Technology

Pitch Deck Demolition: Protecto’s $4 million seed deck

In an era where data is king and its volume and complexity are exploding, Security goals to eliminate the long-standing dilemma that corporations face between harnessing the ability of artificial intelligence while ensuring data privacy. With the surge in popularity of generative AI tools like ChatGPT, recalcitrant data is becoming easier to seek out, process, and do naughty things with. Protecto APIs are designed to guard sensitive data throughout the AI lifecycle while maintaining its usability.

The company announced that it had raised approx $4 million seed funding round led by the Together fund, with the support of Better Capital, FortyTwo VC, Arali Ventures and Speciale Invest. This round brings Protecto’s total funding to $5 million.

Slides on this deck

Before submitting its deck to TechCrunch, Protecto made revisions to its short-term and five-year goals and specific details of its short-term product roadmap. A timeline of goals and milestones for the seed funding round has also been edited. Still, there’s lots you possibly can learn from a 14-slide deck:

- Cover slide

- Problem slide

- Urgent slide

- Interstitial platform slide

- Technology overview slide

- Results slide

- Slide with solution

- Case study, slide 1

- Case study, slide 2

- Competitive alternatives are shifting

- Team slide

- Go to market slide

- Slide with motion plan

- Ask and use the funds slide

Three things I loved concerning the Protecto pitch

There are just a few things missing from this deck, but there are also some good things value highlighting.

Competitive alternatives

This slide doesn’t discuss direct competitors (there are one or two). But the corporate still does a superb job of showing you this information:

(Slide 10) Competitive alternatives are an incredible solution to take a look at the competitive landscape. Image credits: Security

Competitive alternatives are corporations, methods, or approaches which might be different from yours but meet the identical customer needs or solve the identical problems. For example, if you happen to run a coffee shop, your direct competitor could be one other coffee shop, and a competitive alternative may be a tea shop or fast-food restaurant that also sells coffee and other beverages. These competitors matter because they represent alternative solutions to your customers, underscoring the importance of understanding broader market dynamics and customer preferences.

Understanding and analyzing these competitive alternatives might be powerful as an extra layer of data, uncovering potential opportunities for differentiation and helping to discover unmet customer needs. Having said all this, Protecto should consider its direct competitors, but this slide continues to be an incredible example of how a startup can examine its position available in the market.

