and security in social media, suddenly became interested in” friendly privacy “alternative, in particular the signal.”

Signal of intentions

While the Netherlands is only one market of 18 million people in the European population over 700 million, its increase in adoption can signal a wider trend throughout the continent, especially when governments try to cut back privacy barriers.

For example, Apple has recently pulled out comprehensive encryption from iCloud in Great Britain to counteract government efforts to put in a backdoor.

Speech Fr. Rightcon 25 In Taiwan, this week, Whittaker confirmed the unwavering Signal attitude regarding privacy.

“Signal position on this subject is very clear- we will not walk, falsify or otherwise disturb the solid guarantees of privacy and security that people rely on” Said Whittaker. “Regardless of whether this disturbance or backdoor is called scanning on the client’s side or removing the protection of encryption against one or the other, the features similar to what Apple has been forced to do in Great Britain”

Separately, in Interview with Swedish public broadcaster, Whittaker said that Signal wouldn’t follow the proposed Swedish law requiring application to send messages for storage.

“In practice, this means asking us to break encryption, which is the basis of our entire activity,” said Whittaker. “Asking us to store data would undermine all our architecture and we would never do it. We would prefer to completely leave the Swedish market. “

TechCrunch contacted to signal a comment, but he didn’t hear during the publication.

(Tagstotranslat) signal of the Netherlands

Technology

Gayle King announces participation in the space mission of all women

Gayle King will join the thirty first Blue Origin civil flight into space.

Gayle King announced that he was going to space. The host of the talk show during the day provided messages CBS MORNINGS.

King revealed Her participation in the thirty first Blue Origin flights, NS-31. Before discussing the details of the mission, she and her co -lecturers presented the video editing, which described her long -term fascination with travel travel.

In one clip, King said: “I am excited to watch the premiere at home in my pajamas.”

Her enthusiasm led to an invite with Blue Origin. The television personality will disappear from Crew from the whole familyIncluding an award -winning journalist Lauren Sánchez, award -winning Grammy singer Katy Perry and astronaut Aish Bowe.

Soon the explorer of the space admitted that she was hesitating at first.

“I don’t know how to explain at the same time terrified and excited,” said King.

To make a choice, King turned to a gaggle of family members, including her children and a detailed friend, Oprah Winfrey. She said that when her most trusted confidants approved, she was ready.

“When Kirby, Will and Oprah were fine, I was fine,” said King. “I thought Oprah would say no. She said: “I feel that when you don’t do it, if you all come back and also you had the opportunity to do it, you’ll kick.” She is right. “

King is not going to be the first television host who wandered into space with blue origin. In 2021, then-Good morning America Coheat Michael Strahan took part in the third civil flight Blue Origin. The former NFL star and the sender was delighted after returning, expressing how this experience gave him a brand new “perspective” in the world.

“I want to come back,” said Strahan.

Blue origin, Founded by Amazon Billionaire Jeff Bezos in 2000 is a non-public aviation company that focuses on sharing space travels for civilians and developing technology to explore the space long.

The upcoming flight of the king New Shepard It will probably be part of Blue Origin’s constant efforts to normalize civil space travel.

Technology

Instagram can turn the rollers in a separate application

Meta is occupied with an independent application for brief movies, Information He informed, citing an anonymous source, which he heard the boss on Instagram Adam Mosseri talked about the personnel project.

The project is reportedly called RAY code, which goals to enhance recommendations for brand new users and existing users in the US and to conclude one other three minutes of movies, the report quoted the source.

The finish line didn’t answer immediately at the request for comment.

Last month, the company announced a video editing application called Edyta to compete with Capcut (belonging to Tiktok Matter Company Bytedance) since it was geared toward using the uncertain future Tiktok and Bytedance in the USA

Currently, the Instagram channel is a mixture of photos, movies (drums) and stories. However, many users imagine that the application has been cluttered since it incorporates movies and not persist with the roots as an application for sharing photos. If the company rotates in an independent application for brief movies, it can create a possibility for Instagram to emphasise other functions.

Instagram began at the starting of this yr paying creators To promote Instagram on other platforms, resembling Tiktok, Snapchat and YouTube. Apparently he also began to supply Big money for the creators Present only on roller skates.

(Tagstranslate) Instagram

-

Press Release11 months ago

Press Release11 months agoCEO of 360WiSE Launches Mentorship Program in Overtown Miami FL

-

Press Release11 months ago

Press Release11 months agoU.S.-Africa Chamber of Commerce Appoints Robert Alexander of 360WiseMedia as Board Director

-

Business and Finance9 months ago

Business and Finance9 months agoThe Importance of Owning Your Distribution Media Platform

-

Business and Finance11 months ago

Business and Finance11 months ago360Wise Media and McDonald’s NY Tri-State Owner Operators Celebrate Success of “Faces of Black History” Campaign with Over 2 Million Event Visits

-

Ben Crump11 months ago

Ben Crump11 months agoAnother lawsuit accuses Google of bias against Black minority employees

-

Theater11 months ago

Theater11 months agoTelling the story of the Apollo Theater

-

Ben Crump12 months ago

Ben Crump12 months agoHenrietta Lacks’ family members reach an agreement after her cells undergo advanced medical tests

-

Ben Crump12 months ago

Ben Crump12 months agoThe families of George Floyd and Daunte Wright hold an emotional press conference in Minneapolis

-

Theater11 months ago

Theater11 months agoApplications open for the 2020-2021 Soul Producing National Black Theater residency – Black Theater Matters

-

Theater9 months ago

Theater9 months agoCultural icon Apollo Theater sets new goals on the occasion of its 85th anniversary