Technology

Artificial intelligence and data infrastructure are driving demand for open source startups

New report highlights the necessity for start-ups creating open source tools and technologies for the synthetic intelligence revolution because the data infrastructure industry grows in popularity.

Capital Runethe enterprise capital (VC) firm that upped the ante from Silicon Valley and moved its headquarters to Luxembourg in 2022 has published Startup Runa Open Source (ROSS) Index during the last 4 years, shining a lightweight on the fastest-growing business open source software (COSS) startups. The company publishes quarterly updates, but last 12 months it released its first annual report showing the general 12 months 2022 from top to bottom – something it’s now repeating for 2023.

Trends

Data is closely related to AI because AI relies on data for learning and prediction, and this requires infrastructure to administer the gathering, storage and processing of this data. In this report, these tangential trends collided.

Last 12 months, the corporate took first place within the ROSS index LangChaina startup from San Francisco that has been developing for two years open source framework to create applications based on large language models (LLM). In 2023, the corporate’s essential project exceeded 72,500 stars, and Sequoia might be lead a $25 million Series A round to LangChain just last month.

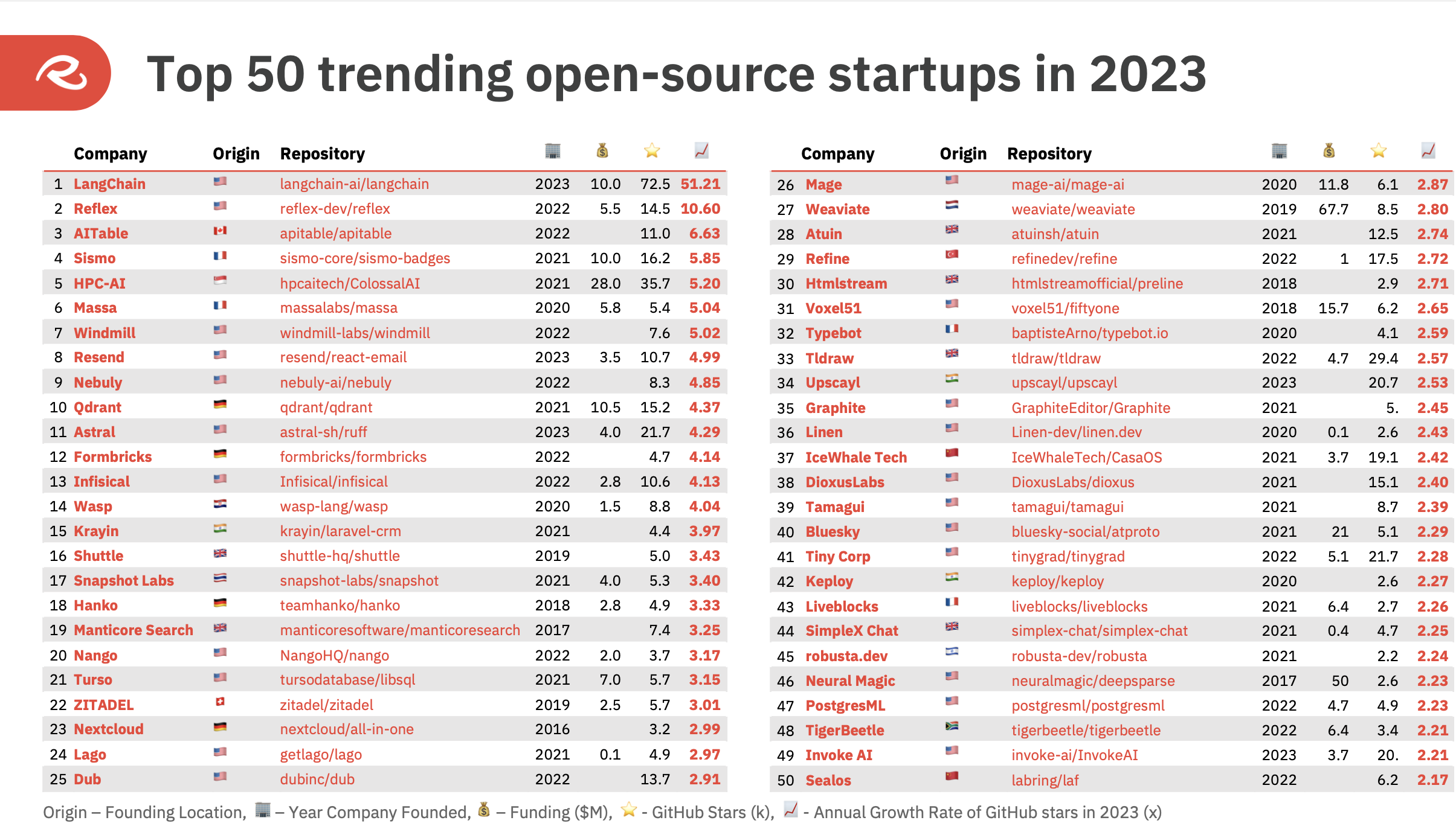

Top 10 COSS startups within the ROSS Index for 2023 Image credits: Great Rune

Where else is he in the highest 10? Reflexsome open source framework for constructing pure Python web applications, and the corporate behind the product recently raised a $5 million seed investment; AITablea spreadsheet-based AI chatbot builder and something just like Open source Airtable competitor; Earthquakea privacy-focused platform that permits users selectively disclose personal information for application; HPC-AI, which is constructing a distributed platform for AI development and deployment, aiming to turn into something like Southeast Asia’s OpenAI; and the open-source vector database Qdrant, which recently raised $28 million to capitalize on the burgeoning artificial intelligence revolution.

