Politics and Current

Fairway Mortgage reaches $8 million Redlining settlement after mocking Black Neighborhoods

In May 2020, a top loan officer at Fairway Independent Mortgage Company sent an email to a loan processor regarding a possible property purchase in Ensley, a majority Black neighborhood in Birmingham, that stated: “Ensley is a GHETTO. I assure you we do not have a house there. A LOT OF LAUGHTER!”

The Fairway mortgage processor replied, “ROFLOL,” which likely meant “rolling on the floor laughing out loud,” in accordance with a court document that noted the lender didn’t accept any loan applications within the Ensley area between 2018 and 2021 .

No one at Fairway Mortgage is laughing now, after a four-year investigation this week by the Consumer Financial Protection Bureau and the U.S. Department of Justice forced the mortgage lender to succeed in an $8 million settlement to deal with its alleged discriminatory lending practices, including redlining black neighborhoods in and around Birmingham.

Redlining is an illegal, discriminatory practice wherein lenders and other firms make credit and other financial services out of reach for people in certain areas based on race or national origin.

According to a criticism filed by each federal agencies on Oct. 15, Madison, Wisconsin-based Fairway, doing business in Birmingham as MortgageBanc, operated retail lending offices in predominantly white areas of metro Birmingham from 2015 to 2022. The company also solicited lending referrals from individuals and organizations in majority-white areas and targeted its marketing efforts at them, while ignoring majority-black neighborhoods.

As a result, just 3.7 per cent of the ten,247 Fairway mortgage applications reported to the federal government between 2018 and 2022 were for properties in predominantly black areas, compared with 12.2 per cent for other lenders in Birmingham, in accordance with complaints. Only 3.3 percent of the 7,913 mortgages Fairway actually originated within the metro area were for properties in predominantly black neighborhoods, compared with 10.1 percent from other mortgage lenders.

At that point, the Birmingham Metropolitan Statistical Area (MSA) comprised six counties in north-central Alabama with a complete population of 1.1 million made up of residents that were 62% white, 30% black, 5% Latino, and three% other races.

Such Fairway policies and practices constitute an override because they “were intended to disclaim and, in effect, resulted within the denial of equal access to home loans to majority Black (a minimum of 50 percent Black) and high Black (a minimum of 80 percent of the Black population) residents black) percentage of black people) residential areas and applicants for loans for properties situated in those areas,” argued the 2 federal agencies, which found that Fairway violated the federal Fair Housing Act, the Equal Credit Opportunity Act and the U.S. financial consumers.

The agencies argued that Fairway must have been well aware that it was not adequately serving majority Black areas because the corporate had been using third-party vendors since 2017 to review credit data to evaluate the danger of redlining in majority Black areas. and minorities. Those annual risk-mitigation reports “should have brought attention to Fairway,” the feds argued, but the corporate “failed to take any significant action to increase (loan) applications and originations in majority-black areas” in metro Birmingham .

The criticism also noted that piece of email between several white Fairway employees between 2018 and 2020 used offensive language in reference to majority-Black areas of Birmingham, “indicating a culture consistent with discrimination, including by discouraging applications.” for real estate loans in these areas.”

In addition to calling Ensley and one other majority-Black neighborhood, Tarrant, a “ghetto,” Fairway loan officers in a 2018 email chain referred to an African-American male loan applicant as having “thug friends” and wrote that “(w)e don’t need him as a client. He is a burden waiting to occur. The black applicant withdrew his application.

The settlement announced Tuesday requires Fairway to offer $8 million for a loan subsidy program to supply reasonably priced loans for home purchases, refinances and residential renovations in predominantly black neighborhoods in Birmingham, in addition to pay a civil penalty of 1.9 million dollars to the CFPB Victim Assistance Fund. It has not yet been certified by the U.S. District Court for the Northern District of Alabama.

The Birmingham settlement is the fifteenth settlement the Justice Department has reapproved in three years as a part of its settlement Anti-redlining initiativewhich has now raised greater than $150 million in settlements “to benefit communities of color across the country who have experienced lending discrimination,” including Houston, Memphis, Los Angeles and Philadelphia.

“This settlement…will help ensure that future generations of Americans inherit the legacy of home ownership that has been too often denied,” said Attorney General Merrick Garland. “This case is a reminder that redlining is not a relic of the past.”

