Technology

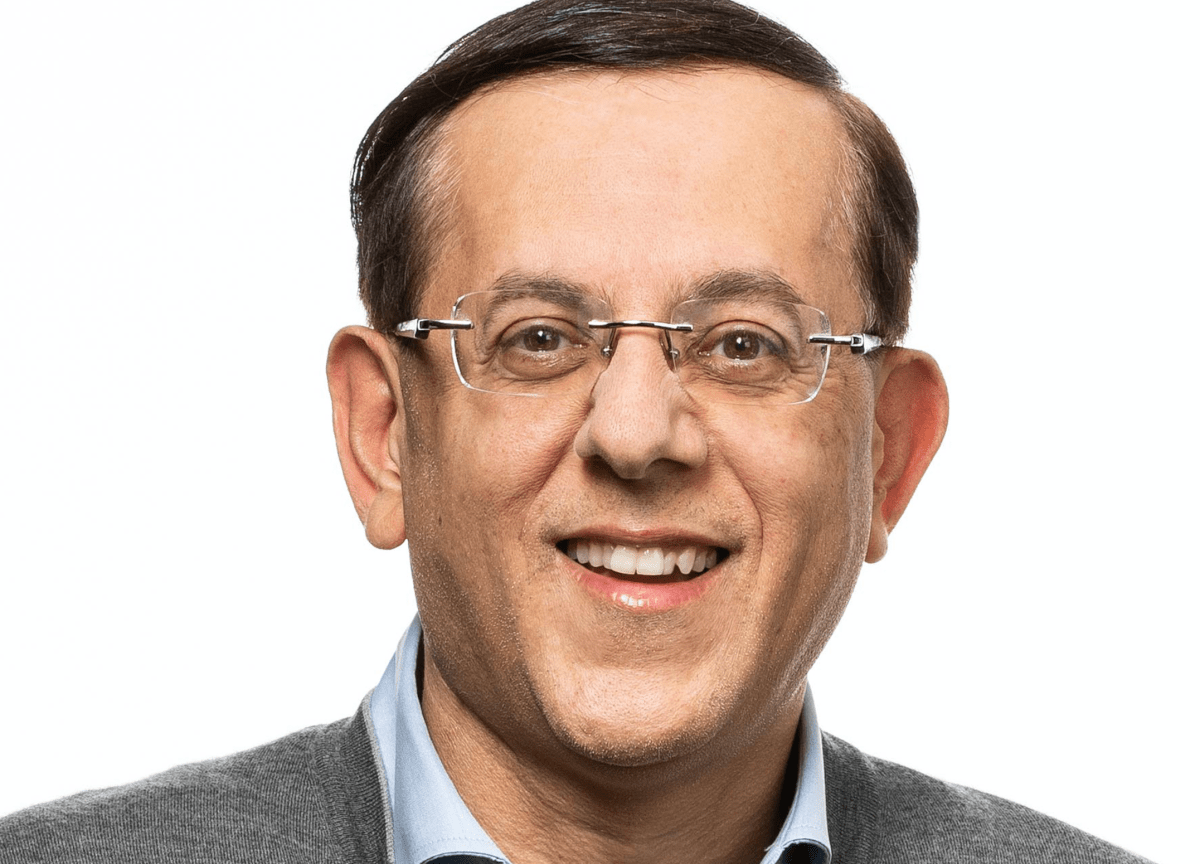

How Rubrik’s IPO paid off big Greylock VC Asheem Chandna

When Asheem Chandna arrived at Rubrik’s office in Palo Alto on a Friday evening in early 2015, he couldn’t wait to search out out what the young company that hadn’t yet created a product would show him. Greylock’s partner was not upset.

The company’s CEO, Bipul Sinha, drew on a whiteboard Rubrik’s plan to revamp the info management and recovery market. “The old and new architecture he presented was very convincing,” Chandna said. “Based on my knowledge of the industry, I knew it could be turned into a big business.”

It was a prophetic call. On Thursday, nine years after that meeting, Rubrik began its operations as a publicly traded company with: market capitalization exceeding $6 billion. Greylock owns 13% of the shares, in keeping with the newest SEC reports. By the close of trading Friday, at a share price of $38, nearly 19.9 million shares were value greater than $756 million.

But Chandna says he was motivated to steer the Rubrik team by rather more than simply a desire to tackle the arcane data recovery market. Series B for $40 million in May 2015. (According to SEC filings, the Series B round sold for $2.45 per share, adjusted for splits. Although Greylock also participated in later rounds at higher prices, Chandra’s profits from this round are enormous.)