A broader take a look at the “50 most popular” open source startups last 12 months shows that greater than half (26) are related to artificial intelligence and data infrastructure.

Top 50 COSS startups within the ROSS Index for 2023 Image credits: Great Rune

It is difficult to properly compare the 2023 index with the previous 12 months from a vertical perspective, mainly resulting from the incontrovertible fact that firms often change their product positioning to adapt to the present trend. As the ChatGPT hype was in full swing last 12 months, it could have prompted earlier-stage startups to alter course and even simply place more emphasis on the present “AI” element of their product.

But as A breakthrough 12 months for generative artificial intelligenceIt’s easy to see why demand for open source components could skyrocket as firms of all sizes try to maintain up with proprietary AI giants like OpenAI, Microsoft, and Google.

Open source software has also all the time been very widespread, with developers from all around the world contributing to its creation. This ethos often translates to business open source startups, which can not have the normal center of gravity anchored in a brick-and-mortar headquarters.

However, the ROSS index does approximate geography to some extent and states that 26 of the businesses on the list are based within the US, although 10 of them were founded elsewhere and still have founders or employees in other locations.

In total, the highest 50 got here from 17 different countries, with 23 firms based in Europe, a rise of 20% in comparison with the previous 12 months’s index. France counted probably the most COSS startups, including seven Earthquake AND Mass which are in the highest 10, while the UK increased from only one startup in 2022 to 6 in 2023, putting it in second place from a European perspective.

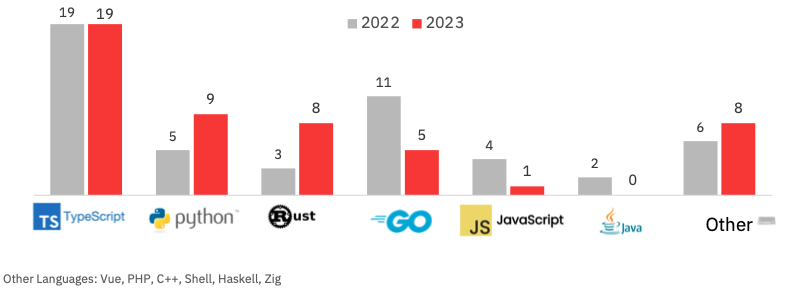

Other notable tidbits to emerge from the report include programming languages - the ROSS index recorded 12 languages utilized by the highest 50 last 12 months in comparison with 10 in 2022. Typescript, a superset of JavaScript developed by Microsoft, remained the preferred, utilized by 38% of the highest 50 startups. Both Python and Rust have increased in popularity, while Go and JavaScript have declined.

