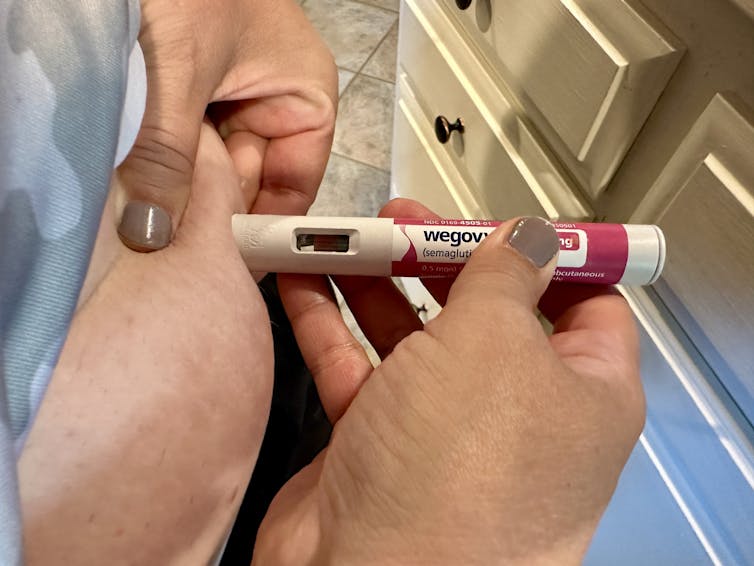

People with high body weight live in England can now access subsidized slimming drugs treat their obesity. This is included in Wegova (dose of slimming ozempic or semaglutduide) and Mounjaro (certainly one of Tirrzepatide brands).

These drugs, known as GLP-1 agonists, can Improve health people who find themselves chubby or obese and are usually not able to lose weight and never stop him with other approaches.

The government in Australia subsidizes costs semaglutide (ozempic) for individuals with diabetes.

But also subsidizing semaglutide (Wegova) within the pharmaceutical advantages program (PBS) to lose weight.

This happens despite the Australian regulator approval of GLP-1 agonists For individuals with obesity and for chubby individuals with at the least one weight related to weight.

This leaves Australians who use Wegovya to pay slimming About USD 450-500 out of your pocket per 30 days.

But can Australia follow the leader of England and replace drugs such as Wegova or Mounjaro on PBS to lose weight? It can bring a price until USD 31.60 (7.70 USD license).

Australia has already rejected Wegovya for a subsidy

The Advisory Committee for Pharmaceutical Benefits (PBAC) reviews the reports of the pharmaceutical company in order that their medical therapies are subsidized via PBS.

In the case of every such suggestion, PBAC publishes a public document that summarizes the evidence and reasons for recommending that the medication must be added to PBS – or not.

In November 2023, PBAC checked Notification of Novo Nordisk. He proposed, including semaglutide on PBS for adults with the initial BMI 40 or higher and a diagnosis of at the least two weight -related states. At least certainly one of these related states had to be an obstructive sleep apnea, osteoarthritis of knee joints or pre -closes.

Jpc-prod/shutterstock

However, PBAC stated that the semaglutide must be subsidized by PBS because he didn’t discover a profitable medicine on the proposed price.

PBAC referred to evidence for long -term advantages from weight reduction in individuals with an increased risk of developing heart disease, diabetes or stroke. However, he didn’t take under consideration these effects in his calculations when estimating the profitability of semaglutide.

The Committee suggested that future submission can give attention to patients with previously existing cardiovascular (heart), type 2 diabetes or at the least two markers of “high cardiometabolic risk”. This may include hypertension (hypertension), high cholesterol, chronic kidney disease, liver fat or pre -stem.

What did England resolve?

The National Institute for Health and Care Excellence (Nice) has an analogous role to PBAC, informing about decisions about subsidizing drugs in England.

As a result Nice suggestionSemaglutide is subsidized in England for adults with at the least one weight and BMI related to 30 or more. Patients should be treated by a specialist weight management service, and prescriptions last a maximum of two years.

Recently, Nice approved one other GLP-1 agonistTirrzepatid, for adults with at the least one weight related to weight and BMI 35 or higher.

This approval didn’t limit prescriptions for people treated within the Specialist Service Service. However, only 220,000 out of three.4 million, which meet the eligibility criteria will receive a tiRZEPATID In the subsequent three years. It shouldn’t be clear how 220,000 patients might be chosen.

The boundaries of the tirpatide will reduce the impact of GLP-1 agonists on the health budget. It can also be aimed toward informing wider implementation to all qualifying patients.

Both within the case of semaglutide and girls, Nice noticed that clinicians should consider stopping treatment if the patient loses lower than 5% of body weight after six months of use.

Antoniodiazshutterstock

Why did they make such different decisions?

Nice assessed using GLP-1 agonists for a wider population than PBAC: individuals with one condition related to weight and BMI 30 or more.

Another difference was that the evaluation of Nice profitability included estimates of long-term advantages of those drugs in reducing the chance of diabetes, heart problems (heart), stroke, knee exchange and bariatric surgery.

The proposed prices of GLP-1 agonists in England and Australia are usually not reported. We can only observe the estimated health advantages. They are represented as an extra variety of “years of corrected life” (Qaly) related to using drugs. One qaly is the equivalent of 1 extra yr of life in the perfect -imaginable health.

Committees estimate the variety of additional expenses on the health required to obtain qalys to check whether it is definitely worth the public investment. Looking on the estimates of slimming drugs committees (and not using a two -year maximum):

-

PRETTY reported a rise of 0.7 qalys per patient receiving semaglutide for the goal population with BMI of 30 or more

-

PBAC reported a rise of 0.3 qalys, but for the population with BMI 40 and more.

Part of the reason of the difference within the estimated profits of Qala is that PBAC didn’t take under consideration the reduced risk of future weight -related conditions, but an impact on existing conditions.

On the opposite hand, Nice referred to significant cost shifts due to the reduced conditions related to weight, particularly because some patients would avoid the event of diabetes.

Matt Fowler KC/Shutterstock

Time to think in regards to the concentration of PBAC?

Both Nice and PBAC are clearly concerned in regards to the influence of GLP-1 agonists on the health budget.

PBAC tries to limit access to a limited pool of individuals with the best risk. It can also be more conservative than nice to estimate the expected advantages of GLP-1 agonists. This would require producers to lower the value to make PBAC consider these drugs.

Perhaps this approach will work, and the Australian government pays less for these drugs when it considers public financing next time.

However, GLP-1 agonists are usually not within the agenda of the upcoming PBAC meetings, so there isn’t a schedule when GLP-1 agonists may be financed in Australia due to weight reduction.