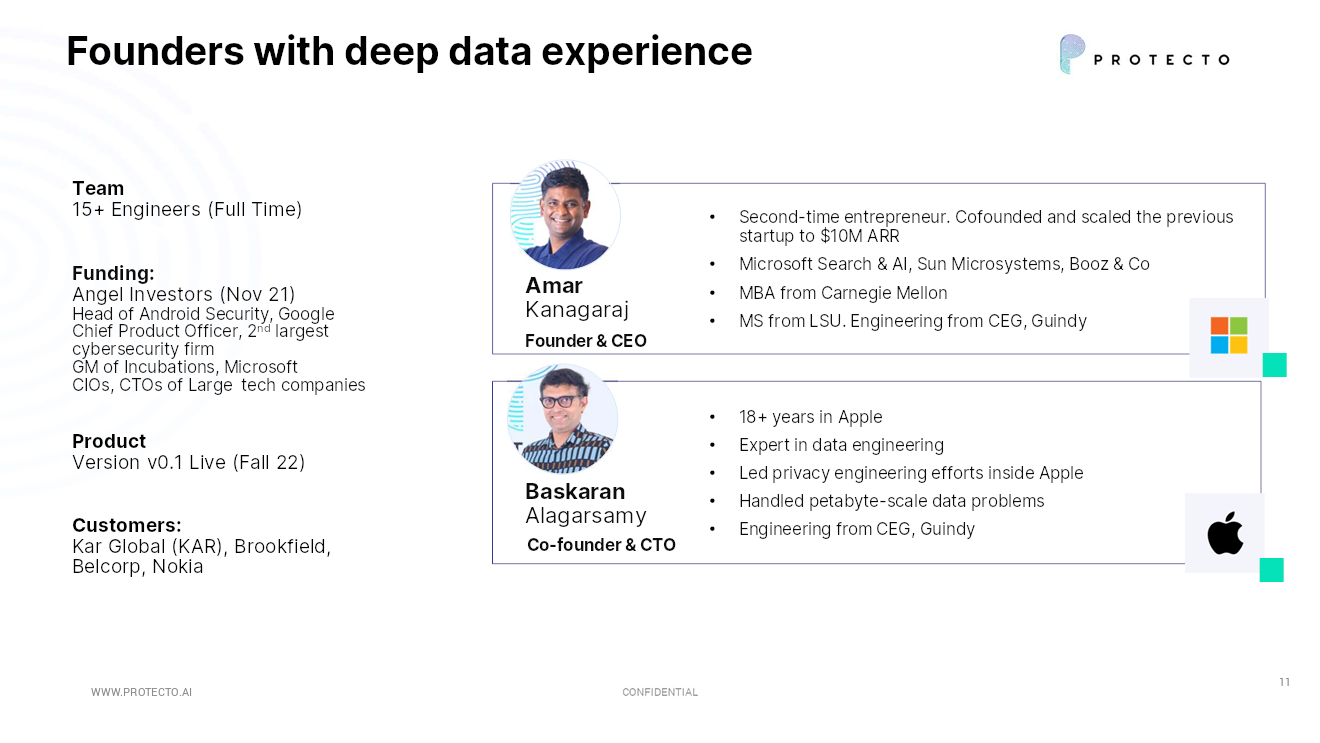

Hello, team

This team slide is so solid – the one downside is that they put it because the eleventh slide:

(Slide 11) Solid team slide. Image credits: Security

To stand out within the suddenly crowded AI space, it is best to bring receipts to prove you may have the nerve to do it. The left side of the slide has an excessive amount of information (why are the funds, products, and customers on the team moving?), however the part on the best has a variety of great information.

CEO Amar Kanagaraj spent nearly eight years at Microsoft, including working on search and artificial intelligence, based on his LinkedIn. CTO Baskaran Alagarsamy spent seven years as a ‘manager’ at Apple India. I’d like to see more details about what exactly he was managing there (and why the slide says 18 years and LinkedIn says seven), but that is the beginning of a extremely solid team. If I were investing on this space, a team of this caliber would pique my interest and I’d likely schedule a gathering.

