Technology

AI chip startup DEEPX secures $80 million Series C at $529 million valuation

DEEPX is a South Korean AI chip-on-device startup that creates hardware and software for various AI applications in electronic devices. This week, the corporate announced that it had raised $80 million (KRW 108.5 billion) in a Series C round at a valuation of $529 million (KRW 723 billion), a rise of greater than eightfold in comparison with its Series B financing of roughly $15 thousands and thousands of dollars. in 2021

The Series C funding, which brings a complete amount of roughly $95 million, will support mass production of the startup’s inaugural products – DX-V1, DX-V3, DX-M1 and DX-H1 – in late 2024 for global distribution. The startup will even use the brand new capital to speed up the event and launch of a brand new generation of enormous language model (LLM) device solutions.

DEEP was founded in 2018 by CEO Lokwon Kim, who previously worked at Apple, Cisco Systems, IBM Thomas J. Watson Research Center and Broadcom.

The global edge AI, also called on-device AI, market size is: expected to achieve $107.47 billion by 2029The latest report shows that in 2021, this amount increased from $11.98 billion. “The market for AI on devices, excluding edge servers, requires the implementation of AI capabilities bypassing servers or the cloud,” Kim told TechCrunch. “The on-device AI market is growing with computer vision capabilities such as facial and voice recognition, smart mobility, robotics, IoT and physical security systems.”

Kim said that if mass production begins this yr, potential customers equivalent to end-product manufacturers could commercialize their products with DEEPX AI chips in 2025.

DEEPX, with about 65 employees, just isn’t the one company that has developed AI chip solutions. The Korean company competes with Hailo, which received a $120 million funding round last month; SiMa.ai, which closed on $70 million, also in April; and Axelera, a Belgian AI chip startup that raised $27 million in 2022.

Kim said his company’s differentiators include cost efficiency, energy efficiency and All-in-4 AI, a comprehensive solution for various AI applications. Its All-in-4 AI solutions include: DX-V1 and DX-V3, designed for vision systems in home appliances, surveillance camera systems, robotic vision systems and drones; in addition to the DX-M1 and DX-H1, that are designed for AI computing computers, AI servers, smart factories and AI amplification chips. Kim said DEEPX currently has greater than 259 patents pending within the U.S., China and South Korea.

“Nvidia’s GPGPU-based solutions are most cost-effective for services with large language models such as ChatGPT; the total power consumed by running GPUs has reached levels that exceed the electricity of the entire country,” Kim said. “This collaborative technology between server-scale AI and large AI models on devices is expected to significantly reduce energy consumption and costs compared to relying solely on data centers.”

The startup has no customers yet, but is working with over 100 potential customers and strategic partners equivalent to Hyundai Kia Motors Robotics Lab and Korean IT company POSCO DX to check the capabilities of DEEPX’s AI chips.

SkyLake Equity Partners, a South Korean technology private equity firm, led the newest investment with BNW Investments, a Korean private equity firm founded by the previous CEO of Samsung LED and Samsung Electronics’ memory chip unit. AJU IB and former sponsor Timefolio Asset Management also participated on this round.

Technology

Flipkart co-founder Binny Bansal is leaving PhonePe’s board

Flipkart co-founder Binny Bansal has stepped down three-quarters from PhonePe’s board after making an identical move on the e-commerce giant.

Bengaluru-based PhonePe said it has appointed Manish Sabharwal, executive director at recruitment and human resources firm Teamlease, as an independent director and chairman of the audit committee.

Bansal played a key role in Flipkart’s acquisition of PhonePe in 2016 and has since served on the fintech’s board. The Walmart-backed startup, which operates India’s hottest mobile payment app, spun off from Flipkart in 2022 and was valued at $12 billion in funding rounds that raised about $850 million last 12 months.

Bansal still holds about 1% of PhonePe. Neither party explained why they were leaving the board.

“I would like to express my heartfelt gratitude to Binny Bansal for being one of the first and staunchest supporters of PhonePe,” Sameer Nigam, co-founder and CEO of PhonePe, said in a press release. His lively involvement, strategic advice and private mentoring have profoundly enriched our discussions. We will miss Binny!”