“The longer I do what I do, the more I truly believe that venture is a people business,” said Chandna, who has been an investor for over 20 years and has an enviable track record of successful exits. He helped incubate Palo Alto Networks within the Greylock offices and until last 12 months served on the board of directors of the nearly $100 billion company. Chandna was also an early investor Application dynamics, Sumo logic and Arista Networks.

Chandna looks for individuals who are usually not only motivated and bold, but in addition aware of their weaknesses and may recruit individuals who can get things done in areas that are usually not the founder’s strong suit.

Another essential ingredient for the founder is sand. “If you had the right technology, but slightly inferior to mine, but you were very aware and persistent, you would beat me,” he said.

This is what he saw in Sinha. The founding father of Rubrik dreamed of beginning a company all his life. Chandra recalls that when he founded a knowledge management and recovery startup in 2013, he couldn’t find strong engineers willing to work there. The business he was attempting to construct wasn’t inherently sexy on the time.

Despite being an investor in Lightspeed for 4 years before founding Rubrik, recruiting talent proved to be a serious challenge for Sinha. But he didn’t quit. He called engineers on LinkedIn after which invited them to coffee breaks outside the workplace.

“The startup path is very difficult, even for the most successful companies,” Chandna said. “I want people who won’t take no for an answer.”

Perhaps it was Sinha’s resolve and ambition that forced him to take his company public despite the unfavorable IPO atmosphere.

“Rubrik has almost $800 million in annual recurring revenue,” Chandna said. “This is more than most companies that have gone public in the last many years. I think they just wanted to keep it going.”

Chandna would not say whether he expects other Greylock portfolio corporations to follow Rubrik’s lead, but added emphatically that the best-performing late-stage corporations are Abnormal Security, Cato Networks, Discord, Figma and Lyra Health.

We will follow their fate closely.

Technology

The time of the American semiconductor market in 2025.

It was already a turbulent yr for the American semiconductor industry.

The semiconductor industry plays a major role in the “AI race”, which the US appears to be determined, so it’s value being attentive to this: from the appointment of Lip-Bu Tan-which has not waste time to work, attempting to revitalize the Heritage Company-Joe Biden proposing latest rules of exports AI AI along the way that would not or can follow.

Here’s what happened since the starting of the yr.

Power

Last reversal

May 7: Just every week before the “Frame of Artificial Intelligence Diffusion”. According to many media, including Axios AND BloombergThe administration won’t implement restrictions when it was to start out on May 15 and as a substitute works in its own framework.

April

Anthropic doubles the support of chip export restrictions

April 30: Anthropic has doubled because of the limitation of exports of chip systems in the USA, including several corrections to artificial intelligence framework, akin to imposing further restrictions in level 2 and dedication of resources to enforcement. The NVIDIA spokesman rejected, saying: “American companies should focus on innovations and get up to the challenge, instead of telling high stories that large, heavy and sensitive electronics are somehow smuggled in” Baby bugghs “or” next to the lobsters live “.

Planned exemptions at Intel

April 22: Before connecting profits with Q1, Intel said he was planning to release over 21,000 employees. The exemptions were to enhance management, something that the general director of Lip-Bu Tan has long said that Intel must do and help in the reconstruction of the company’s engineering.

The Trump administration further limits the chip export

April 15: The NVIDIA H20 AI chip was hit with the requirement of export license, the company revealed in the SEC application. The company added that it expects for $ 5.5 billion fees related to this latest requirement in the first quarter of the tax yr in 2026. H20 is the most advanced AI Nvidia chip can still export to China in some form or fashion. TSMC and Intel reported similar expenses in the same week.

TechCrunch event

Berkeley, California

|.

June 5

Book now

NVIDIA seems to talk of further export of chips

April 9: According to reports, the general director of Nvidia, Jensen Huang, was noticed for dinner at the Mar-A-Lago Center in Donald Trump. Then, NPR was reported Huang could have the ability to save lots of AI H20 NVIDIA systems from export restrictions after investing in AI data centers in the USA

Alleged agreement between Intel and TSMC

April 3: Intel and TSMC allegedly reached a preliminary agreement on the commencement of a joint project of Chips. This joint undertaking would work in Intel devices, and TSMC would have 20% shares in the latest undertaking. Both firms refused to comment or confirm. If this contract just isn’t accomplished, this might be a good preview of potential offers in this industry.

Intel rotates from non -corporate assets, proclaims a brand new initiative

April 1: CEO Lip-BU TAN immediately worked. Just just a few weeks after joining the Intel, the company announced that it might rotate resources unrelated to the core in order that it could focus. He also said that the company would introduce latest products, including non -standard semiconductors for purchasers.

March

Intel calls the latest CEO

March 12: Intel announced that a veteran of the industry and a former board member, Lip-Bu Tan will return to the company as general director on March 18. At the time of his appointment, Tan said that Intel could be a “engine -oriented company” under his leadership.