ROSS Index: Popular programming languages. Image credits: Great Rune

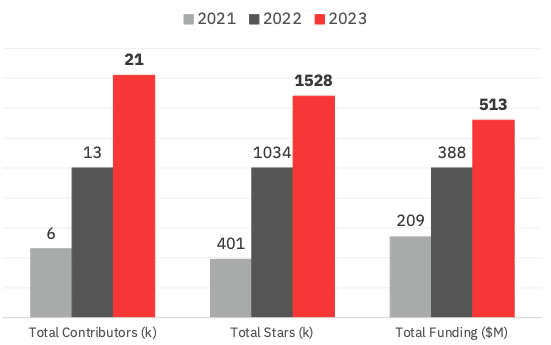

In 2023, the highest 50 participants within the ROSS Index gained a complete of 12,000 contributors, while the general variety of GitHub stars increased by almost 500,000. The index also shows that funding for the highest 50 COSS startups last 12 months reached $513 million, which suggests a rise of 32% in comparison with 2022 and 145% in comparison with 2021.

ROSS Index: Collaborators, Stars and Funding Image credits: Great Rune

Methodology and context

It’s value visiting the methodology behind all of it — what aspects influence whether an organization might be considered “top-trend”? To start with, all firms are included will need to have at the very least 1,000 GitHub stars (a GitHub metric just like a “like” on social media) to be considered. However, the variety of stars alone doesn’t tell us much about trends, provided that stars accumulate over time – so a project that has been on GitHub for 10 years has likely gathered more stars than a project that has been on GitHub for 10 months. Instead, the Rune measures the relative growth of stars over a given period using the Annual Growth Rate (AGR) – it compares the worth of stars today to the identical period in a previous period to see what has grown most impressively.

There can also be a level of manual selection here, provided that the goal is specifically to serve open source “startups” – so Runa’s investment team selects projects that belong to a “product-focused commercial organization” and will need to have been founded lower than a decade ago with known funding of lower than $100 million.

Defining what constitutes “open source” also has its inherent challenges, as there’s a complete spectrum of what constitutes “open source” as a startup – some are more just like “open core”, where most of their core functionality is wrapped up in a premium package paywall, and some have more restrictive licenses than others. To this end, Runa’s curators decided that a startup simply needed to have a product that was “reasily connected to open source repositories”, which after all involves a certain degree of subjectivity in deciding which of them are chosen.

Further nuances also come into play. The ROSS Index takes a very liberal interpretation of “open source” – for example each flexible and MongDB have abandoned their open source roots in favor of “available from source” licenses to guard themselves from exploitation by mainstream cloud providers. Under the ROSS Index methodology, each of those firms would qualify as “open source” – despite the fact that their licenses are not formally approved as such by Open Source Initiativeand these particular example firms not call themselves “open source.”

So, consistent with Runa’s methodology, his report uses what he calls the “commercial perception of open source” reasonably than the actual license an organization attaches to its project. This implies that source-restricted licenses akin to BSL (business source license) i SSPL (server-side public license), which MongoDB introduced as a part of its move away from open source in 2018, are highly regarded amongst business firms on the ROSS Index.

“Such licenses preserve the spirit of OSS — all of its freedoms, except for somewhat limited redistribution that does not impact developers but gives original providers a long-term competitive advantage,” Konstantin Vinogradov, general partner of London-based Runa Capital, explained to TechCrunch. “From a VC perspective, it’s just an expanded playbook for the exact same form of firms. The definition of open source applies to software, not firms.