Technology

The company is currently developing washing machines for humans

Forget about cold baths. Washing machines for people may soon be a brand new solution.

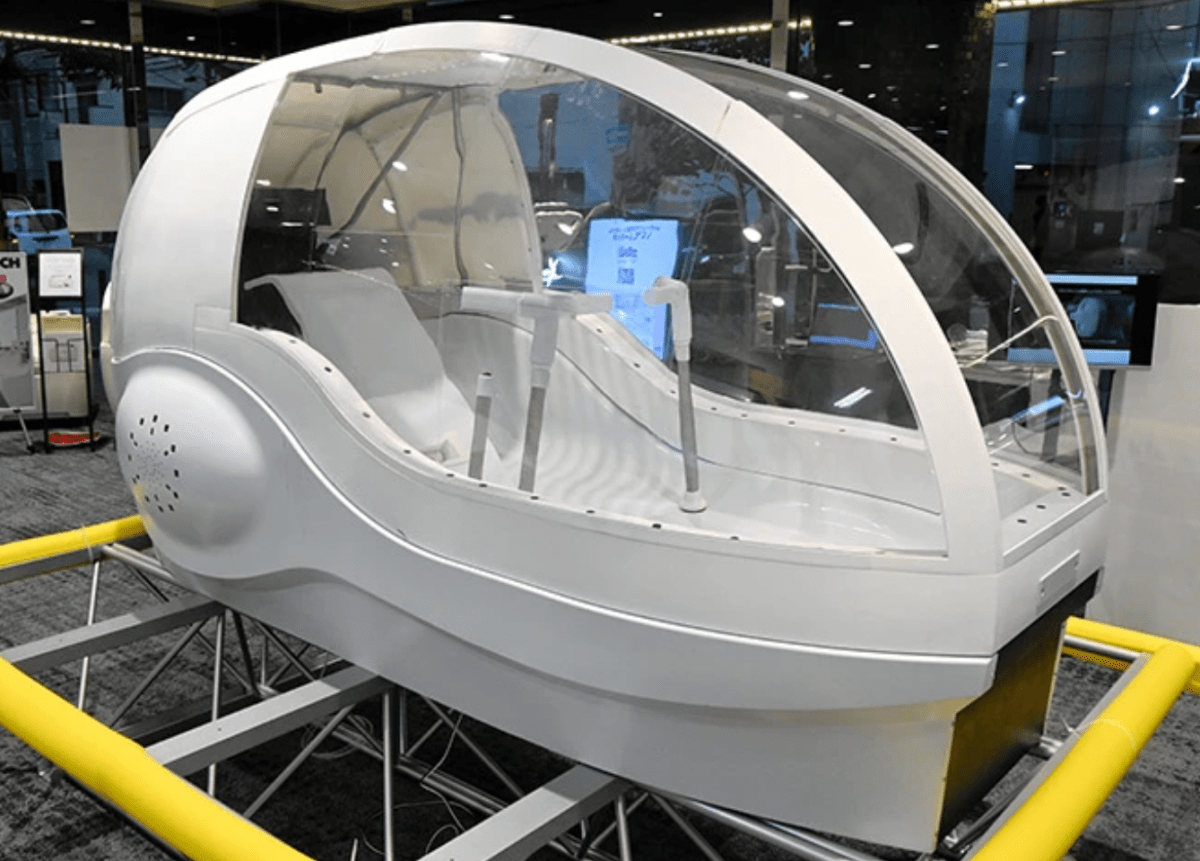

According to at least one Japanese the oldest newspapersOsaka-based shower head maker Science has developed a cockpit-shaped device that fills with water when a bather sits on a seat in the center and measures an individual’s heart rate and other biological data using sensors to make sure the temperature is good. “It also projects images onto the inside of the transparent cover to make the person feel refreshed,” the power says.

The device, dubbed “Mirai Ningen Sentakuki” (the human washing machine of the longer term), may never go on sale. Indeed, for now the company’s plans are limited to the Osaka trade fair in April, where as much as eight people will have the option to experience a 15-minute “wash and dry” every day after first booking.

Apparently a version for home use is within the works.