“This is good news for those looking to buy or renovate a home in this area,” George McCall, 81, president of the Ensley Neighborhood Association, told Atlanta Black Star in regards to the settlement.

“This is not a ghetto as they said. Our homes are not neglected or neglected, but many of the homeowners are seniors who have had a hard time getting loans to make needed improvements,” McCall said, adding, “I hope this will help more young people be able to buy a home.” It’s really hard for them to get financing for anything.

Eric Guster, an attorney and developer who grew up in Ensley and who recently built a $2.5 million shopping mall in nearby Five Points West, told Atlanta Black Star he hopes the settlement and loan assistance program will result in more homeowners in mostly Birmingham -Black neighborhoods.

“When people start owning homes, they take more pride in their homes, they become attached to their neighborhood, and that promotes social responsibility,” he said. “When there is no inflow of cash and investment, when people are disenfranchised, it is a faster path to collapse and decay. And that was what the mortgage company was doing, helping the decomposition process.”

Fairway released statement on Tuesday, denying that he participated in redlining and noting that the federal lawsuit was filed a day after the settlement was reached. He called the criticism “inflammatory” and said it incorrectly characterizes Fairway’s actions as “willful and reckless, a claim that was mutually denied by the parties prior to the settlement.”

In the primary half of 2024, the corporate ranked twelfth amongst the most important U.S. mortgage lenders, with $11.8 billion in home loan production. HousingWire reported. The criticism says Fairway is among the many top five lenders within the Birmingham area for application volume.

“Fairway has vigorously defended itself against the government agencies’ allegations and continues to deny that the Company engaged in any discriminatory conduct,” Fairway said in an announcement. “Fairway also maintains its strong opposition to government agencies’ legal and statistical approaches to identifying potential discrimination. However, to resolve this issue and reduce further expenditure of resources, Fairway concluded that a settlement with the Bureau and the Department of Justice can be probably the most appropriate solution.

The company said the settlement “gives Fairway the opportunity to redirect financial resources to majority-Black neighborhoods through loan subsidies, consumer financial education and community development.” Fairway hopes these efforts will further expand lending options for people seeking to purchase properties within the majority-Black census tracts of the Birmingham MSA.

Politics and Current

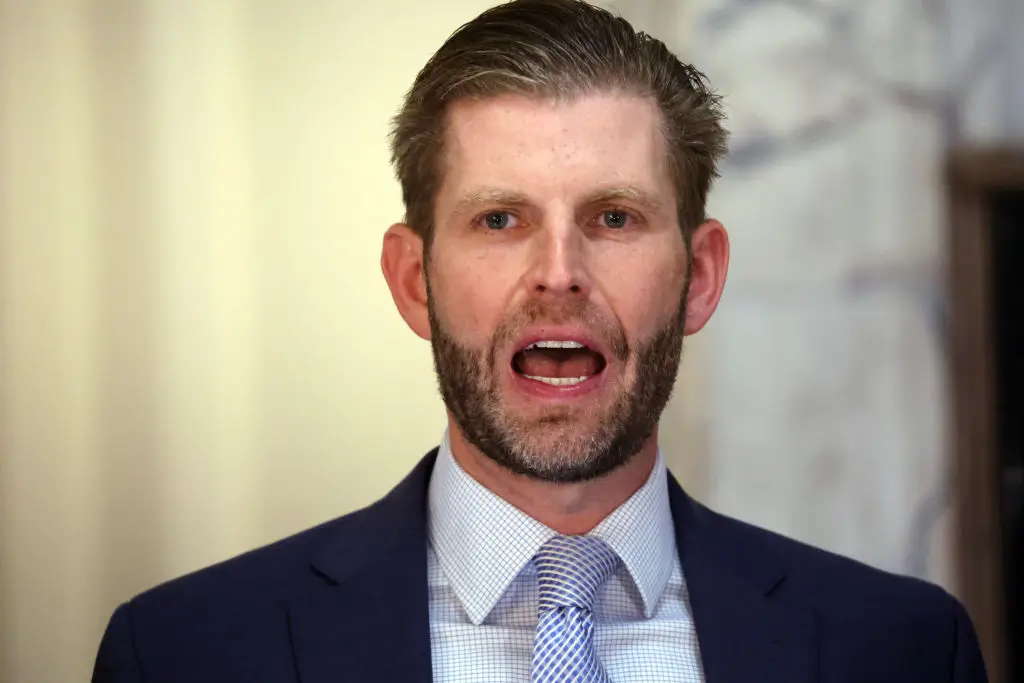

Social media break out after Erica Trump debuts Trump 2028, raises concerns that the president will look for the third term

For Donald Trump, trolling never ends, whether online or in your head.