February

Intel’s Ohio Chip Plant is delayed again

February 28: This yr, Intel was to start out running its first chip factory in Ohio. Instead, the company slowed down the construction of the plant for the second time in February. Now the design of semiconductors value $ 28 billion won’t end with the construction until 2030 and might even open only in 2031.

Senators call for more chip export restrictions

February 3: US Senators, including Elizabeth Warren (D-Mass) and Josh Hawley (R-MO), wrote a letter to the Secretary for Trade for Howard Lutnicka Calling Trump’s administration for further restriction Export of the AI system. A letter addressed especially to AI H20 NVIDIA systems, which were used during training of the R1 Deepseek “reasoning” model.

January

Deepseek releases its open model “reasoning”

January 27: The Chinese startup Ai Deepseek caused quite mixing in the Silicon Valley when he released the open version of his model “reasoning” R1. Although this just isn’t a special message of semiconductors, the alarm in the AI industry and Deepseek semiconductors meant that it still has an impact on the chip industry.

Order Joe Biden on the export of chip

January 13: Only the incumbent week remained, former President Joe Biden proposed extensive export restrictions on AI systems made by the USA. The order has created a 3 -level structure that determined what number of American systems will be exported to every country. According to this proposal, level 1 countries didn’t face any restrictions; Countries 2 level 2 had a chip purchase limit for the first time; And level 3 countries received additional restrictions.

Dario Amodei from anthropics weighs the limitations of chip exports

January 6: Co -founder of anthropics and general director, Dario Amodei, co -author of opinions The Wall Street Journal Supporting existing control controls of the AI system and indicating them as the reason why the Chinese market of artificial intelligence was in the US. “He also called on the incoming President Donald Trump to impose further restrictions and shutting the gaps that allowed AI to get these tokens in China.

(Tagstranslate) Intel

Technology

One of the long -term VC Elona Muska suits his former employer after alleged dismissal

Josh Raffaella, who has deep roots as an investor of the Silicon Valley and was supported by many firms Elon Musk, suits his former employer, massive trillion dollars Aum Brookfield Asset Management, reports the New York Times.

A major part of Raffaella’s criticism concerns how Brookfield covered losses related to the pandemic of real estate and claims that the company released him after submitting the criticism of informants at SEC. His lawsuit gives allegations akin to fraud and bribe, while Brookfield deny all offenses rapidly, said The Times.

In February, Brookfield quietly closed the Venture Capital unit run by Raffaella and threw some assets on one other unit, Bloomberg reported at the moment. One of Raffaella’s complaints in the lawsuit is that Brookfield didn’t buy so many shares in firms belonging to musk because he provided the possibility of purchase.

Raffaella had shopping transactions in Musk, akin to SpaceX, XAI and a boring company, claims the claim. Bloomberg announced that his Brookfield fund was an awesome supporter of Twitter’s takeover by Musk.

The lawsuit is a really public battle of Raffaella, who previously worked as a partner at VC, known at the time as a drapeer Fisher Jurvetson. (Today it’s a set of funds.) In DFJ Brookfield, it has helped this company spend money on Musk, akin to Solarcity (acquired by Tesla), Spacex and Tesla.

(Tagstranslate) Brookfield

Technology

The AI X Dream Machine library project is intended to help in underestimated innovators

Through the project of the AI X library, the CNN commentator, activist and entrepreneurs Van Jones and co -chairman of the projects Inayah Bashir and Steven Pargett be sure that the Black and Brown communities have free, practical opportunities to learn the force of artificial intelligence.

Libraries have long been secure for knowledge, access and community. Now they grow to be starts in innovation. Through the CNN commentator, the activist and entrepreneur Van Jones and co -chairing Project Inayah Bashir and Steven Pargett be sure that black and brown communities have free, practical possibilities of learning the strength of artificial intelligence.

Launched by the trio Dream Machine Innovation Lab in cooperation with Google, AI X Library Project already has an impact on cities corresponding to Brooklyn and Atlanta, with plans to extend on Miami, Detroit and Los Angeles.

“We don’t just want to consume technology – we want to create, shape and run it,” said Jones during an interview with Black company. „Myślę, że AI jest potencjalnie najbliższe odszkodowania, jakie kiedykolwiek dostaniemy, ponieważ po raz pierwszy od 400 lat mamy dosłownie równy dostęp i równe szanse na coś transformacyjnego. To, o czym polega nasz projekt, jest wrażliwa na możliwość i upewniając się, że jesteśmy w rozmowie o równym dostępie do dobrej rzeczy. Jeśli chodzi o edukację, jeśli chodzi o edukację, jeśli chodzi o edukację, jeśli chodzi o edukację, jeśli chodzi o edukację, jeśli It is about education when it comes to education when it comes to education when it comes to education.