Technology

Zepto raises another $350 million amid retail upheaval in India

Zepto has secured $350 million in latest financing, its third round of financing in six months, because the Indian high-speed trading startup strengthens its position against competitors ahead of a planned public offering next yr.

Indian family offices, high-net-worth individuals and asset manager Motilal Oswal invested in the round, maintaining Zepto’s $5 billion valuation. Motilal co-founder Raamdeo Agrawal, family offices Mankind Pharma, RP-Sanjiv Goenka, Cello, Haldiram’s, Sekhsaria and Kalyan, in addition to stars Amitabh Bachchan and Sachin Tendulkar are amongst those backing the brand new enterprise, which is India’s largest fully national primary round.

The funding push comes as Zepto rushes so as to add Indian investors to its capitalization table, with foreign ownership now exceeding two-thirds. TechCrunch first reported on the brand new round’s deliberations last month. The Mumbai-based startup has raised over $1.35 billion since June.

Fast commerce sales – delivering groceries and other items to customers’ doors in 10 minutes – will exceed $6 billion this yr in India. Morgan Stanley predicts that this market shall be value $42 billion by 2030, accounting for 18.4% of total e-commerce and a pair of.5% of retail sales. These strong growth prospects have forced established players including Flipkart, Myntra and Nykaa to cut back delivery times as they lose touch with specialized delivery apps.

While high-speed commerce has not taken off in many of the world, the model seems to work particularly well in India, where unorganized retail stores are ever-present.

High-speed trading platforms are creating “parallel trading for consumers seeking convenience” in India, Morgan Stanley wrote in a note this month.

Zepto and its rivals – Zomato-owned Blinkit, Swiggy-owned Instamart and Tata-owned BigBasket – currently operate on lower margins than traditional retail, and Morgan Stanley expects market leaders to realize contribution margins of 7-8% and adjusted EBITDA margins to greater than 5% by 2030. (Zepto currently spends about 35 million dollars monthly).

An investor presentation reviewed by TechCrunch shows that Zepto, which handles greater than 7 million total orders every day in greater than 17 cities, is heading in the right direction to realize annual sales of $2 billion. It anticipates 150% growth over the following 12 months, CEO Aadit Palicha told investors in August. The startup plans to go public in India next yr.

However, the rapid growth of high-speed trading has had a devastating impact on the mom-and-pop stores that dot hundreds of Indian cities, towns and villages.

According to the All India Federation of Consumer Products Distributors, about 200,000 local stores closed last yr, with 90,000 in major cities where high-speed trading is more prevalent.

The federation has warned that without regulatory intervention, more local shops shall be vulnerable to closure as fast trading platforms prioritize growth over sustainable practices.

Zepto said it has created job opportunities for tons of of hundreds of gig employees. “From day one, our vision has been to play a small role in nation building, create millions of jobs and offer better services to Indian consumers,” Palicha said in an announcement.

Regulatory challenges arise. Unless an e-commerce company is a majority shareholder of an Indian company or person, current regulations prevent it from operating on a listing model. Fast trading corporations don’t currently follow these rules.

-

Press Release8 months ago

Press Release8 months agoCEO of 360WiSE Launches Mentorship Program in Overtown Miami FL

-

Business and Finance6 months ago

Business and Finance6 months agoThe Importance of Owning Your Distribution Media Platform

-

Press Release7 months ago

Press Release7 months agoU.S.-Africa Chamber of Commerce Appoints Robert Alexander of 360WiseMedia as Board Director

-

Business and Finance8 months ago

Business and Finance8 months ago360Wise Media and McDonald’s NY Tri-State Owner Operators Celebrate Success of “Faces of Black History” Campaign with Over 2 Million Event Visits

-

Ben Crump7 months ago

Ben Crump7 months agoAnother lawsuit accuses Google of bias against Black minority employees

-

Fitness7 months ago

Fitness7 months agoBlack sportswear brands for your 2024 fitness journey

-

Theater8 months ago

Theater8 months agoApplications open for the 2020-2021 Soul Producing National Black Theater residency – Black Theater Matters

-

Ben Crump8 months ago

Ben Crump8 months agoHenrietta Lacks’ family members reach an agreement after her cells undergo advanced medical tests