With a hat that doubles the trigger warning: the Trump 2028 CAP, for fans of unconstitutional threats guaranteed, frightens democrats.

The presidential scion Eric Trump published his photo on Thursday in a hat, now available for $ 50 at Trumpstore.com. This is the latest tip of the president’s team that he can look for the third term, even when the structure forbids him. Or it could simply be more trolling.

“Assume a statement that in America Trump 2028 hat. Fully embroidered with a latch at the back will become your new hat”, an outline about Trumpstore. And with the tariff war, it is simply good that the hat is “made in America.”

Trump for the first time began to point to the third term during last yr’s presidential campaign. In May 2024 he he said Participants of the annual National Rifle Association, by which the third term may happen as a part of.

“I do not know if we will be considered three,” asked a crowd of enthusiasts of firearms, one in all his most loyal constituencies.

He quoted Franklin Delano Roosevelt, elected for 4 terms, as a precedent, seemingly unaware that the twenty second amendment, which limits presidents to 2 terms, was ratified after the FDR term as the head of the Supreme Director.

NBC News recently said: “I’m not kidding” about the search for the third term, adding: “There are methods that can be done.”

Later on the same day, when asked about it by reporters at Air Force One, the president said: “I had more people asked me for the third term, which in a sense is the fourth term, because other elections, elections in 2020 were completely falsified.”

He stopped that he had committed himself to the fourth race to the White House, saying: “I do not want to talk about the third term now, because no matter how you look at it, we have a lot of time.”

But this didn’t stop a few of his biggest supporters, including Steve Bannon’s adviser, from pressure to the next 4 years.

In an interview at the starting of this month with Bill Maher, Bannon he said“President Trump will run for the third term. President Trump will be re -elected. In the afternoon on January 20, 2029, he will be the president of the United States.”

But how? Republican Congressman Tennessee Andy Ogles proposed a bill that would allow the president to take the third term if their first two terms weren’t consistent. In America’s history, only two presidents met with this threshold: Donald Trump and Grover Cleveland, who lost their re -election offer with Benjamin Harrison in 1888, but won the rematch 4 years later.

Changing the structure is rare, largely since it is so difficult.

First of all, the congress must secure two-thirds of the majority in each the Chamber and the Senate, followed by three-quarters of state legislators (38 out of fifty) must sign-like, alternatively, three quarters of state conventions that took place just once.

But despite the constitutional obstacles, the idea of support, including co -founder Tesla and Trump Megadonor Elon Musk.

“Think in advance!” He wrote in a post with the Trump 2032 cap on his social media platform X.

But most of the X said that they like to not take into consideration the perspective of Trump’s third term.

“Eric Trump not only hawts Trump 2028 hats, but is in favor of the dictatorship of his daddy” wrote One critic. “The American people throw Trump’s crime family into the history of history, the better for America and the democratic free world.”

“Like the Bannon’s Wall Fundraiser fraud, it was always money” as well as other. “Every moment”.

(Tagstotransate) Donald Trump

Politics and Current

“We are in the fight for all our lives”: from Houston and a former member of the City Council runs to represent the historic Texas District in Congress

Amanda K. Edwards He is one of several democratic candidates in special elections representing the 18th Congress district of Texas – a cult, historically black district, which incorporates the Houston center and more. The places remained empty after the death in January 2025, former mayor of Houston and Congressmen Sylvester Turner, who replaced the deceased Congressmenka Sheila Jackson Lee after her death in 2024.

Of the greater than 800,000 TX-18 residents remained without representation in Congress, November 4 Special elections He will resolve who will fill the powerful post. Edwards, from Houston, lawyer, non -profit founder and a former member of the city council, claims that this moment is bigger than politics – it’s about protecting the future.

