Technology

Pregnant women were left unemployed due to layoffs in technology companies

No specific legal protections protect pregnant or postpartum employees from mass layoffs based on business needs.

Amid widespread layoffs in the tech industry last 12 months, a disturbing trend emerged: Pregnant women and other people on parental leave were amongst those laid off.

There have been many stories on social media detailing the difficult situation of pregnant or postpartum employees who’ve been laid off from work. However, as stated, there are not any explicit legal guarantees protection of pregnant employees or latest parents against dismissal driven by business needs.

Employment lawyer Jack Tuckner, who specializes in gender discrimination cases, said he has received calls from affected employees across the country.

“I think young mothers and pregnant women are certainly vulnerable and are more likely to have abortions,” Tuckner said. “But it’s the same analysis as always: You [can] be fired when you are pregnant, just not because you are pregnant. The bigger problem comes when a thousand or more people are laid off en masse and positions are eliminated – how do you prove that gender, pregnancy and perceived disability mattered?”

In the absence of federally required paid leave, these women must deal with minimal support from their former employers while caring for newborns or preparing for childbirth, with no job security. Or no job.

Nichole Foley, who was fired from Google while on maternity leave, revealed that she was asked to hire a lawyer to reject the terms of her layoff, which Google said was due to performance issues. Former Google worker Brittany Lappano, who was laid off in 2023, founded the Labor Club Discord group, which now has greater than 400 members and offers advice to laid-off employees.

The scale of tech layoffs affecting pregnant employees and latest parents is staggering. Giants like Google, Amazon and Meta have collectively laid off tens of 1000’s of employees over the past 12 months and a half in consequence of widespread downsizing efforts. Tesla recently joined the fray, eliminating over 14,000 positions.

According to the Layoffs.fyi tracker, job cuts in the industry will occur from the start of 2023 has surpassed a devastating 340,000 across companies. According to CNBC, in 2023 Amazon and Microsoft announcing a complete of 28,000 layoffsand Google CEO Sundar Pichai announced layoffs of about 12,000 employees.

Technology

Revolut will introduce mortgage loans, smart ATMs and business lending products

Revolutthe London-based fintech unicorn shared several elements of the corporate’s 2025 roadmap at a company event in London on Friday. One of the corporate’s important goals for next yr will be to introduce an AI-enabled assistant that will help its 50 million customers navigate financial apps, manage money and customize software.

Considering that artificial intelligence is at the middle of everyone’s attention, this move shouldn’t be surprising. But an AI assistant could actually help differentiate Revolut from traditional banking services, which have been slower to adapt to latest technologies.

When Revolut launched its app almost 10 years ago, many individuals discovered the concept of debit cards with real-time payment notifications. Users may lock the cardboard from the app.

Many banks now can help you control your card using your phone. However, they’re unlikely to supply AI features that might be useful yet.

In addition to the AI assistant, Revolut announced that it will introduce branded ATMs to the market. These will end in money being spent (obviously), but in addition cards – which could encourage latest sign-ups.

Revolut said it plans so as to add facial recognition features to its ATMs in the longer term, which could help with authentication without using the same old card and PIN protocol. It will be interesting to see the way it implements this technology in a way that complies with European Union data protection regulations, which require explicit consent to make use of biometric data for identification purposes.

According to the corporate, Revolut ATMs will start appearing in Spain in early 2025.

Revolut has had a banking license in Europe for a while, which implies it may offer lending products to its retail customers. It already offers bank cards and personal loans in some countries.

Now the corporate plans to expand into mortgage loans – some of the popular lending products in Europe – with an emphasis on speed. If it’s an easy request, customers should generally expect immediate approval and a final offer inside one business day. However, mortgages are rarely easy, so it will be interesting to see if Revolut overpromises.

It appears that the mortgage market rollout will be slow. Revolut said it was starting in Lithuania, with Ireland and France expected to follow suit. Although all these premieres are scheduled for 2025.

Finally, Revolut intends to expand its business offering in Europe with its first loan products and savings accounts. In the payments space, it will enable business customers to supply “buy now, pay later” payment options.

Revolut will introduce Revolut kiosks with biometric payments especially for restaurants and stores.

If all these features seem overwhelming, it’s because Revolut is consistently committed to product development, rolling out latest features quickly. And 2025 looks no different.

Technology

Flipkart co-founder Binny Bansal is leaving PhonePe’s board

Flipkart co-founder Binny Bansal has stepped down three-quarters from PhonePe’s board after making an identical move on the e-commerce giant.

Bengaluru-based PhonePe said it has appointed Manish Sabharwal, executive director at recruitment and human resources firm Teamlease, as an independent director and chairman of the audit committee.

Bansal played a key role in Flipkart’s acquisition of PhonePe in 2016 and has since served on the fintech’s board. The Walmart-backed startup, which operates India’s hottest mobile payment app, spun off from Flipkart in 2022 and was valued at $12 billion in funding rounds that raised about $850 million last 12 months.

Bansal still holds about 1% of PhonePe. Neither party explained why they were leaving the board.

“I would like to express my heartfelt gratitude to Binny Bansal for being one of the first and staunchest supporters of PhonePe,” Sameer Nigam, co-founder and CEO of PhonePe, said in a press release. His lively involvement, strategic advice and private mentoring have profoundly enriched our discussions. We will miss Binny!”