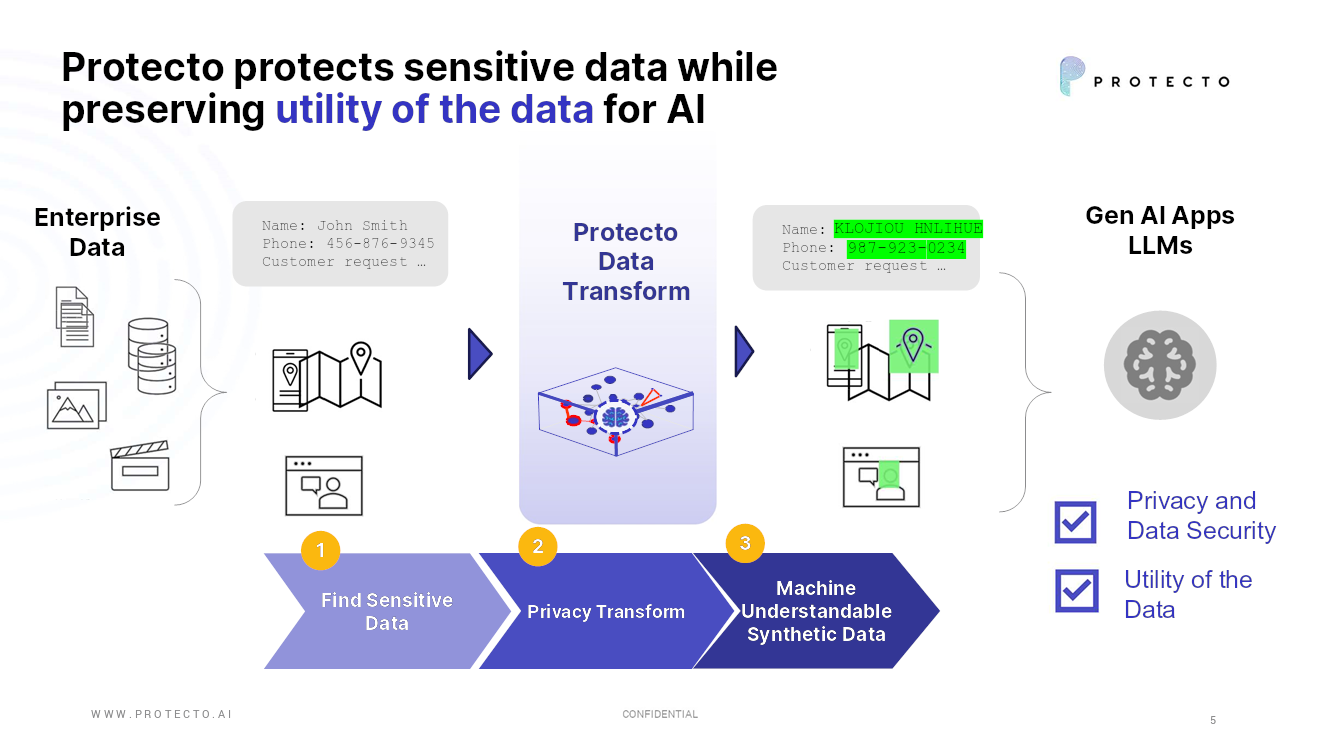

An elegant solution

Privacy and AI can quickly develop into painfully complicated. I appreciate Protecto’s efforts to simplify it to the purpose where most individuals can understand what is going on on in technology.

(Slide 5) Collect sensitive, private data. Replace with similar fake data. It is sensible to me. Image credits: Security

Three things that Protecto could have improved

The design of a pitch deck is not often that essential, however the design of this deck is especially bad. There are also rather more serious flaws hidden in these pages.