Instead of focusing only on threats of artificial intelligence, corresponding to algorithmic prejudice, Jones, Pargett and Bashir, they challenge themselves to concentrate on the chances. “Often black people are very sensitive to threat and we quickly go into conversations about equal protection against bad things,” said Jones. “This is important. But our project is to be sensitive to possibilities-insulting that we are also in a conversation about equal access to good things.”

Libraries are a perfect entry point for such a democratized technological education. “The library has always been a technology center or anything else,” Bashir noted. “In the case of insufficient or underestimated people, the library is a place where they touch new technology for the first time. When the computers came out, when the internet began, people went to libraries to learn.”

During each AI X library workshop, participants can pick from topics corresponding to marketing with artificial intelligence, writing with AI-Holności, intelligent monitors and the long run of labor. Importantly, local librarians help select which topics might be taught on the idea of the needs of their patrons.

“We were looking for a way to transfer this conversation to real communities,” said Jones. “A lot of online and fancy conferences are happening, but not much at the neighborhood level. Most districts still have a library. This is a trusted place. We decided to go there.”

The project attracted participants on the age of seven and old as 70, creating an intergenerational learning environment. “We develop at least three new business ideas in every workshop,” said Bashir. “In Atlanta we had a mother who runs a collective at home. She said that they already use artificial intelligence to plan the curriculum – and even used artificial intelligence to find our event.”

Other participants are a waste management employee in Miami, bringing their two sons to study next to him, and grandparents examined AI tools for the primary time. “It is amazing that families learn together,” said Bashir. “Excience exists – creativity is there.”

Changing considering, not only skill sets

In contrast to the digital division in the 90s, where access to software and hardware created entry barriers, Jones believes that the most important obstacle with which our communities with which they stand today is the way in which of considering. “We have no problem with the equipment because everyone has a smartphone,” said Jones. “We have no problem with the software because it is so much free now. We have a problem with” wet software “. Our brains do not process artificial intelligence as something that is for black people. It must change. “

Instead of perceiving artificial intelligence as a perfect, almighty tool, Jones encourages people to give it some thought as “a bit stupid, but free, very fast interns”. He explained: “Nothing is perfect – you need to check human work and you need to check the work AI. But do you prefer to improve something that you will get in two weeks or improve something that you will get in two minutes?”

Marlon Avery repeated this sentiment, reminding the participants that everybody is involved with AI for the primary time at their very own pace. “It’s okay to hurry,” Avery said. “AI is like a treadmill – you can walk, jogging or sprint depending on what you are ready for. It is important to get on it.”

Building liberatorial innovations

Ultimately, the project of the AI X library concerns something greater than just learning latest tools – it is concerning the idea of a greater future.

“Liberatorial innovation is not only creating new technologies and new systems – it is about creating new freedoms,” explained Bashir. “Our brains, our communities, even our definitions of what it means to be human.

Jones emphasized the urgency of quite a lot of participation in technology. “When one small group tries to design a civilization for everyone, it doesn’t work well,” he said. “We now have a chance to build something more human, more simply – but only when everyone takes place at the table.”

When Dream Machine tries to scale the project of the AI X library outside its pilot cities, one thing is clear: the long run of innovation is not only happening in the Silicon Valley – it is built in neighborly libraries, one workshop without delay.

-

Press Release1 year ago

Press Release1 year agoU.S.-Africa Chamber of Commerce Appoints Robert Alexander of 360WiseMedia as Board Director

-

Press Release1 year ago

Press Release1 year agoCEO of 360WiSE Launches Mentorship Program in Overtown Miami FL

-

Business and Finance11 months ago

Business and Finance11 months agoThe Importance of Owning Your Distribution Media Platform

-

Business and Finance1 year ago

Business and Finance1 year ago360Wise Media and McDonald’s NY Tri-State Owner Operators Celebrate Success of “Faces of Black History” Campaign with Over 2 Million Event Visits

-

Ben Crump1 year ago

Ben Crump1 year agoAnother lawsuit accuses Google of bias against Black minority employees

-

Theater1 year ago

Theater1 year agoTelling the story of the Apollo Theater

-

Ben Crump1 year ago

Ben Crump1 year agoHenrietta Lacks’ family members reach an agreement after her cells undergo advanced medical tests

-

Ben Crump1 year ago

Ben Crump1 year agoThe families of George Floyd and Daunte Wright hold an emotional press conference in Minneapolis

-

Theater1 year ago

Theater1 year agoApplications open for the 2020-2021 Soul Producing National Black Theater residency – Black Theater Matters

-

Theater11 months ago

Theater11 months agoCultural icon Apollo Theater sets new goals on the occasion of its 85th anniversary