Lifestyle

Experts warn against the high costs of applications providing access to employee salaries

NEW YORK (AP) – When 37-year-old Anna Branch cut her work hours in 2019, she suddenly noticed ads for an app called EarnIn.

“You know how they use you – the algorithms – like they read your mind,” Branch said. “The ad said I could get up to $100 this week and pay it back the next pay period.”

Branch, who worked as an administrative assistant in Charleston, South Carolina, downloaded the app and added a suggested “tip.” The money helped cover her expenses until payday, when the app took the $100 she borrowed plus a $14 tip. Five years later, Branch said she still uses the app, even once a month.

EarnIn is one of several corporations providing this service, billed as access to wages. Apps provide staff with small, short-term loans between paychecks in order that they pays bills and meet each day needs. On payday, the user repays the money from his salary. According to Datos Insights, between 2018 and 2020, transaction volume tripled from $3.2 billion to $9.5 billion.

While wage access apps have been around for over a decade, the pandemic and its aftermath have increased their popularity. Some apps have accessible, human names – like Dave, Clio, Albert and Brigit – while others suggest financial freedom: Empower, FloatMe, FlexWage, Rain. According to the Government Accountability Office, the typical user earns lower than $50,000 a 12 months and has experienced two years of high inflation.

Proponents of the app say they assist people living paycheck to paycheck manage their funds and avoid having to resort to more burdensome options like payday loans or overdrafts. But some analysts, consumer advocates and lawmakers say these apps are literally payday loans in a brand new technological package and will trap users in a never-ending cycle of borrowing that eats away at their earnings.

Critics also say that borrowing costs are usually not all the time transparent. Many of them charge monthly subscription fees, and most charge mandatory fees for fast fund transfers, although there will likely be a free option to receive funds inside one to three business days. The average APR on a loan repaid inside 7 to 14 days was 367%, which is a rate comparable to payday loans, according to data report by the Center for Responsible Lending.

Adding to the confusion is the undeniable fact that some employers have incorporated payroll apps into their payrolls, offering different costs, models and fee structures. For example, Amazon and Walmart don’t all the time charge employees for early access to earned wages outside of regular pay periods.

“They suck you in”

Sheri Wilkins, 60, who works as a house health aide in College Station, Texas, said she has been using the app since 2020 and feels “money dependent.”

The health care skilled who employs Wilkins offers Every dayPay, and Wilkins typically uses the app to submit his each day pay amount ($10.60 per hour) twice a day – once after each of two shifts for which he’s paid individually. He pays a fee of $3.49 every time, for a complete of $7 per day. At $35 per week, the app takes up greater than three hours of her wages per week, or a day and a half of work monthly.

“They trick you into having this money,” Wilkins said. “It’s great to have it – buy groceries and cigarettes – but when it comes time to pay, it only costs $50 or $60.”

Wilkins said she didn’t know the app offered a free option to send money inside one to three days. She said the app all the time directed her to the quick transfer option.

A Every dayPay spokesperson said in a press release that the app offers two no-fee options for many users and a 3rd, which they described as a “small ATM-like fee.”

Matt Bahl, who researches workplace issues for the Financial Health Network, said the growth of the wage access industry is a symptom of widespread financial uncertainty.

“This is to help address short-term liquidity challenges,” he said. “But if these challenges are the result of insufficient revenue, it will not solve them. You cannot “technically” get out of material deficits.

Tips

Andrew Lewis, 32, of Bucks County, Pennsylvania, said he uses EarnIn partially to cover unexpected expenses. Lewis works as a process technician at an electronics manufacturing company and said he sometimes uses the app as often as weekly to get money for gas or do something his child or wife needs.

Lewis often pays the “tips” that the apps suggest, he said, but he “doesn’t like them very much,” partly because of the messages.

“Tips help us advocate for millions of members like you,” the EarnIn app says. The company says it uses suggestions to keep the option free.

“I feel a little guilty about how it sounds,” Lewis said.

In 2021, the California Department of Financial Protection and Innovation found that “users often feel pressured to leave (tipping) due to pressure tactics used, such as… claiming that tips are used to support other vulnerable consumers or for charitable purposes.” .

In its report, the department found that Earned Income Access borrowers take out a mean of 36 loans a 12 months. Across 5.8 million transactions, 73% of consumers paid a “tip,” averaging $4.09 per tip. For three dozen loans, that is $147 a 12 months in suggestions alone.

Convenience and no credit checks

Penny Lee, head of industry group the Financial Technology Association, says more individuals are turning to access to wage earners as a convenience that permits them to compensate for “the gap between what a consumer needs to be able to spend… and their wage cycle.”