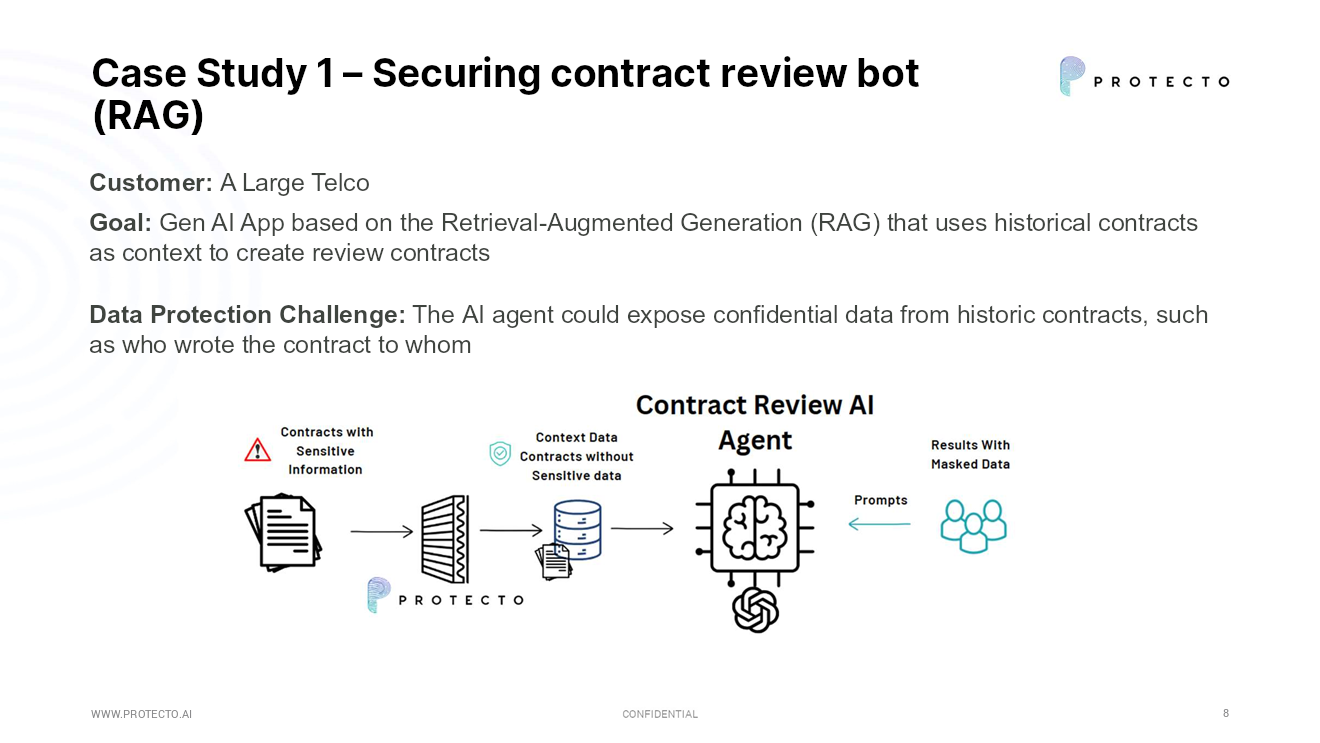

These case studies are usually not case studies

In a 14-slide set, Protecto wastes slide 4 as full-screen (it simply says “our platform”). He then wastes two slides titled “case studies.” However, a more accurate term could be “use cases”.

(Slide 8) This shouldn’t be a case study. Image credits: Security

A full case study would come with rather more information concerning the solution’s effectiveness (did the product manage to remove all sensitive data? How was this measured?), how long the combination took, and the way satisfied the client was with the answer. Slide 9 is one other “case study” that is comparable: a use case, not a case study.

The slide header is a promise that the remainder of the slide must fulfill. In this case, I used to be upset on each counts, expecting one kind of information and receiving one other. Proper case studies could be really helpful in telling this story.

Not an incredible “use of funds” slide.

Editorial aside, there’s not much here.

(Slide 14) Almost completely irrelevant information. Image credits: Security

The company wanted to lift $3 million. However, using funds is so fluffy; every point here makes me wish to ask, “But how do you know it works?”

- Expand engineering: Yes, but why, for what purpose and for a way much?

- Promote marketing: Yes, but for what purposes? Until when? How much growth?

- Build channel sales: Yes, but which channels do you select first? Why?

- Encourage developers to evangelize: What does that even mean?

- Define category: ???

Basically, it’s all corporate jargon. Even if the founders themselves buy into it, investors probably won’t.

Yes, prediction and specificity are terrifying. What if you happen to fail? All plans and forecasts are predictions. We know. Investors know. The idea is to indicate how you’re thinking that whenever you analyze these predictions; investors can learn lots about you as a founder. This is incredibly helpful – and never optional.