“We fight in life,” says Edwards Essence, pointing to the withdrawal of politics under the administration of President Donald Trump. He cites federal decisions that might increase the prices of pharmaceuticals, reduce Pell Grant funds, hurt small corporations and influence families throughout the country. “Everyone affects the Trump’s administration tariffs and other efforts to undermine our American economy.”

Edwards, a democrat, is one of not less than nine candidates who’ve declared his candidacyIn this Christian Menefee, former advocate of Harris’s Country; Isaiah Martin, former senior adviser to Jackson Lee; and James Joseph, who previously served as the director of civic involvement for the senator of State Borris Miles.

According to Edwards and Menefee are widely perceived as favors, each of whom has collected almost $ 400,000.

He also notes that the decision of the governor Greg Abbott, finally, finally call special elections After public pressure To make sure that that the inhabitants were not without a voice in Washington. And for Edwards, the heritage of the TX-18-represented by Trailblazer in favor of civil rights Barbara Jordan, lawyers of counteracting poverty Mickey Leland and a few years of Congressmenka Jackson Lee-is too essential to leave.

“They need a federal lawyer to provide financial support,” he says. “They need a federal lawyer to express their fears. They need a federal lawyer to become their decision -maker and they don’t have them.”

The basis of the Edwards platform are three primary issues: healthcare, economic possibilities and education. Her passion for healthcare reform is rooted in her own childhood. He remembers how he watches the battle of his father multiple myeloma When she was only 10 years old.

“I remember how I asked my father many questions at that time, for example, whether his life-saving care would be covered by the insurance, which I studied about,” he says.

Today, the same issue fuels her struggle for stronger health care in the Black Mother and support for Momlibus Act,The packet of federal bills that may extend the mother’s care and would cope with racial differences in health results. Economic capital is one other key pillar. As a member of the city council, she often questioned the concept that the representation itself is enough.

“What is the most diverse if we do not solve the challenges faced by our diverse communities – this is the meaning of equality, right?”

To this end, he’s in favor of larger federal investments in the financial institutions of community development (CDFiS), which regularly borrow their very own and their very own women in black.

“They borrow much higher rates to colorful enterprises, for women belonging to women, which are actually larger banks considered a higher risk,” explains Edwards.

He says that education is each deeply personal and at national level. Edwards, a graduate of the Houston public school system, won Emory University and Harvard Law School. But she is worried about nationwide efforts to censor what students can learn.

“We observe throughout the country, our students’ books have been taken and what they read politicization,” he says. He warns without access to a true story: “People do not have information, and therefore history can repeat themselves.”

He also criticizes educational cuts from the time of Trump and a wider lack of investment in students. “There is a large federal component of financing education that is omitted from this conversation.”

Despite the polarized political landscape and driveway battles often battling black candidates, Edwards claims that he’s unable. He is guided by the goal – and the belief that change remains to be possible through targeted strategic leadership.

“I spent my whole career how best to use difficult circumstances,” he says. “You find your ways to settle matters because they have to do.”

He can also be honest about the persistent barriers he stands with. “I enter the rooms every day and I am underestimated because of my sex. I am underestimated because of my race; I am underestimated because of my age. You can’t let the limited perspective of other people become your own perspective.”

When asked how a democratic party can higher support black women, Edwards doesn’t hesitate: “Authorized women strengthen women. We are smart, we are brave, we are brave, but we also have to get involved again.”

And if the party doesn’t perform real work in constructing trust and listening, it warns, risks further political errors. “If you don’t do this real job, guess what? You will have a problem with mathematics again. And you know what politics and choices are – mathematics,” he adds.

He believes that the path forward consists in accepting younger leadership, closing the gaps in the scope of obtaining funds and deliberate introduction of insufficiently represented voters and candidates.

“You see differences in obtaining funds for black women’s candidates. You see differences in their minds as if they are not asking for escape.”

Despite these challenges, Edwards says he’s unwavering in his mission. “I think that my goal is to use these blessings and the possibilities that I received to bring benefits to other people and improve the community,” he says. “I want people to say what my job meant for their lives, because that’s what I mean for me.”

In the November election on the horizon, Amanda K. Edwards calls voters to remain involved.

“Show. Speak. Stay involved,” he says. “Our future depends on this.”