There are other notable filters as well. For example, firms that are largely focused on providing skilled services or side projects with limited energetic support or no business element are not included within the ROSS Index.

For comparison purposes, there are other indexes and lists that offer you an idea of what’s hot within the open source community. Another VC firm called Two Sigma Ventures maintains Open Source Indexfor example, similar in concept to Runa, except that it covers every kind of open source projects (not only startups) and has additional filters, including the flexibility to browse by GitHub’s “follower” metric, which some say gives a more accurate picture of true popularity project.

GitHub itself also publishes the file popular repositories a site that, like Two Sigma Ventures, doesn’t deal with the business behind the project.

The ROSS Index has subsequently proven to be a useful complementary tool for determining which open source “startups” are value tracking.

Technology

Students of young, talented and black yale collect $ 3 million on a new application

Nathaneo Johnson and Sean Hargrow, juniors from Yale University, collected $ 3 million in only 14 days to finance their startup, series, social application powered by AI, designed to support significant connections and challenge platforms, similar to LinkedIn and Instagram.

A duo that’s a co -host of the podcast A series of foundersHe created the application after recognizing the gap in the way in which digital platforms help people connect. SEries focuses moderately on facilitating authentic introductions than gathering likes, observing or involvement indicators.

“Social media is great for broadcasting, but it does not necessarily help you meet the right people at the right time,” said Johnson in an interview with Entrepreneur warehouse.

The series connects users through AI “friends” who communicate via IMessage and help to introduce. Users introduce specific needs-are on the lookout for co-founders, mentors, colleagues or investors-AI makes it easier to introduce based on mutual value. The concept attracts comparisons to LinkedIn, but with more personal experience.

“You publish photos on Instagram, publish movies on Tiktok and publish work posts on LinkedIn … And that’s where you have this microinfluuncer band,” Johnson added.

The application goals to avoid the superficial character of typical social platforms. Hargrow emphasized that although aesthetics often dominates on Instagram and the content virus drives tabktok, Number It is intentional, deliberate contacts.

“We are not trying to replace relationships in the real world-we are going to make it easier for people to find the right relationships,” said Hargrow.

Parable projects carried out before the seeded (*3*)Funding roundwhich included participation with Pear VC, DGB, VC, forty seventh Street, Radicle Impact, UNCASMON Projects and several famous Angels Investors, including the General Director of Reddit Steve Huffman and the founder of GPTZERO Edward Tian. Johnson called one meeting of investors “dinner for a million dollars”, reflecting how their pitch resonated with early supporters.

Although not the principal corporations, Johnson and Hargrow based pre-coreneuring through their podcast, through which they interviews the founders and leaders of C-Suite about less known elements of constructing the company-as accounting, business law and team formation.

Since the beginning of the series, over 32,000 messages between “friends” have been mentioned within the test phases. The initial goal of the application is the entrepreneurs market. Despite this, the founders hope to develop in finance, dating, education and health – ultimately striving to construct probably the most available warm network on the earth.

(Tagstranslate) VC (T) Yale (T) Venture Capital (T) Technology (T) APP

Technology

Tesla used cars offers rapidly increased in March

The growing variety of Tesla owners puts their used vehicles on the market, because consumers react to the political activities of Elon Musk and the worldwide protests they were driven.

In March, the variety of used Tesla vehicles listed on the market at autotrader.com increased rapidly, Sherwood News announcedCiting data from the house company Autotrader Cox Automotive. The numbers were particularly high in the last week of March, when on average over 13,000 used Teslas was replaced. It was not only a record – a rise of 67% in comparison with the identical week of the yr earlier.

At the identical time, the sale of latest Tesla vehicles slowed down even when EV sales from other brands increases. In the primary quarter of 2025, almost 300,000 latest EVs were sold in the USA According to the most recent Kelley Blue Book reporta rise of 10.6% yr on yr. Meanwhile, Tesla sales fell in the primary quarter, which is nearly 9% in comparison with the identical period in 2024.