It’s a brainstorming session, not a plan

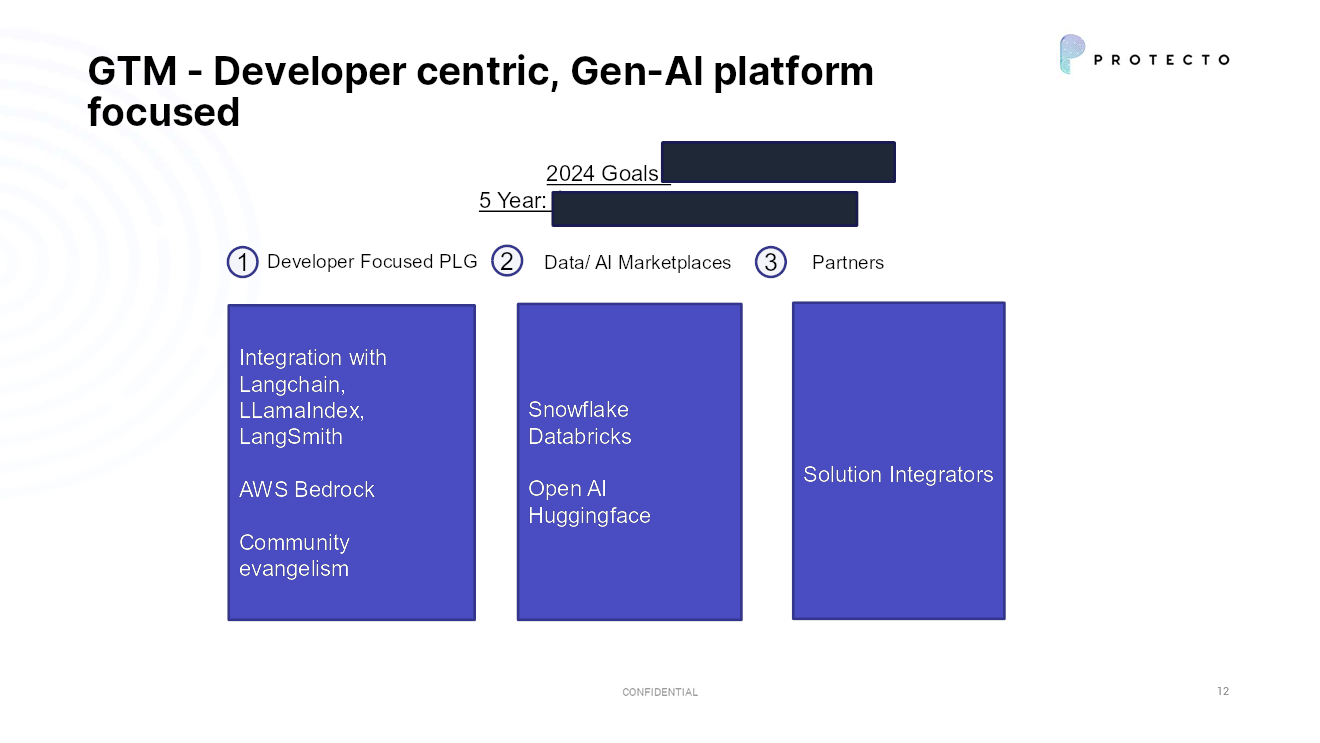

(Slide 12) This entry into the market is just too vague. Image credits: Security

There are many problems with this slide. The company says it can grow through product-led development. That’s great, however it rarely works in isolation – it must be done along side other marketing channels. “If you build it, they will come” shouldn’t be a thing within the crowded startup ecosystem.

I’d wish to know what these integrations actually mean and the way customers find them. I would love to know how Snowflake and Databricks impact this plan. What does he imagine about “solution integrators”?

This slide is a pile of words on a page, not an actionable and measurable go-to-market plan.

Plus all of the stuff is missing from the deck…

- How big is the marketplace for such a thing?

- How much traction do you may have up to now? Did the “case studies” repay? If so, how much? Did they still use the product?

- There is nothing concerning the business model: how will they charge? How much?

- How can this be defended? Does the corporate have any patents? Is there any special magic sauce?

Overall, the issue with this deck is that it doesn’t explain why this problem is difficult to resolve and why this company might be the one to resolve it. Perhaps this is just too simplistic within the deck, but based on what’s here, I believe I could get a handful of developers together and construct most of this product in just a few weeks. This cannot be true, right? Because if that’s the case, there’s nothing here. But since that is probably not the case, meaning there’s simply a storytelling problem. Yes, it is a big problem; now explain why it is a difficult problem to resolve.