Politics and Current

Black Democrats who attended Harvard and Candace Owens agree to one thing: the repression of the Trump campus goes too far

This is a rare moment in American policy, when the ultra-conservative personality of Candace Owens Democrats are on the opposite side of Donald Trump. The political brand of the bonfire publicly condemned the president’s crusade against Harvard University and other university campus; Trump threatened to annul the billions of federal subsidies if the institution disagrees with the list of demands that Harvard described as “going beyond the power of the federal government.”

As Owens put it, Trump’s fight with Harvard – which increased to the federal lawsuit filed by the very wealthy Ivy league – is a struggle for freedom of speech.

“We cannot allow us to violate our rights. And if you think it will stop at university campus, you have no head,” said Owens, who previously supported President Trump. “So it’s better in this fight Harvard University. You should hope that they will overcome the Trump administration and this absurd definition.”

In his lawsuit, Harvard claims that their rights to the first amendment as a non-public institution are violated by the administration of Trump, who tried to force the university to meet their requirements regarding policies related to the solution to anti -Semitism in campus, in addition to other policies and reforms, corresponding to eliminating diversity, own capital and inclusion in principles, scholarship and honesty.

Apart from the violations of the first amendment, Edwards, a democrat applying for Congress in the 18th Congress District in Texas, said that her attempt to dismantle the Harvard of federal financing, which is used for research to increase innovation in medicine and technology, is especially disturbed.

A former member of the Houston City Council said that aiming administration on Harvard and other university campuses is “effective” and “irresponsible”.

Everton Blair, a graduate of Harvard University and Harvard Graduate School of Education, who also candidates for Congress in the thirteenth Congress District in Georgia, said that he “enjoys” that the institution “will be in a state of himself”.

However, Blair said that he was and remains to be critical of his home parent, because the problem with how they handled campus tensions during the war in gas and other matters – even when he was a student.

“It is a bit interesting that only because it violates their ability to be independently conducted institution, that it recalled this resistance,” said Blair, former chairman of the board of Gwinnett County Board of Education. “They showed me once and again that they have very peculiar cash interests.”

Blair noticed that Harvard, who has over $ 50 billion equipment, has a “privileged position” to find a way to “work fully, even if he loses billions of dollars”, unlike other campuses. He said that he shows that “not all we are simply forced and forced to do things that are bad for people, bad for students (and) for the community.”

Edwards said that the attacks of the first correction of Trump’s administration on Harvard “cannot be normalized”.

“These are dangerous practices that do not intend to develop us. It must be more than revenge and political punishment. What is happening in our academic institutions affects how tomorrow may be clear tomorrow,” said the candidate for Congress in Texas.

In the future, attacking American universities and universities will affect the “position in the world”, said Edwards, including “what we produce, available talent and information to which we have access”.

She added: “The precedent, which is established along with the Trump administration attack on a higher ED and other institutions that were very significant and valuable in our society … This is something that we have to repel with, because our future depends on this.”

(Tagstotransate) candia o Owens

-

Press Release1 year ago

Press Release1 year agoU.S.-Africa Chamber of Commerce Appoints Robert Alexander of 360WiseMedia as Board Director

-

Press Release1 year ago

Press Release1 year agoCEO of 360WiSE Launches Mentorship Program in Overtown Miami FL

-

Business and Finance11 months ago

Business and Finance11 months agoThe Importance of Owning Your Distribution Media Platform

-

Business and Finance1 year ago

Business and Finance1 year ago360Wise Media and McDonald’s NY Tri-State Owner Operators Celebrate Success of “Faces of Black History” Campaign with Over 2 Million Event Visits

-

Ben Crump1 year ago

Ben Crump1 year agoAnother lawsuit accuses Google of bias against Black minority employees

-

Theater1 year ago

Theater1 year agoTelling the story of the Apollo Theater

-

Ben Crump1 year ago

Ben Crump1 year agoHenrietta Lacks’ family members reach an agreement after her cells undergo advanced medical tests

-

Ben Crump1 year ago

Ben Crump1 year agoThe families of George Floyd and Daunte Wright hold an emotional press conference in Minneapolis

-

Theater1 year ago

Theater1 year agoApplications open for the 2020-2021 Soul Producing National Black Theater residency – Black Theater Matters

-

Theater11 months ago

Theater11 months agoCultural icon Apollo Theater sets new goals on the occasion of its 85th anniversary