Technology

The company is currently developing washing machines for humans

Forget about cold baths. Washing machines for people may soon be a brand new solution.

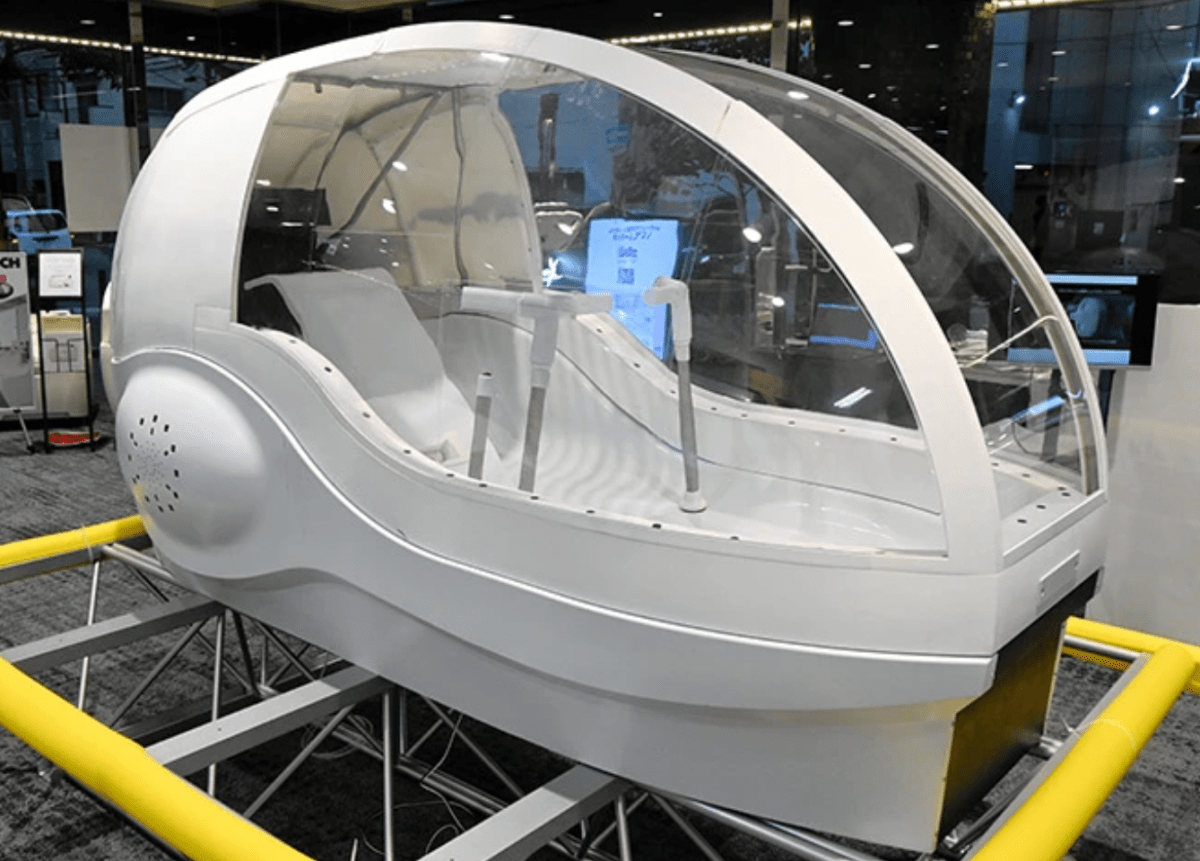

According to at least one Japanese the oldest newspapersOsaka-based shower head maker Science has developed a cockpit-shaped device that fills with water when a bather sits on a seat in the center and measures an individual’s heart rate and other biological data using sensors to make sure the temperature is good. “It also projects images onto the inside of the transparent cover to make the person feel refreshed,” the power says.

The device, dubbed “Mirai Ningen Sentakuki” (the human washing machine of the longer term), may never go on sale. Indeed, for now the company’s plans are limited to the Osaka trade fair in April, where as much as eight people will have the option to experience a 15-minute “wash and dry” every day after first booking.

Apparently a version for home use is within the works.

-

Press Release8 months ago

Press Release8 months agoCEO of 360WiSE Launches Mentorship Program in Overtown Miami FL

-

Business and Finance6 months ago

Business and Finance6 months agoThe Importance of Owning Your Distribution Media Platform

-

Press Release7 months ago

Press Release7 months agoU.S.-Africa Chamber of Commerce Appoints Robert Alexander of 360WiseMedia as Board Director

-

Business and Finance8 months ago

Business and Finance8 months ago360Wise Media and McDonald’s NY Tri-State Owner Operators Celebrate Success of “Faces of Black History” Campaign with Over 2 Million Event Visits

-

Ben Crump7 months ago

Ben Crump7 months agoAnother lawsuit accuses Google of bias against Black minority employees

-

Fitness7 months ago

Fitness7 months agoBlack sportswear brands for your 2024 fitness journey

-

Theater8 months ago

Theater8 months agoApplications open for the 2020-2021 Soul Producing National Black Theater residency – Black Theater Matters

-

Ben Crump8 months ago

Ben Crump8 months agoHenrietta Lacks’ family members reach an agreement after her cells undergo advanced medical tests