Full deck

If you would like to have your individual pitch deck featured on TechCrunch, you’ll find more information here. Check also all our Pitch Deck demolitions all the pieces gathered in a single convenient place for you!

Technology

Former President Barack Obama weighs Human Touch vs. And for coding

Former President Barack Obama spoke in regards to the way forward for human jobs because he feels artificial intelligence (AI) exceeding people’s coding efforts, reports.

By participating within the Sacerdote Great Names series at Hamilton College in CLinton, New York, the previous president of America, he talked about what number of roles will probably be potentially eliminated – and so they aren’t any longer mandatory – on account of the effectiveness of AI, claiming that the software encodes 60% to 70% higher than people.

“Already current models of artificial intelligence, not necessarily those you buy or just go through retail chatgpt, but more advanced models that are now available to companies can cod better than let’s call it 60%, 70% programmers now,” said former president Hamilton Steven Teper.

“We are talking about high qualified places that pay really good salaries and that until recently they were completely the market for the vendor within the Silicon Valley. Many of those works will disappear. The best programmers will have the ability to make use of these tools to expand what they’re already doing, but within the case of many routine things, you’ll simply not need a code, since the computer or machine will do the identical.

Obama isn’t the one celebrity that slowly emphasized the importance of AI, but for sure. Through the Coramino Fund, investment cooperation between comedian Kevin Hart and Juan Domingo Beckmann Gran Coramino Tequila, entrepreneurs and small firms from the community insufficiently confirmed It was encouraged to submit an application for a subsidy program of USD 10,000. While applications for the primary round closed on April 23, 50 firms will receive not only capital to the extension, but additionally receive “the latest AI technological training and practical learning of responsible and effective inclusion in their operations”, in response to.

Hart claims that business owners must jump on opportunities and education.

“The train is coming and fast,” he said. “Either you are on it or if not, get off the road.”

Data and research also support Hart and Obama points of view, and colourful people may be probably the most affecting this because they change into more popular within the workplace. After reviewing the info from the American census, scientists from Julian Samora Institute from Michigan State University stated that Latynoskie firms reported almost 9% of AI adoption, and Asian firms used about 11%. Almost 78% of Białe firms have reported high technology.

Black own firms He handled the last, with the bottom use of artificial intelligence all over the world in 2023, with a smaller number than 2% of firms reporting “high use”.

A report of scientists from the University of California in Los Angeles (UCLA) revealed that Latinx AI employees are exposed to loss of labor on account of automation and increased use of technology, which performs repetitive tasks without human involvement.

Data from the McKinsey Institute for Economic Mobility indicate that the division of AI can broaden the gap in racial wealth by $ 43 million a yr.

(Tagstranslatate) artificial intelligence

Technology

Musk’s XAI Holdings reportedly collects the second largest private round of financing

Elon Musk’s Xai Holdings talks about gathering $ 20 billion for fresh funds, potentially valuing the combination of AI and social media at over $ 120 billion, in accordance with A New Bloomberg report This says that the talks are at “early stages”. If it succeeds, the contract can be the second largest round of financing startups in history, only with an OPENAI increase in the amount of $ 40 billion last month.

Financing may help alleviate the significant burden of X debt, which costs an organization price $ 200 million monthly, for Bloomberg sources, with annual interest costs exceeding $ 1.3 billion by the end of last yr.

The increase on this size would also show the constant attractiveness of AI investor, and likewise reflects the surprising appearance of Musk as a player of political power in the White House of President Trump.

Musk will probably get from some of the same supporters who consistently financed their ventures, from Tesla to SpaceX, including Antonio Gracias from Valor Equity Partners and Luke Nosek from Gigafund. Gracias even took the role lieutenant In the Musk government department.

Xai didn’t answer immediately.