Automaks resembling GM and Hyundai are still behind Tesla. But they see growth growth. For example, GM brands sold over 30,000 EV in the primary quarter, almost double the amount of a yr ago, in line with Kelley Blue Book.

(Tagstranslat) electric vehicles

Technology

Ilya Sutskever uses Google Cloud to supply AI Startup tests

Co -founder and former scientist of Opeli and former primary scientist ILYA SUTSKEVER, SAFE SUPERINTELELENCE (SSI), uses the Google Cloud TPU systems to supply their AI research, partly latest partnership that corporations announced on Wednesday press release.

Google Cloud claims that the SSI uses TPU to “accelerate its research and development to build safe, overintelical artificial intelligence.”

Cloud suppliers chase a handful of AI Unicorn startups, which spend tons of of hundreds of thousands of dollars annually on computing power supply for training AI Foundation models. The SSI agreement with Google Cloud suggests that the primary will spend a big a part of its computing budget with Google Cloud; The well -known source says TechCrunch that Google Cloud is the primary supplier of SSI calculations.

Google Cloud has the history of striking computing agreements with former AI researchers, a lot of which now lead billions of dollars of AI start-ups. (Sutskever once worked on Google.) In October Google Cloud said that he can be the primary supplier of computers for World Labs, founded by the previous scientist Ai Ex-Google Cloud Ai Fei-Feii Li.

It is just not clear whether the SSI has hit the partnership with other cloud or computers suppliers. Google Cloud spokesman refused to comment. A spokesman for a secure superintelligence didn’t immediately answer to the request for comment.

SSI got here out of Stealth in June 2024, months after Sutskever left his role because the primary scientist Opeli. The company has $ 1 billion in support from Andreessen Horowitz, Sequoia Capital, DST Global, SV Angel and others.

Since the premiere of the SSI, we’ve got heard relatively little about startup activities. On his websiteSSI says that the event of secure, super -intellectual AI systems is “our mission, our name and our entire product map, because this is our only goal.” SUTSKEVER He said earlier that he identified the “new mountain to climb” and is investigating latest ways to improve the performance of AI Frontier models.

Before the co -founder of Opeli, Sutskever spent several years on Google Brain examining neural networks. After years of conducting work of security, AI Openai Sutskever played a key role within the overthrow of the overall director of OPENNAI Altman in November 2023. Sutskever later joined the worker’s movement to restore Altman as CEO.

After the Sutskever trial, he was supposedly not seen in Openai offices for months and eventually left the startup to start SSI.

(Tagstransate) ilya SUTSKEVER (T) SSI

-

Press Release1 year ago

Press Release1 year agoU.S.-Africa Chamber of Commerce Appoints Robert Alexander of 360WiseMedia as Board Director

-

Press Release1 year ago

Press Release1 year agoCEO of 360WiSE Launches Mentorship Program in Overtown Miami FL

-

Business and Finance10 months ago

Business and Finance10 months agoThe Importance of Owning Your Distribution Media Platform

-

Business and Finance1 year ago

Business and Finance1 year ago360Wise Media and McDonald’s NY Tri-State Owner Operators Celebrate Success of “Faces of Black History” Campaign with Over 2 Million Event Visits

-

Ben Crump12 months ago

Ben Crump12 months agoAnother lawsuit accuses Google of bias against Black minority employees

-

Theater1 year ago

Theater1 year agoTelling the story of the Apollo Theater

-

Ben Crump1 year ago

Ben Crump1 year agoHenrietta Lacks’ family members reach an agreement after her cells undergo advanced medical tests

-

Ben Crump1 year ago

Ben Crump1 year agoThe families of George Floyd and Daunte Wright hold an emotional press conference in Minneapolis

-

Theater1 year ago

Theater1 year agoApplications open for the 2020-2021 Soul Producing National Black Theater residency – Black Theater Matters

-

Theater10 months ago

Theater10 months agoCultural icon Apollo Theater sets new goals on the occasion of its 85th anniversary