As with Buy Now and Pay Later loans, the apps don’t perform credit checks and don’t bill you as interest-free. Unlike payday loans or automotive loans, where borrowers pledge their vehicles as collateral, app users do not have to take care of balloon payments, black marks on credit reports or the possibility of losing their automotive in the event that they default. Supporters also say the apps don’t sue or send debt collectors after unpaid debts.

According to FTA, the average cost of using the Earned Wage Access app is between $2.59 and $6.27. The corporations say the fees are comparable to ATM fees and cheaper than overdraft fees that individuals pay in the event that they don’t manage to pay for of their checking account to cover the bill before a withdrawal. The average overdraft fee is over $25 and will be as high as $36.

Featured Stories

However, in its report, the Center for Responsible Lending said that users of the app saw a 56% increase in overdrafts.

A key moment for regulation

Many states have moved to regulate access to wage earners by limiting fees for these products. The industry supports federal laws currently pending in Congress that might preclude regulation of apps under the Truth in Lending Act.

When Connecticut passed a law limiting the fees apps could charge, EarnIn stopped operating in the state. When asked why, EarnIn CEO Ram Palaniappan said it was not “economically viable.”

Both California and Hawaii are currently drafting laws to limit wage access fees.

Rep. Bryan Steil, R-WI, one of the supporters of the federal bill, said it “will ensure that workers across the country can continue to benefit from these services, which will help them better balance work and pay.”

But Hawaii state Sen. Chris Lee, a Democrat who introduced the wage access laws in the state Senate, called rates of interest of greater than 300 percent a “modern day payday program.” Lee said he would really like to see more transparency and protections for staff.

Lauren Saunders, an attorney at the National Consumer Law Center, says this can be a key moment for regulation.

“If people used (access to earned wages) to cover one emergency expense a year, that would be better than being charged overdraft fees, payday loans or car equity loans,” she said. “But being better than terrible predatory products shouldn’t be the bar.”

Lifestyle

An AI discrimination class action lawsuit has finally been settled

Mary Louis’ excitement about moving right into a Massachusetts apartment within the spring of 2021 turned to dismay when Louis, a Black woman, received an email informing her that a “third-party service” had denied her a lease.

This third-party service included an algorithm designed to judge rental applicants, which became the topic of a class-action lawsuit led by Louis that alleged the algorithm discriminated on the premise of race and income.

On Wednesday, a federal judge approved a settlement in that lawsuit, certainly one of the primary of its kind. The company behind the algorithm has agreed to pay greater than $2.2 million and to recall some parts of its monitoring products that the lawsuit said were discriminatory.

The settlement doesn’t include an admission of wrongdoing by SafeRent Solutions, which said in a press release that while it “continues to believe that SRS Scores complies with all applicable laws, litigation is time-consuming and expensive.”

While such lawsuits could also be relatively latest, using algorithms or artificial intelligence programs to screen and rate Americans is just not. For years, artificial intelligence has been secretly helping make essential decisions for US residents.

When an individual applies for a job, applies for a house loan, and even seeks specific medical care, there may be a risk that a man-made intelligence system or algorithm will judge or evaluate them as Louis did. These AI systems, nonetheless, are largely unregulated, although some have been found to cause discrimination.

“Management companies and property owners need to know that they have been warned that systems they believe are reliable and good will face challenges,” said Todd Kaplan, certainly one of Louis’ attorneys.

The lawsuit alleged that SafeRent’s algorithm didn’t bear in mind housing voucher advantages, which it said were a very important detail affecting a tenant’s ability to pay monthly bills, and due to this fact discriminated against low-income applicants who qualified for assistance.

The lawsuit also accused the SafeRent algorithm of over-reliance on credit information. They argued that it doesn’t provide an entire picture of an applicant’s ability to pay rent on time and unfairly awards housing voucher applicants to Black and Latino applicants, partly because they’ve lower average credit scores, which will be attributed to historical inequalities.

Christine Webber, certainly one of the plaintiff’s lawyers, argued that simply because the algorithm or artificial intelligence is just not programmed to discriminate, the info the algorithm uses or weights can have “the same effect as if you told it to intentionally discriminate.”

When Louis’ application was rejected, she tried to appeal the choice by sending two landlords references confirming that she had paid her rent early or on time for 16 years, despite the fact that she didn’t have a robust credit history.

Louis, who had a housing voucher, was floundering, having already notified her previous owner that she was moving out, and was facing custody charges against her granddaughter.