(Tagstransate) Elon Musk (T) XAI Holdings

Technology

Leap Hee launches the 1-to-in-innd-second-mobile application, giving home owners better access to equity

Fintech Real Estate Investment Company Leap AnalyticsAlso often known as Leap Hee, he announced the launch of a brand new and progressive mobile application designed to revolutionize the access of home owners and home equity management,

The application allows users to apply for 3 several types of capital capital contracts (Heas) directly on the phone, providing a wealth of comprehensive housing resources. The general director and founding father of Leap, Ashley Bete, claims that the recent application helps home owners make smarter financial decisions without connecting.

“Our new mobile application revolutionizes how home owners gain access to home owners and use their own capital,” said Bete. “By offering three types of hea at your fingertips, together with a package of tools related to the apartment, we authorize home owners to make very informed financial decisions, while releasing the capital potential of their most valuable assets.”

In addition to having Hea-Zarówno in 10-year contracts, in addition to 30-year contracts-at your fingertips, the functions of application supporting the travel of home owners include access to the financial library, financial analyzes and tools, similar to Simulator Improvement Simulators, similar to the Improvement Improvement simulator.

While the purpose of the application is to solve significant problems on the housing market, similar to the effects of redlining and gentrification, Bete said that it’s also consistent with the company’s mission involving the education of home owners in the scope of fixing real estate industry, while ensuring tools for extracting capital from homes, reduction of debt and increasing the renewal of monetary faith. “The LEAP application is a significant progress in the Leap mission to close the gaps in the field of wealth and apartments, and at the same time promoting financial health through innovative household solutions,” he said.

The mission can also be consistent with the findings of how American house owners have been blocked before billions in their very own capital, without even knowing it. AND Recent studies conducted by Home Equity Investment Company Point showed that home owners The risk is blocked before access to $ 731 billion in their very own capitalwhich many depend on, due to a decrease in the resulting credit scoring Loss of labor, according to.

In 2024, the total American domestic capital reached USD 34.7 trillion, which is a rise of 80% since 2020. However, a big a part of this housing wealth stays “closed”.

Applicant Leap Juune Lucero from California said that he would “recommend Leap” after the designation of the company’s home capital contracts as a wonderful alternative to expensive options.

“They helped me and my family to improve our personal finances,” said Lucero. The Munashe Shumba technology director shared similar moods, adding that the application “helps property owners intelligently manage homes and increase their value” with recommendations based on data on “necessary services”.

Download the LEAP mobile application on iOS and Android platforms.

(Tagstranslate) FINTECH (T) Home Equity (T) Leap Hea (T) ASHLEY BETE (T) Leap Analytics (T) Mobile application

-

Press Release1 year ago

Press Release1 year agoU.S.-Africa Chamber of Commerce Appoints Robert Alexander of 360WiseMedia as Board Director

-

Press Release1 year ago

Press Release1 year agoCEO of 360WiSE Launches Mentorship Program in Overtown Miami FL

-

Business and Finance11 months ago

Business and Finance11 months agoThe Importance of Owning Your Distribution Media Platform

-

Business and Finance1 year ago

Business and Finance1 year ago360Wise Media and McDonald’s NY Tri-State Owner Operators Celebrate Success of “Faces of Black History” Campaign with Over 2 Million Event Visits

-

Ben Crump1 year ago

Ben Crump1 year agoAnother lawsuit accuses Google of bias against Black minority employees

-

Theater1 year ago

Theater1 year agoTelling the story of the Apollo Theater

-

Ben Crump1 year ago

Ben Crump1 year agoHenrietta Lacks’ family members reach an agreement after her cells undergo advanced medical tests

-

Ben Crump1 year ago

Ben Crump1 year agoThe families of George Floyd and Daunte Wright hold an emotional press conference in Minneapolis

-

Theater1 year ago

Theater1 year agoApplications open for the 2020-2021 Soul Producing National Black Theater residency – Black Theater Matters

-

Theater11 months ago

Theater11 months agoCultural icon Apollo Theater sets new goals on the occasion of its 85th anniversary