Interpreting corporate carbon reports may be difficult. The current, ad hoc approach to how companies share this information makes it difficult to inform whether or not they have set the appropriate goals, have realistic plans to fulfill them, or are transparent about their progress.

While there’s a legal framework in place to manage the reporting of climate and sustainability data, there are still large differences in how this data is disclosed.

We have developed the Climate Action Tracker Aotearoa (EXECUTIONER) to resolve these problems. Based on the worldwide Tracking Net Zero EmissionsCATA evaluates companies’ reports and climate plans to share and explain their climate actions.

We used a tracker to analyse 21 companies in Aotearoa New Zealand, specializing in the most important emitters and companies within the energy, retail, agriculture and transport, and banking sectors.

We assessed three features – goals, plans and reporting – by reading publicly available information provided by the corporate. These three features help us understand what the corporate is doing and intends to do to mitigate climate change.

Here’s what we discovered.

Setting goals

While most companies have 2030 targets (86%) and absolute targets (81%), only five of 21 companies (25%) have verified targets Science-Based Goals Initiative.

All but two companies cover scope 1 (emissions the corporate produces directly) and scope 2 (emissions produced not directly, similar to from electricity or the energy it buys to heat and funky buildings) – areas over which companies have essentially the most control and ownership. But in the case of scope 3 emissions, which come from business travel by plane, train and taxi, and the availability chain, far fewer companies have set such targets.

Scope 3 targets are difficult to ascertain because they involve numerous supply chain partners. However, understanding the total impact of an organization’s emissions is a crucial think about meeting the goals of the Paris Agreement.

1933bkk/Getty Images

Making plans

It is in planning that differences in performance between companies begin to seem. It seems easier to set a goal than to present detailed plans for achieving it.

Some companies are doing a terrific job of making clear and reliable climate maps (Meridian Energyfor instance). However, many companies didn’t provide enough detail to know how the reductions might occur.

It is much more obscure how companies plan to make use of offsets and carbon credits.

Carbon offsetting involves reducing or avoiding emissions that may be used to offset emissions elsewhere. For example, offsetting projects might include renewable energy or energy efficiency projects.

We found that just over half of companies offset emissions or have plans to do so, with only two saying they might only offset hard-to-abate emissions.

According to Oxford University Compensation Policybest practice is to cut back these remaining emissions as much as possible and use the compensation closer to the web zero date (2050).

It is just not good that compensation is already being applied.

We also found that companies weren’t at all times transparent about their offset policies. Most of them either didn’t specify the terms of the offset or just had no terms in any respect.

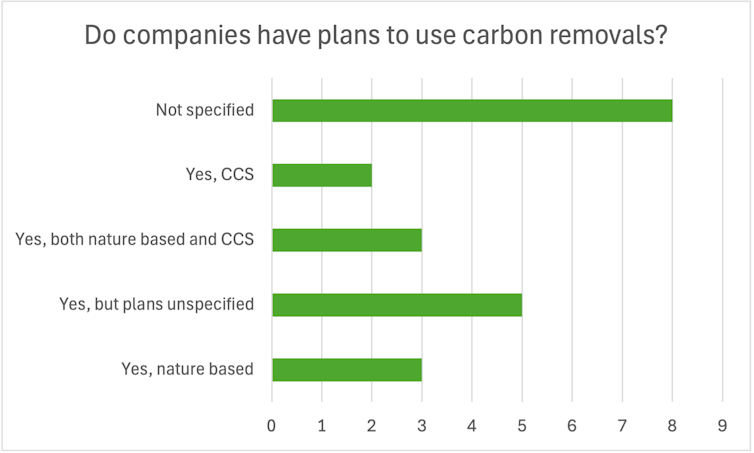

Most companies haven’t clarified their approach to carbon removal (the technique of removing carbon dioxide from the atmosphere).

These carbon removal measures relied on nature (similar to planting a combination of exotic and native trees) and carbon capture and storage (CCS), and typically got here from companies that also operated overseas.

Author provided

This World Economic Forum Last 12 months, he outlined best practices for voluntary carbon dioxide removal.

Carbon removal has been identified as vital for difficult-to-abate emissions, to reverse the buildup of historical emissions and to deal with feedback loops in natural processes similar to forest fires.

In 2022 Ministry of the Environment also published a set of principles for carbon dioxide removal. These principles included that information have to be transparent, clearly defined and publicly available.

We found that a minority of companies were following these standards. Therefore, more transparency is required on each offsets and removals in their reporting.

Climate Action Reporting

Most companies report their carbon emissions and supply some detailed information in keeping with international standards.

At the identical time, nonetheless, many companies make it difficult to seek out and collect the info needed to obviously define what climate actions they’re taking.

We know that voluntary disclosure of knowledge about social and environmental impacts is usually a result pressure from stakeholders. But it will possibly even be used as a method to conform to those societal expectations without providing enough information.

In our research, we found a combination of conformity and subversion. Some companies provided an enormous amount of positive details about a few of their influences, some provided many reports with information scattered across them, and a few were direct concerning the information they required.

Companies should use CATA as a tool for self-assessment and reporting to be certain that they supply sufficient and transparent information to stakeholders, partners, investors and consumers.

This will enable consistency across the industry, evidence-based delivery of objectives, detailed motion plans and quick access to comprehensive, clear and concise reporting.