The response from a management company that used SafeRent’s tenant screening service was: “We do not accept appeals and cannot overrule a tenant screening result.”

Louis felt defeated; the algorithm didn’t know her, she said.

“It’s all about numbers. You can’t get individual empathy from them,” Louis said. “You can’t beat the system. The system will always beat us.”

While state lawmakers have proposed aggressive regulation of a majority of these AI systems, these proposals have largely modified them did not obtain sufficient support. This implies that lawsuits like Louis’ are beginning to lay the groundwork for AI liability.

SafeRent’s attorneys argued within the motion to dismiss that the corporate shouldn’t be chargeable for discrimination because SafeRent didn’t make the ultimate decision on whether to simply accept or deny a tenant. This service would screen applicants, evaluate them and supply a report, but leave it to the landlords or management firms to come to a decision whether to simply accept or reject the tenant.

Louis’ lawyers, together with the U.S. Department of Justice, which filed a press release of interest within the case, argued that the SafeRent algorithm could possibly be held liable since it still plays a job in housing access. The judge denied SafeRent’s motion to dismiss the lawsuit on these grounds.

The settlement stipulates that SafeRent cannot include its rating in tenant screening reports in certain cases, including if an applicant is on a housing voucher. It also requires that if SafeRent develops a distinct audit result that it plans to make use of, it have to be validated by a 3rd party, to which the plaintiffs agree.

Louis’ son found her an inexpensive apartment on Facebook Marketplace, which she moved into, even though it was $200 dearer and in a less desirable neighborhood.

“I’m not optimistic that I’ll be able to take a break, but I have to continue playing and that’s it,” Louis said. “I have too many people depending on me.”

Lifestyle

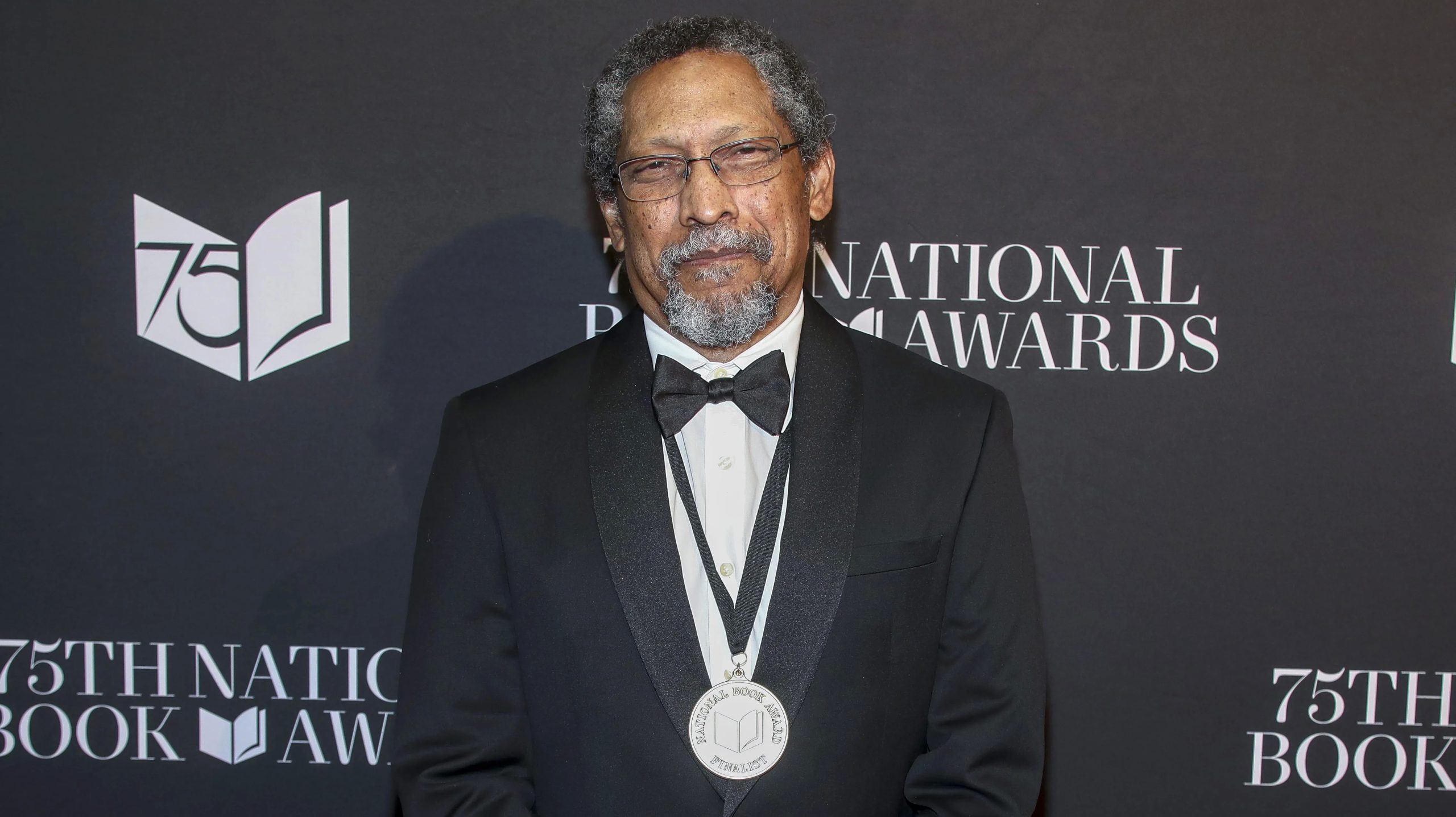

Percival Everett wins the National Book Award for his Huckleberry Finn-inspired epic “James.”

NEW YORK (AP) – Percival Everett’s “James,” a daring reworking of “The Adventures of Huckleberry Finn,” won the National Book Award for fiction. The winner in the nonfiction category was “Soldiers and Kings: Survival and Hope in the World of Human Smuggling” by Jason De León, while the finalists included Salman Rushdie’s memoir about his brutal stabbing in 2022, “The Knife.”

The youth literature prize was awarded Wednesday night to Shifa Saltaga Safadi’s coming-of-age story “Kareem Between,” and the poetry prize was awarded to Lena Khalaf Tuffah’s “Something About Living.” In the translation category, the winner was “Taiwan Travel Diary” by Yáng Shuāng-zǐ, translated from Mandarin Chinese by Lin King.

Evaluation panels composed of writers, critics, booksellers and other representatives of the literary community chosen from lots of of submitted entries, and publishers nominated a complete of over 1,900 books. Each of the winners of the five competitive categories received $10,000.

Everett’s victory continues his remarkable development over the past few years. Little known to readers for many years, the 67-year-old was a finalist for the Booker and Pulitzer Prizes for such novels as “Trees” and “Dr. No” and the novel “Erasure” was adapted into the Oscar-nominated “American Fiction”.

Continuing Mark Twain’s classic about the wayward Southern boy, Huck, and the enslaved Jim, Everett tells the story from the latter’s perspective and highlights how in another way Jim acts and even speaks when whites usually are not around. The novel was a finalist for the Booker and won the Kirkus Prize for Fiction last month.

“James was well received,” Everett noted during his speech.

Demon Copperhead novelist Barbara Kingsolver and Black Classic Press publisher W. Paul Coates received Lifetime Achievement Medals from the National Book Foundation, which awards the awards.

Speakers praised diversity, disruption and autonomy, whether it was Taiwanese independence or immigrant rights in the US. The two winners, Safadi and Tuffaha, condemned the years-long war in Gaza and U.S. military support for Israel. Neither mentioned Israel by name, but each called the conflict “genocide” and were met with cheers – and more subdued reactions – after calling for support for the Palestinians.

Tuffaha, who’s Palestinian-American, dedicated her award partly to “all the incredibly beautiful Palestinians this world has lost, and all the wonderful ones who survive, waiting for us, waiting for us to wake up.”

Last yr, publisher Zibby Owens withdrew support for the awards after learning that the finalists planned to sentence the war in Gaza. This yr, the World Jewish Congress was amongst critics of Coates’ award, citing partly his reissue of the essay “The Jewish Onslaught,” which was called anti-Semitic.

National Book Foundation executive director Ruth Dickey said in a recent statement that Coates was being honored for his body of labor, not for any single book, and added that while the foundation condemns anti-Semitism and other types of bigotry, it also believes in free speech.

“Anyone who looks at the work of any publisher over the course of almost fifty years will find individual works or opinions with which they disagree or find offensive,” she added.

The National Book Awards took place way back in mid-November, shortly after the election, and supply an early glimpse of the book world’s response: hopeful in the wake of Barack Obama’s 2008 victory, when publisher and honorary winner Barney Rosset predicted a “new and uplifting program.” ; grim but determined in 2016, after Donald Trump’s first victory, when fiction winner Colson Whitehead urged viewers to “be kind to everyone, make art and fight power.”

This yr, as lots of gathered for a dinner ceremony at Cipriani Wall Street in downtown Manhattan to have a good time the seventy fifth anniversary of the awards, the mood was certainly one of sobriety, determination and goodwill.

Host Kate McKinnon joked that she was hired because the National Book Foundation wanted “something fun and light to distract from the fact that the world is a bonfire.” Musical guest Jon Batiste led the crowd in a round of “When the Saints Go Marching In” and sang a couple of lines from “Hallelujah,” the Leonard Cohen standard that McKinnon somberly performed at the starting of the first “Saturday Night Live” after the 2016 election.

Kingsolver admitted that she feels “depressed at the moment”, but added that she has faced despair before. She compared truth and like to natural forces equivalent to gravity and the sun, that are at all times present whether you may see them or not. The screenwriter’s job is to assume “a better ending than the one we were given,” she said.

During Tuesday evening’s reading by the award finalists, some spoke of community and support. Everett began his turn by confessing that he really “needed this kind of inspiration after the last few weeks. In a way, we need each other. After warning that “hope just isn’t a technique,” he paused and said, “Never has a situation seemed so absurd, surreal and ridiculous.”

It took him a moment to understand that he wasn’t discussing current events, but fairly was reading James.

Lifestyle

What is GiveTuesday? The annual day of giving is approaching

Since it began as a hashtag in 2012, Giving on Tuesdaythe Tuesday after Thanksgiving, became one of the largest collection days yr for non-profit organizations within the USA

GivingTuesday estimates that the GivingTuesday initiative will raise $3.1 billion for charities in 2022 and 2023.

This yr, GivingTuesday falls on December 3.

How did GivingTuesday start?

The hashtag #GivingTuesday began as a project of the 92nd Street Y in New York City in 2012 and have become an independent organization in 2020. It has grown right into a worldwide network of local organizations that promote giving of their communities, often on various dates which have local significance. like a vacation.

Today, the nonprofit organization GivingTuesday also brings together researchers working on topics related to on a regular basis giving. This too collects data from a big selection of sources comparable to payment processors, crowdfunding sites, worker transfer software and offering institutions donor really helpful fundstype of charity account.

What is the aim of GivingTuesday?

The hashtag has been began promote generosity and this nonprofit organization continues to advertise giving within the fullest sense of the word.

For nonprofits, the goal of GivingTuesday is to boost money and have interaction supporters. Many individuals are aware of the flood of email and mail appeals that coincide on the Tuesday after Thanksgiving. Essentially all major U.S. nonprofits will host fundraising campaigns, and plenty of smaller, local groups will participate as well.

Nonprofit organizations don’t have to be affiliated with GivingTuesday in any method to run a fundraising campaign. They can just do it, although GivingTuesday provides graphics and advice. In this manner, it stays a grassroots endeavor during which groups and donors participate as they please.

Was GivingTuesday a hit?

It will depend on the way you measure success, but it surely has definitely gone far beyond initial efforts to advertise giving on social media. The day has change into an everlasting and well-known event that focuses on charitable giving, volunteerism and civic participation within the U.S. and all over the world.

For years, GivingTuesday has been a serious fundraising goal for nonprofits, with many looking for to arrange pooled donations from major donors and leverage their network of supporters to contribute. This is the start year-end fundraising peakas nonprofits strive to fulfill their budget goals for next yr.

GivingTuesday giving in 2022 and 2023 totaled $3.1 billion, up from $2.7 billion in 2021. While that is loads to boost in a single day, the trend last yr was flat and with fewer donorswhich, in accordance with the organization, is a disturbing signal.

-

Press Release8 months ago

Press Release8 months agoCEO of 360WiSE Launches Mentorship Program in Overtown Miami FL

-

Business and Finance6 months ago

Business and Finance6 months agoThe Importance of Owning Your Distribution Media Platform

-

Press Release7 months ago

Press Release7 months agoU.S.-Africa Chamber of Commerce Appoints Robert Alexander of 360WiseMedia as Board Director

-

Business and Finance8 months ago

Business and Finance8 months ago360Wise Media and McDonald’s NY Tri-State Owner Operators Celebrate Success of “Faces of Black History” Campaign with Over 2 Million Event Visits

-

Ben Crump7 months ago

Ben Crump7 months agoAnother lawsuit accuses Google of bias against Black minority employees

-

Fitness7 months ago

Fitness7 months agoBlack sportswear brands for your 2024 fitness journey

-

Theater8 months ago

Theater8 months agoApplications open for the 2020-2021 Soul Producing National Black Theater residency – Black Theater Matters

-

Ben Crump8 months ago

Ben Crump8 months agoHenrietta Lacks’ family members reach an agreement after her cells undergo advanced medical tests